Question: My question wasn't answer but I recieved a message telling it was already solved. Can I received this solution as soon as possible. And no

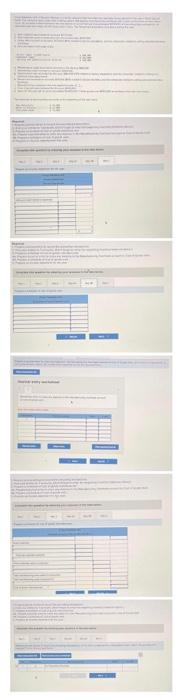

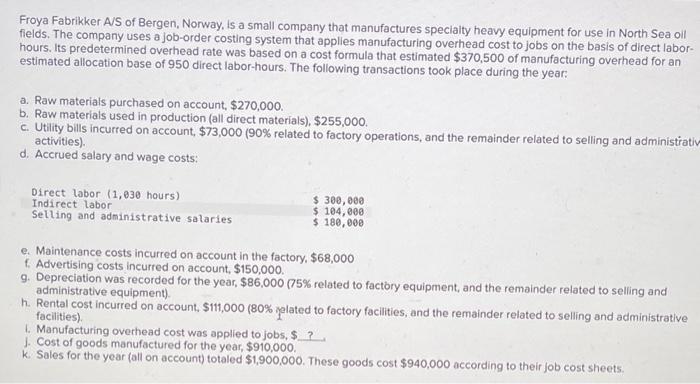

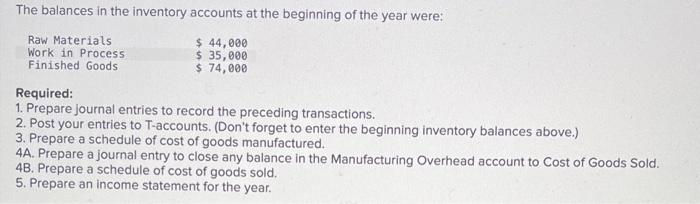

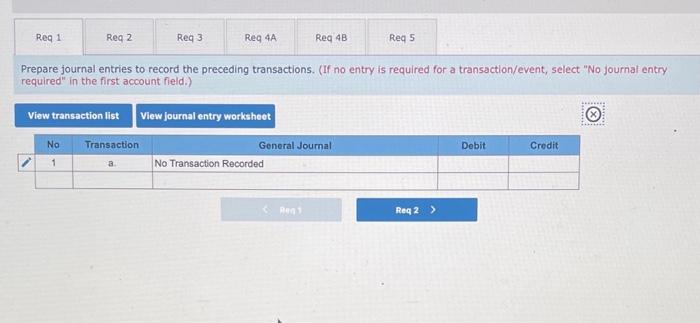

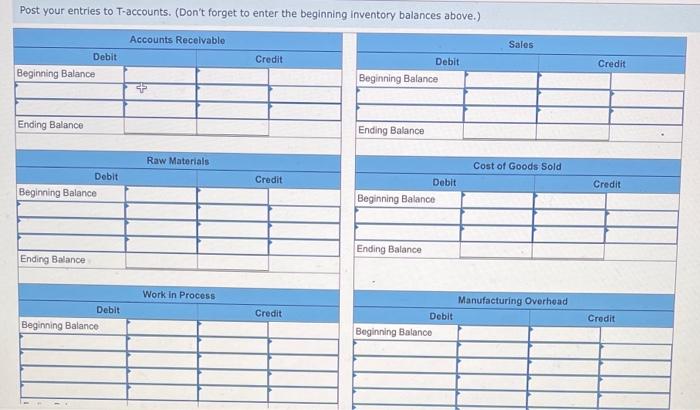

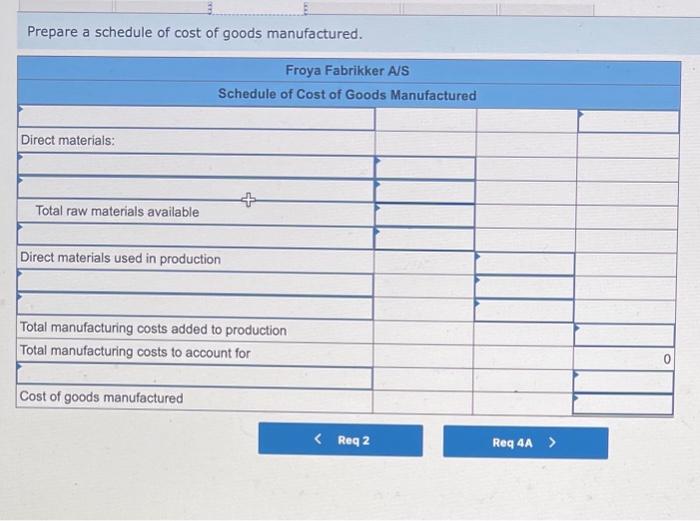

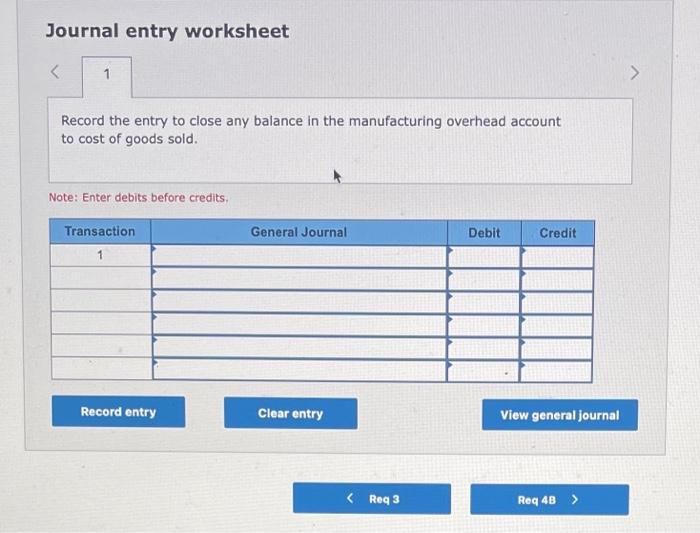

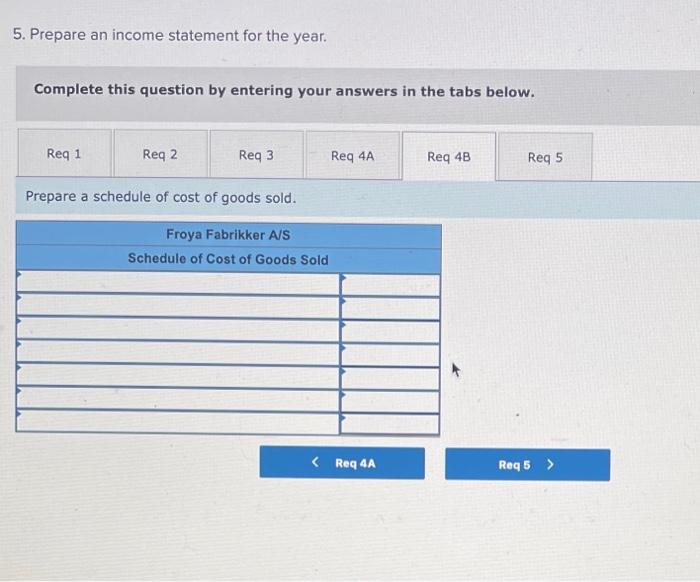

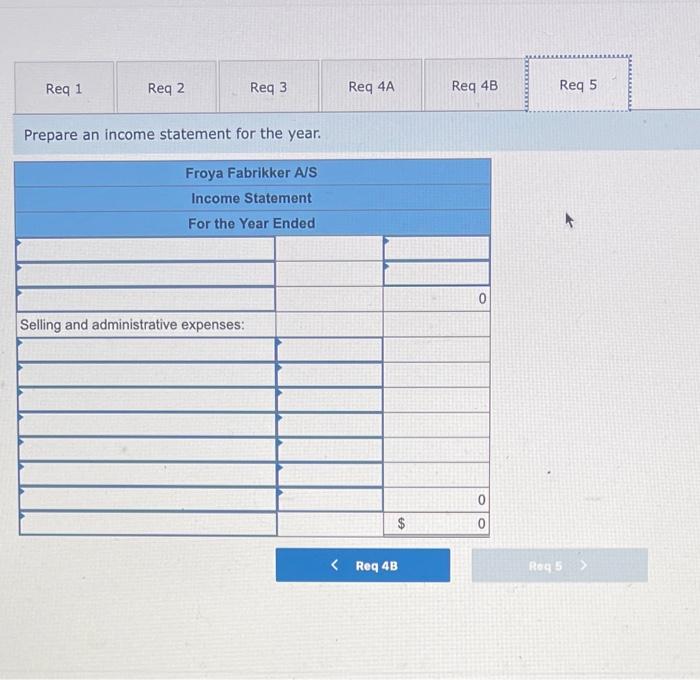

Froya Fabrikker A/S of Bergen, Norway, Is a small company that manufactures speciaity heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct laborhours. Its predetermined overhead rate was based on a cost formula that estimated $370,500 of manufacturing overhead for an estimated allocation base of 950 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $270,000. b. Raw materials used in production (all direct materials), $255,000. c. Utility bills incurred on account, $73,000 ( 90% related to factory operations, and the remainder related to selling and administiath activities). d. Accrued salary and wage costs: e. Maintenance costs incurred on account in the factory, $68,000 f. Advertising costs incurred on account, $150,000. 9. Depreciation was recorded for the year, $86,000 (75\% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $111,000(80% related to factory facilities, and the remainder related to selling and administrative facilities). 1. Manufacturing overhead cost was applied to jobs, $ ? 1. Cost of goods manufactured for the year, $910,000. k. Sales for the year (all on account) totaled $1,900,000. These goods cost $940,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Required: 1. Prepare journal entries to record the preceding transactions. 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) 3. Prepare a schedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4B. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year. Prepare journal entries to record the preceding transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) Prepare a schedule of cost of goods manufactured. Journal entry worksheet Record the entry to close any balance in the manufacturing overhead account to cost of goods sold. Note: Enter debits before credits. 5. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods sold. Prepare an income statement for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts