Question: My work for the incorrect answer. You decided to start planning for your retirement and setting aside part of your paycheck on a regular basis

My work for the incorrect answer.

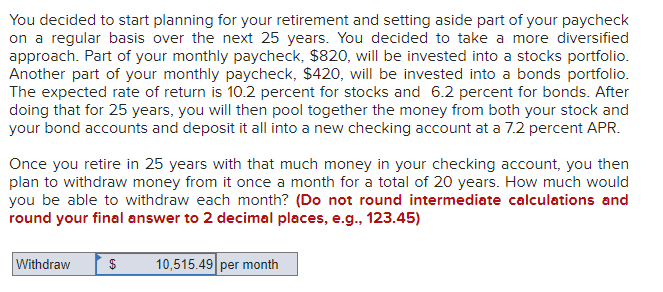

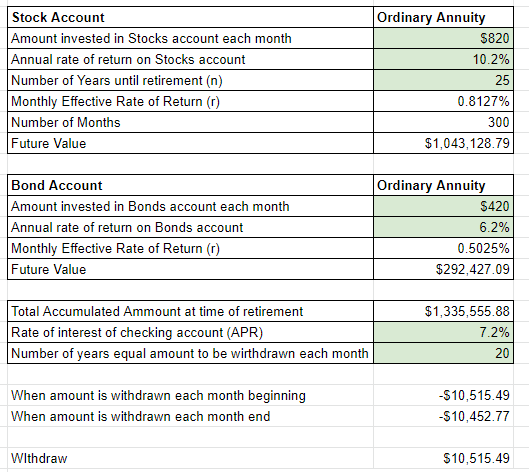

You decided to start planning for your retirement and setting aside part of your paycheck on a regular basis over the next 25 years. You decided to take a more diversified approach. Part of your monthly paycheck, $820, will be invested into a stocks portfolio. Another part of your monthly paycheck, $420, will be invested into a bonds portfolio. The expected rate of return is 10.2 percent for stocks and 6.2 percent for bonds. After doing that for 25 years, you will then pool together the money from both your stock and your bond accounts and deposit it all into a new checking account at a 7.2 percent APR. Once you retire in 25 years with that much money in your checking account, you then plan to withdraw money from it once a month for a total of 20 years. How much would you be able to withdraw each month? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 123.45) Withdraw $ 10,515.49 per month Stock Account Amount invested in Stocks account each month Annual rate of return on Stocks account Number of Years until retirement (n) Monthly Effective Rate of Return (r) Number of Months Future Value Bond Account Amount invested in Bonds account each month Annual rate of return on Bonds account Monthly Effective Rate of Return (r) Future Value Total Accumulated Ammount at time of retirement Rate of interest of checking account (APR) Number of years equal amount to be wirthdrawn each month When amount is withdrawn each month beginning When amount is withdrawn each month end Withdraw Ordinary Annuity $820 10.2% 25 0.8127% 300 $1,043,128.79 Ordinary Annuity $420 6.2% 0.5025% $292,427.09 $1,335,555.88 7.2% 20 -$10,515.49 -$10,452.77 $10,515.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts