Question: My STT = 23 Part II. Optional Problems (3 points) (Please choose and do 2 problems among the following 3 problems) IMPORTANT NOTES: please use

My STT = 23

My STT = 23

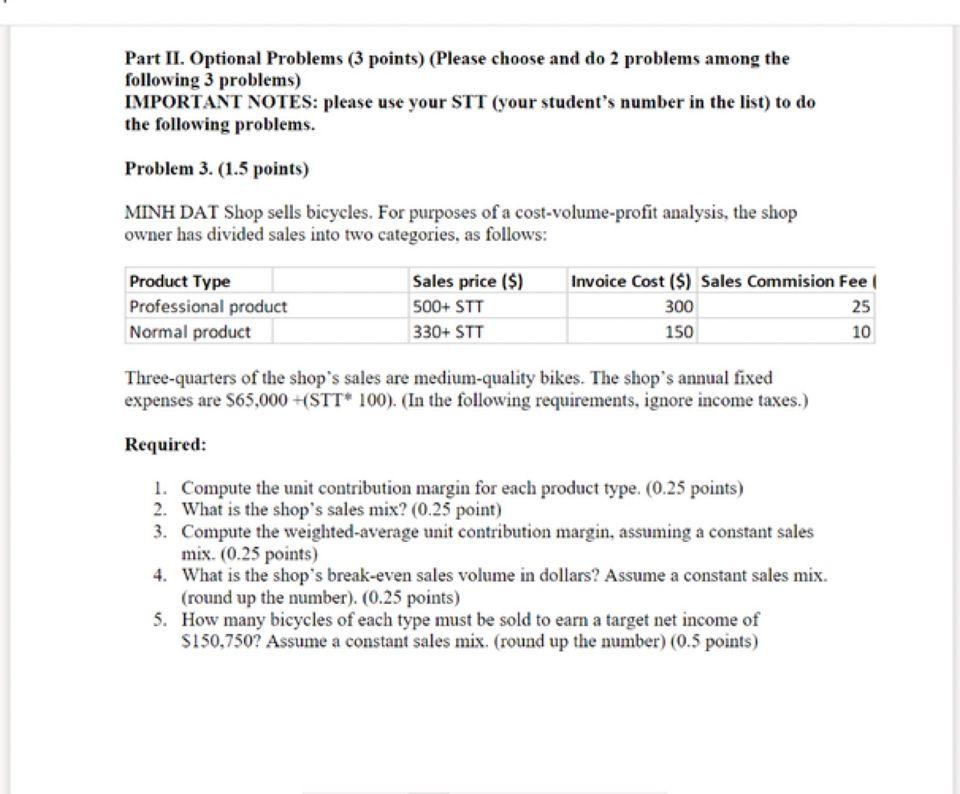

Part II. Optional Problems (3 points) (Please choose and do 2 problems among the following 3 problems) IMPORTANT NOTES: please use your STT (your student's number in the list) to do the following problems. Problem 3. (1.5 points) MINH DAT Shop sells bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: Product Type Professional product Normal product Sales price ($) 500+ STT 330+ STT Invoice Cost ($) Sales Commision Fee 300 25 150 10 Three-quarters of the shop's sales are medium-quality bikes. The shop's annual fixed expenses are $65,000 HSTT* 100). (In the following requirements, ignore income taxes.) Required: 1. Compute the unit contribution margin for each product type. (0.25 points) 2. What is the shop's sales mix? (0.25 point) 3. Compute the weighted average unit contribution margin, assuming a constant sales mix. (0.25 points) 4. What is the shop's break-even sales volume in dollars? Assume a constant sales mix. (round up the number). (0.25 points) 5. How many bicycles of each type must be sold to earn a target net income of $150,750? Assume a constant sales mix. (round up the number) (0.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts