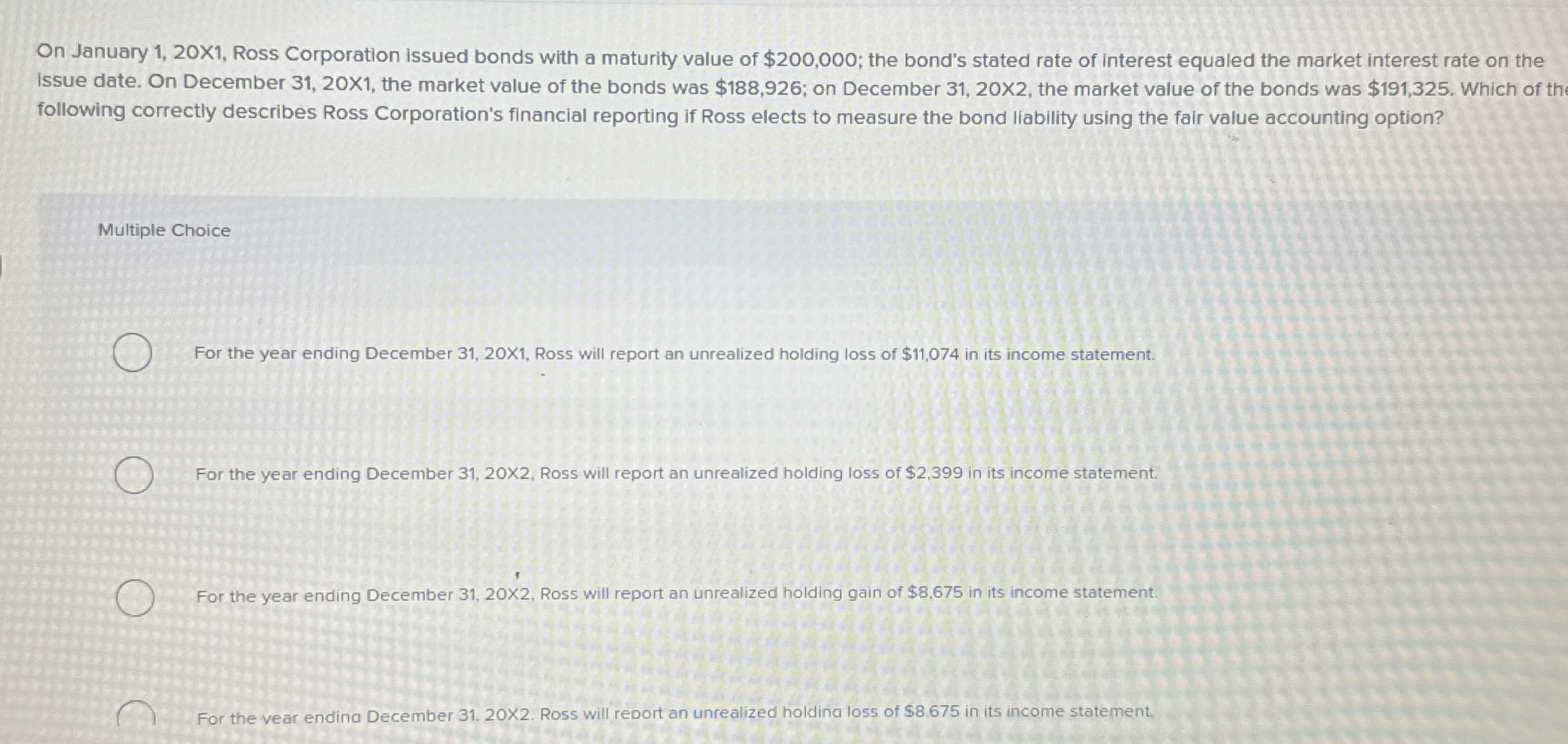

Question: On January 1 , 2 0 X 1 , Ross Corporation issued bonds with a maturity value of $ 2 0 0 , 0 0

On January X Ross Corporation issued bonds with a maturity value of $; the bond's stated rate of interest equaled the market interest rate on the

issue date. On December X the market value of the bonds was $; on December X the market value of the bonds was $ Which of th

following correctly describes Ross Corporation's financlal reporting if Ross elects to measure the bond liability using the fair value accounting option?

Multiple Choice

For the year ending December X Ross will report an unrealized holding loss of $ in its income statement.

For the year ending December X Ross will report an unrealized holding loss of $ in its income statement.

For the year ending December times Ross will report an unrealized holding gain of $ in its income statement.

For the vear endina December Ross will report an unrealized holdina loss of $ in its income statement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock