Question: please answer all points Sare se An asset used in a four-year project falls in the five-year MACRS class (0.20, 0.32 0.192, 0.1152, Q. 1152.

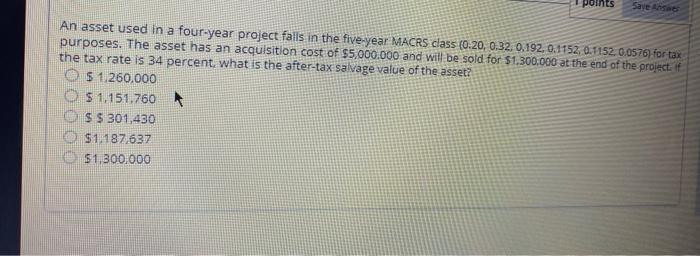

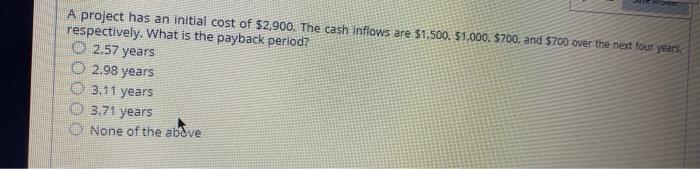

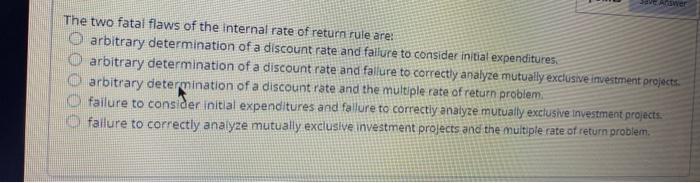

points Sare se An asset used in a four-year project falls in the five-year MACRS class (0.20, 0.32 0.192, 0.1152, Q. 1152. 0.0576) for tax purposes. The asset has an acquisition cost of $5.000.000 and will be sold for $1.300.000 at the end of the project. If the tax rate is 34 percent what is the after-tax salvage value of the asset? $ 1.260.000 $ 1,151.760 $ $ 301,430 $1.187.637 $1,300,000 A project has an initial cost of $2,900. The cash inflows are $1,500. 51.000. $700 and 5700 over the next four years. respectively. What is the payback period? 2.57 years 0 2.98 years 3.11 years 3.71 years None of the abdve VaRwer The two fatal flaws of the internal rate of return rule are: O arbitrary determination of a discount rate and failure to consider initial expenditures arbitrary determination of a discount rate and failure to correctly analyze mutually exclusive investment projects. arbitrary determination of a discount rate and the multiple rate of return problem failure to consider initial expenditures and fallure to correctly analyze mutually exclusive investment projects failure to correctly analyze mutually exclusive investment projects and the multiple rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts