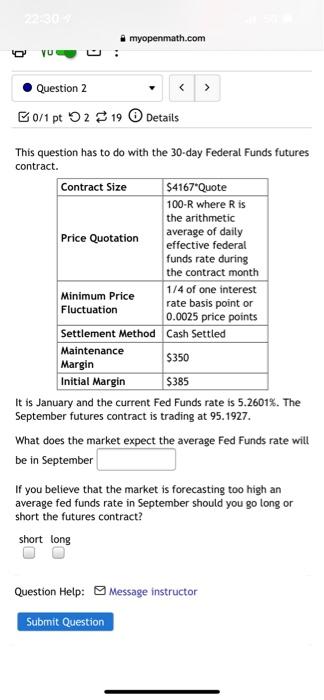

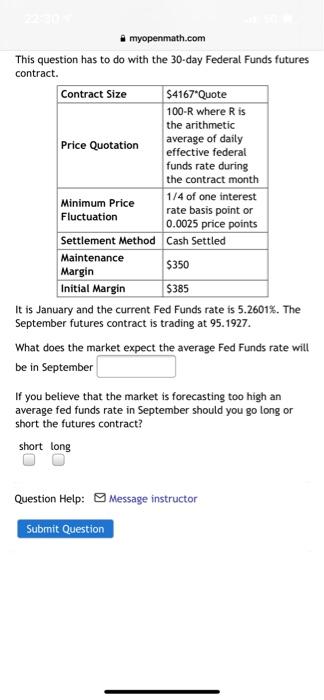

Question: myopenmath.com VU Question 2 B0/1 pt 2 19 Details This question has to do with the 30-day Federal Funds futures contract. Contract Size $4167Quote 100-R

myopenmath.com VU Question 2 B0/1 pt 2 19 Details This question has to do with the 30-day Federal Funds futures contract. Contract Size $4167"Quote 100-R where Ris the arithmetic Price Quotation average of daily effective federal funds rate during the contract month Minimum Price 1/4 of one interest Fluctuation rate basis point or 0.0025 price points Settlement Method Cash Settled Maintenance Margin $350 Initial Margin $385 It is January and the current Fed Funds rate is 5.2601%. The September futures contract is trading at 95.1927. What does the market expect the average Fed Funds rate will be in September If you believe that the market is forecasting too high an average fed funds rate in September should you go long or short the futures contract? short long Question Help: Message instructor Submit Question myopenmath.com This question has to do with the 30-day Federal Funds futures contract. Contract Size $4167"Quote 100-R where Ris the arithmetic Price Quotation average of daily effective federal funds rate during the contract month Minimum Price 1/4 of one interest Fluctuation rate basis point or 0.0025 price points Settlement Method Cash Settled Maintenance Margin $350 Initial Margin $385 It is January and the current Fed Funds rate is 5.2601%. The September futures contract is trading at 95.1927. What does the market expect the average Fed Funds rate will be in September If you believe that the market is forecasting too high an average fed funds rate in September should you go long or short the futures contract? short long Question Help: Message instructor Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts