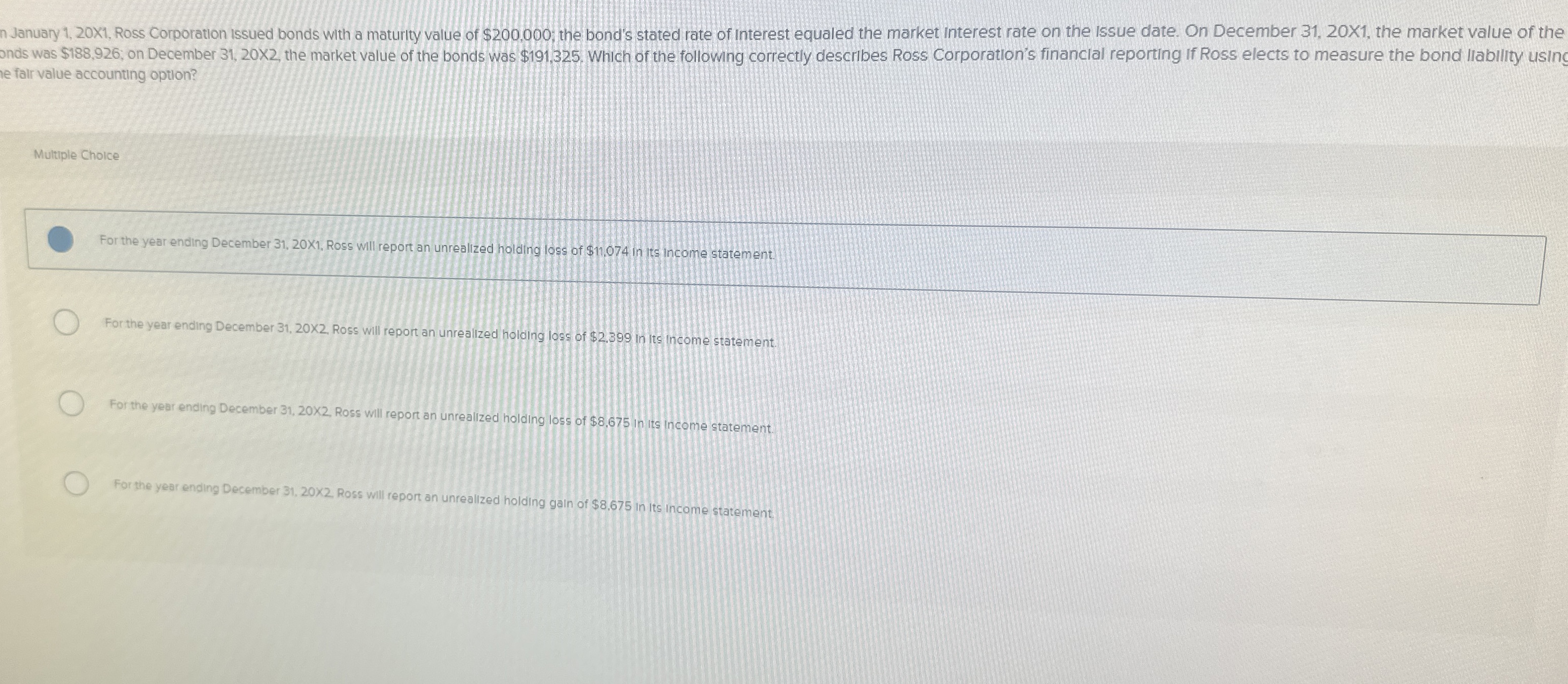

Question: n January 1 , 2 0 X 1 , Ross Corporation issued bonds with a maturity value of $ 2 0 0 , 0 0

n January X Ross Corporation issued bonds with a maturity value of $; the bond's stated rate of interest equaled the market interest rate on the issue date. On December XI the market value of the

onds was $; on December the market value of the bonds wos $ Which of the following correctly describes Ross Corporation's financlal reporting if Ross elects to measure the bond libality using

falir value accounting option?

Multiple Cholce

For the year ending December X Ross will report an unrealized holding loss of $ in iss income statement.

For the year ending December X Ross will report an unrealized holding loss of $ in its income statement.

For the year ending December times Ross will report an unrealized holding loss of $ in its income statement.

For the year ending December Ross will report an unrealized holding gain of $ in its income statement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock