Question: N Q S AD B C D E G H K M R T U W X Z AA AB AC AE Pete's Store Dept

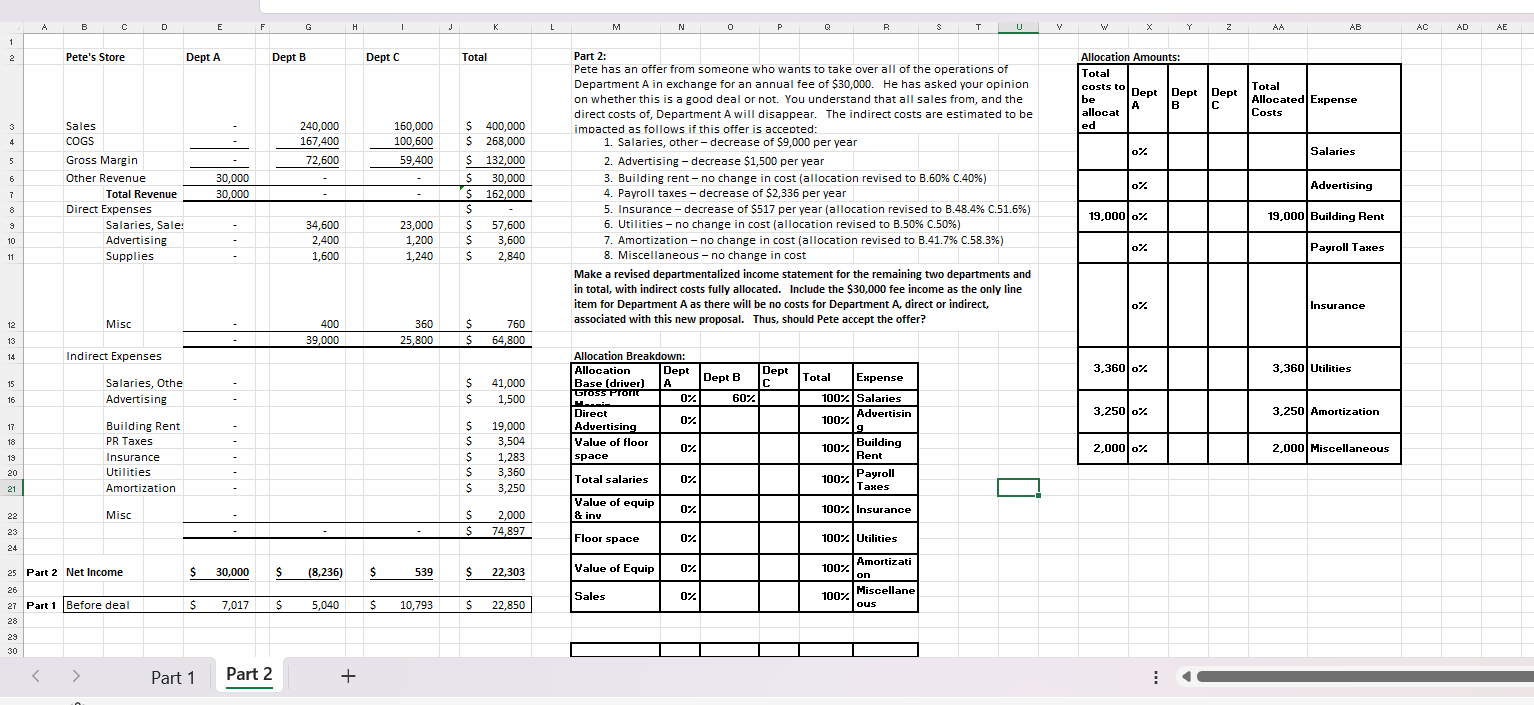

N Q S AD B C D E G H K M R T U W X Z AA AB AC AE Pete's Store Dept A Dept B Dept C Total Part 2: Allocation Amounts: Pete has an offer from someone who wants to take over all of the operations of Total Department A in exchange for an annual fee of $30,000. He has asked your opinion costs to Dept Total Dept Dept on whether this is a good deal or not. You understand that all sales from, and the be A B C Allocated Expense direct costs of, Department A will disappear. The indirect costs are estimated to be allocal Costs Sales 240,000 160,000 400,000 ed S impacted as follows if this offer is accepted: COGS 167,400 100,600 $ 268,000 1. Salaries, other - decrease of $9,000 per year 0% Salaries Gross Margin 72,600 59,400 132,000 2. Advertising - decrease $1,500 per year Other Revenue 30,000 30,000 3. Building rent - no change in cost (allocation revised to B.60% C.40%) Advertising Total Revenue 30,000 $ 162,000 4. Payroll taxes - decrease of $2,336 per year Direct Expenses 5. Insurance - decrease of $517 per year (allocation revised to B.48.4% C.51.6%) 19,000 0% 19,000 Building Rent Salaries, Sale: 34,600 23,000 57,600 6. Utilities - no change in cost (allocation revised to B.50% C.50%) Advertising 2,400 1,200 3,600 7. Amortization - no change in cost (allocation revised to B.41.7% C.58.3%) Payroll Taxes Supplies 1,600 1,240 2,840 8. Miscellaneous - no change in cost Make a revised departmentalized income statement for the remaining two departments and in total, with indirect costs fully allocated. Include the $30,000 fee income as the only line item for Department A as there will be no costs for Department A, direct or indirect, Insurance 400 360 760 associated with this new proposal. Thus, should Pete accept the offer? Misc 39,000 25,800 64,800 Indirect Expenses Allocation Breakdown: Allocation Dept 3,360 0% 3,360 Utilities 15 Salaries, Othe 41,000 Base (driver) Dept B Dept Total C Expense Gross Profit 16 Advertising 1,500 60% 100% Salaries Advertisin 3,250 Amortization Direc 3,250 0% 100% 17 Building Rent S 19,000 Advertising 9 18 PR Taxes 3.50 Value of floor 0% 100%% Building 2.000 0% 2,000 Miscellaneous 19 Insurance 1,28 space Rent 20 Utilities 3,360 Total salaries 0% 100% Payroll Amortization 3,250 Taxes 21 Value of equip 0% 100% Insurance 22 Mis S 2,000 & inv 23 74,897 Floor space 100% Utilities 24 Amortizati 25 Part 2 Net Income 30,000 $ (8,236) $ 539 22,303 Value of Equip 0% 1007- on 26 Sales 100% Miscellane 27 Part 1 Before deal S 7,017 5,040 10,793 $ 22,850 Ous 28 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts