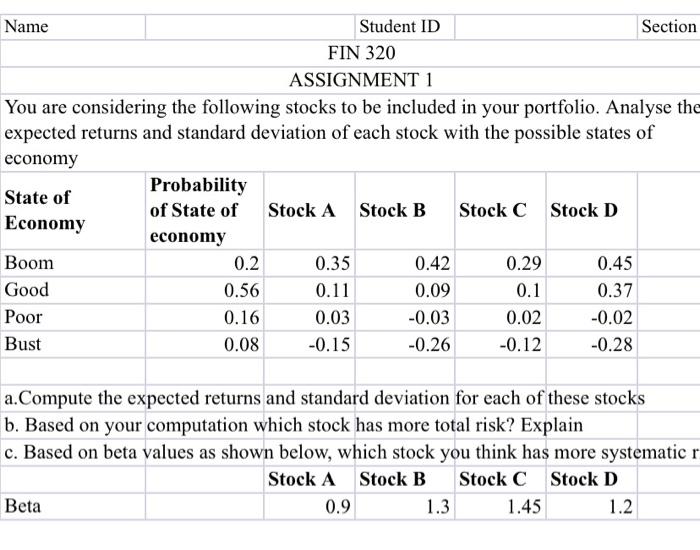

Question: Name Student ID Section FIN 320 ASSIGNMENT 1 You are considering the following stocks to be included in your portfolio. Analyse the expected returns and

Name Student ID Section FIN 320 ASSIGNMENT 1 You are considering the following stocks to be included in your portfolio. Analyse the expected returns and standard deviation of each stock with the possible states of economy State of Probability of State of Stock A Stock B Stock C Stock D Economy economy Boom 0.2 0.35 0.42 0.29 0.45 Good 0.56 0.11 0.09 0.1 0.37 Poor 0.16 0.03 -0.03 0.02 -0.02 Bust 0.08 -0.15 -0.26 -0.12 -0.28 a.Compute the expected returns and standard deviation for each of these stocks b. Based on your computation which stock has more total risk? Explain c. Based on beta values as shown below, which stock you think has more systematic r Stock A Stock B Stock C Stock D Beta 0.9 1.3 1.45 1.2 Student ID Section FIN 320 ASSIGNMENT 1 sidering the following stocks to be included in your portfolio. Analyse the turns and standard deviation of each stock with the possible states of Stock A Stock B Stock C Stock D Probability of State of economy 0.2 0.56 0.16 0.08 0.35 0.11 0.03 -0.15 0.42 0.09 -0.03 -0.26 0.29 0.1 0.02 -0.12 0.45 0.37 -0.02 -0.28 the expected returns and standard deviation for each of these stocks your computation which stock has more total risk? Explain beta values as shown below, which stock you think has more systematic risk? Explain Stock A Stock B Stock C Stock D 0.9 1.3 1.45 1.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts