Question: STT= 2 Part I. Compulsory Problems (5 points) IMPORTANT NOTES: please use your STT (your student's number in the list) to do the following problems.

STT= 2

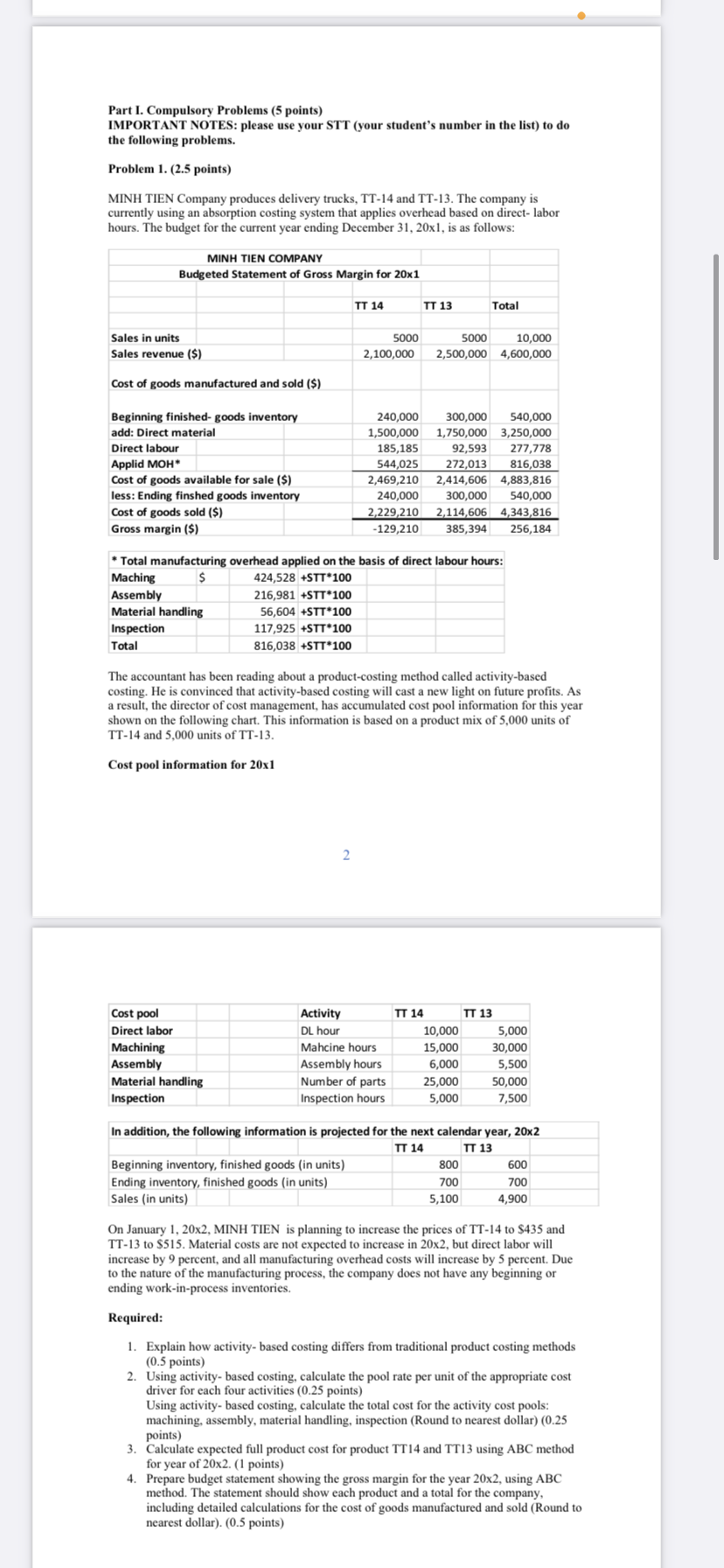

Part I. Compulsory Problems (5 points) IMPORTANT NOTES: please use your STT (your student's number in the list) to do the following problems. Problem 1. (2.5 points) MINH TIEN Company produces delivery trucks, TT-14 and TT-13. The company is currently using an absorption costing system that applies overhead based on direct- labor hours. The budget for the current year ending December 31, 20x1, is as follows: MINH TIEN COMPANY Budgeted Statement of Gross Margin for 20x1 TT 14 TT 13 Total Sales in units Sales revenue ($) 5000 2,100,000 5000 10,000 2,500,000 4,600,000 Cost of goods manufactured and sold ($) Beginning finished- goods inventory add: Direct material Direct labour Applid MOH Cost of goods available for sale ($) less: Ending finshed goods inventory Cost of goods sold ($) Gross margin ($) 240,000 1,500,000 185,185 544,025 2,469,210 240,000 2,229,210 - 129,210 300,000 540,000 1,750,000 3,250,000 92,593 277,778 272,013 816,038 2,414,606 4,883,816 300,000 540,000 2,114,606 4,343,816 385,394 256,184 * Total manufacturing overhead applied on the basis of direct labour hours: Maching $ 424,528 +STT*100 Assembly 216,981 +ST*100 Material handling S6,604 SIT100 Inspection 117,925 +ST*100 Total 816,038 ST100 The accountant has been reading about a product-costing method called activity-based costing. He is convinced that activity-based costing will cast a new light on future profits. As a result, the director of cost management, has accumulated cost pool information for this year shown on the following chart. This information is based on a product mix of 5,000 units of TT-14 and 5,000 units of TT-13. Cost pool information for 20x1 2 Cost pool Direct labor Machining Assembly Material handling Inspection Activity DL hour Mahcine hours Assembly hours Number of parts Inspection hours TT 14 TT 13 10,000 5,000 15,000 30,000 6,000 5,500 25,000 50,000 5,000 7,500 In addition, the following information is projected for the next calendar year, 20x2 TT 14 TT 13 Beginning inventory, finished goods (in units) 800 600 Ending inventory, finished goods (in units) 700 700 Sales (in units) 5,100 4,900 On January 1, 20x2, MINH TIEN is planning to increase the prices of TT-14 to $435 and TT-13 to $515. Material costs are not expected to increase in 20x2, but direct labor will increase by 9 percent, and all manufacturing overhead costs will increase by 5 percent. Due to the nature of the manufacturing process, the company does not have any beginning or ending work-in-process inventories. Required: 1. Explain how activity-based costing differs from traditional product costing methods (0.5 points) 2. Using activity-based costing, calculate the pool rate per unit of the appropriate cost driver for each four activities (0.25 points) Using activity-based costing, calculate the total cost for the activity cost pools: machining, assembly, material handling, inspection (Round to nearest dollar) (0.25 points) 3. Calculate expected full product cost for product TT14 and TT13 using ABC method for year of 20x2. (1 points) 4. Prepare budget statement showing the gross margin for the year 20x2, using ABC method. The statement should show each product and a total for the company, including detailed calculations for the cost of goods manufactured and sold (Round to nearest dollar). (0.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts