Question: Nabil is considering buying a house while he is at university. The house costs $240,000 today. Renting out part of the house and living in

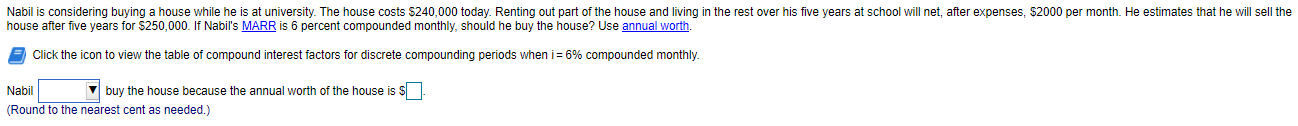

Nabil is considering buying a house while he is at university. The house costs $240,000 today. Renting out part of the house and living in the rest over his five years at school will net, after expenses, $2000 per month. He estimates that he will sell the house after five years for $250,000. If Nabil's MARR is 6 percent compounded monthly, should he buy the house? Use annual worth. Click the icon to view the table of compound interest factors for discrete compounding periods when i=6% compounded monthly Nabil buy the house because the annual worth of the house is $ (Round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock