Question: my question is Q 4 market efficiency implications Total - 2847 .0000 0996 .0000 -0030 0079 0000 We square these deviations and calculate the variances

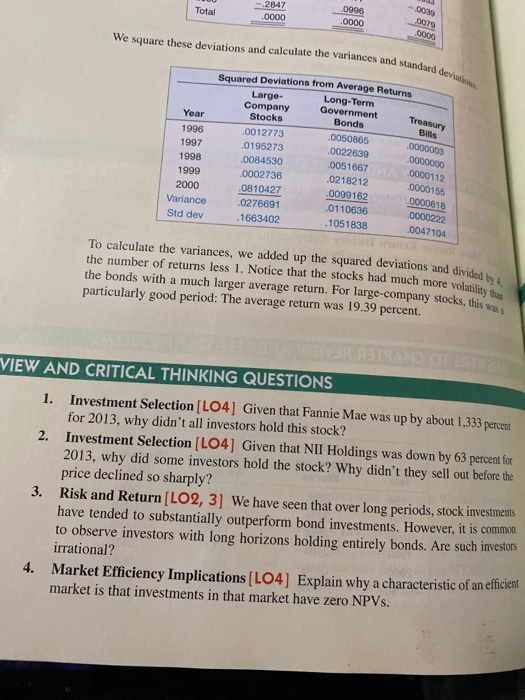

Total - 2847 .0000 0996 .0000 -0030 0079 0000 We square these deviations and calculate the variances and stand standard devia Treasury Bus Squared Deviations from Average Returns Large- Long-Term Company Government Year Stocks Bonds 1996 .0012773 .0050865 .0195273 .0022639 .0051667 .0000112 .0002736 .0218212 .0810427 .0099162 .0000618 Variance .0276691 .0110636 .0000222 Std dev 1663402 .0047104 .0000003 0000000 1997 1998 1999 2000 .0084530 .0000155 .1051838 To calculate the variances, we added up the squared deviations and divided the number of returns less 1. Notice that the stocks had much more volatili the bonds with a much larger average return. For large-company stocks, this! particularly good period: The average return was 19.39 percent. Masided by te volatility then VIEW AND CRITICAL THINKING QUESTIONS 1. Investment Selection [LO4] Given that Fannie Mae was up by about 1.333 percent for 2013, why didn't all investors hold this stock? 2. Investment Selection (LO4] Given that NII Holdings was down by 63 percent for 2013, why did some investors hold the stock? Why didn't they sell out before the price declined so sharply? Risk and Return (LO2, 3] We have seen that over long periods, stock investments have tended to substantially outperform bond investments. However, it is common to observe investors with long horizons holding entirely bonds. Are such investors irrational? 4. Market Efficiency Implications (L04) Explain why a characteristic of an efficien market is that investments in that market have zero NPVs. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts