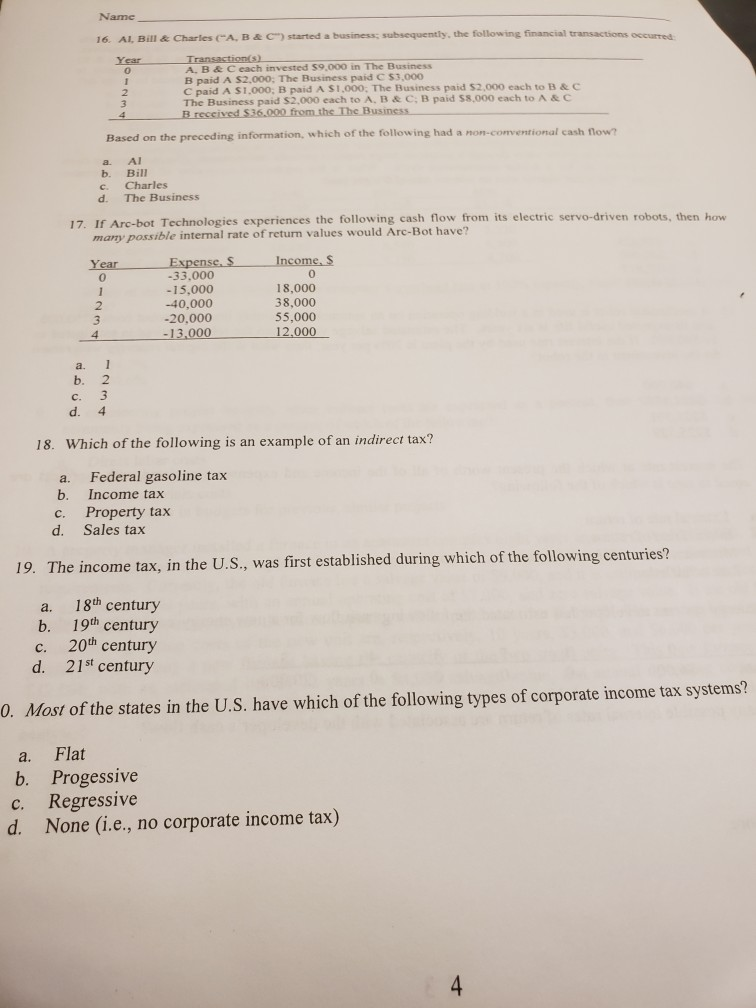

Question: Name 16. AL, Bill & Charles CA, B&C) started a business; subsequently, the following financial transactions occurred Year 0 A, B&C each invested $9,000 in

Name 16. AL, Bill & Charles CA, B&C) started a business; subsequently, the following financial transactions occurred Year 0 A, B&C each invested $9,000 in The Business B paid A $2.000; The Business paid C $3,000 C paid A $1,000, B paid A $1,000. The Business paid $2,000 each to B & C The Business paid $2.000 each to A. B&CB paid $8,000 each to A & C Based on the preceding information, which of the following had a non-conventional cash fow? a. Al c. Charles d. The Business If Arc-bot Technologies experiences the following cash flow from its electric servo-driven robots, then how many possible internal rate of return values would Arc-Bot have? Ex 33,000 -15.000 -40,000 -20.000 13,000 0 0 18,000 38,000 55,000 12,000 2 3 4 a. b. 2 c. 3 d. 4 18. Which of the following is an example of an indirect tax? Federal gasoline tax Income tax a. b. c. Property tax d. Sales tax 19. The income tax, in the U.S., was first established during which of the following centuries? a. 18th century b. 19th century c. 20th century d. 21st century Most of the states in the U.S. have which of the following types of corporate income tax systems a. Flat b. Progessive c. Regressive d. None (i.e., no corporate income tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts