Question: Name 2 Student ID FIN 320 Section 3 ASSIGNMENT 1 You are considering the following stocks to be included in your portfolio. Analyse the expected

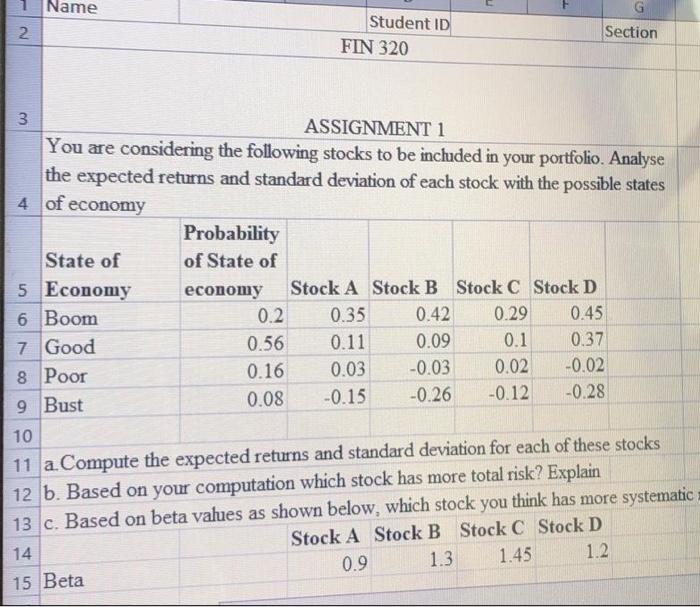

Name 2 Student ID FIN 320 Section 3 ASSIGNMENT 1 You are considering the following stocks to be included in your portfolio. Analyse the expected returns and standard deviation of each stock with the possible states 4 of economy Probability State of of State of 5 Economy economy Stock A Stock B Stock C Stock D 6 Boom 0.2 0.35 0.42 0.29 0.45 7 Good 0.56 0.11 0.09 0.1 0.37 8 Poor 0.16 0.03 -0.03 0.02 -0.02 9 Bust 0.08 -0.15 -0.26 -0.12 -0.28 10 11 a Compute the expected returns and standard deviation for each of these stocks 12 b. Based on your computation which stock has more total risk? Explain 13 c. Based on beta values as shown below, which stock you think has more systematic Stock A Stock B Stock C Stock D 14 0.9 1.3 1.2 1.45 15 Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts