Question: D ormat Arrange View Share Window Help 9% Untitled - Edited v 125% Ev T jew Zoom Add Category Insert Table Chart Text Shape Media

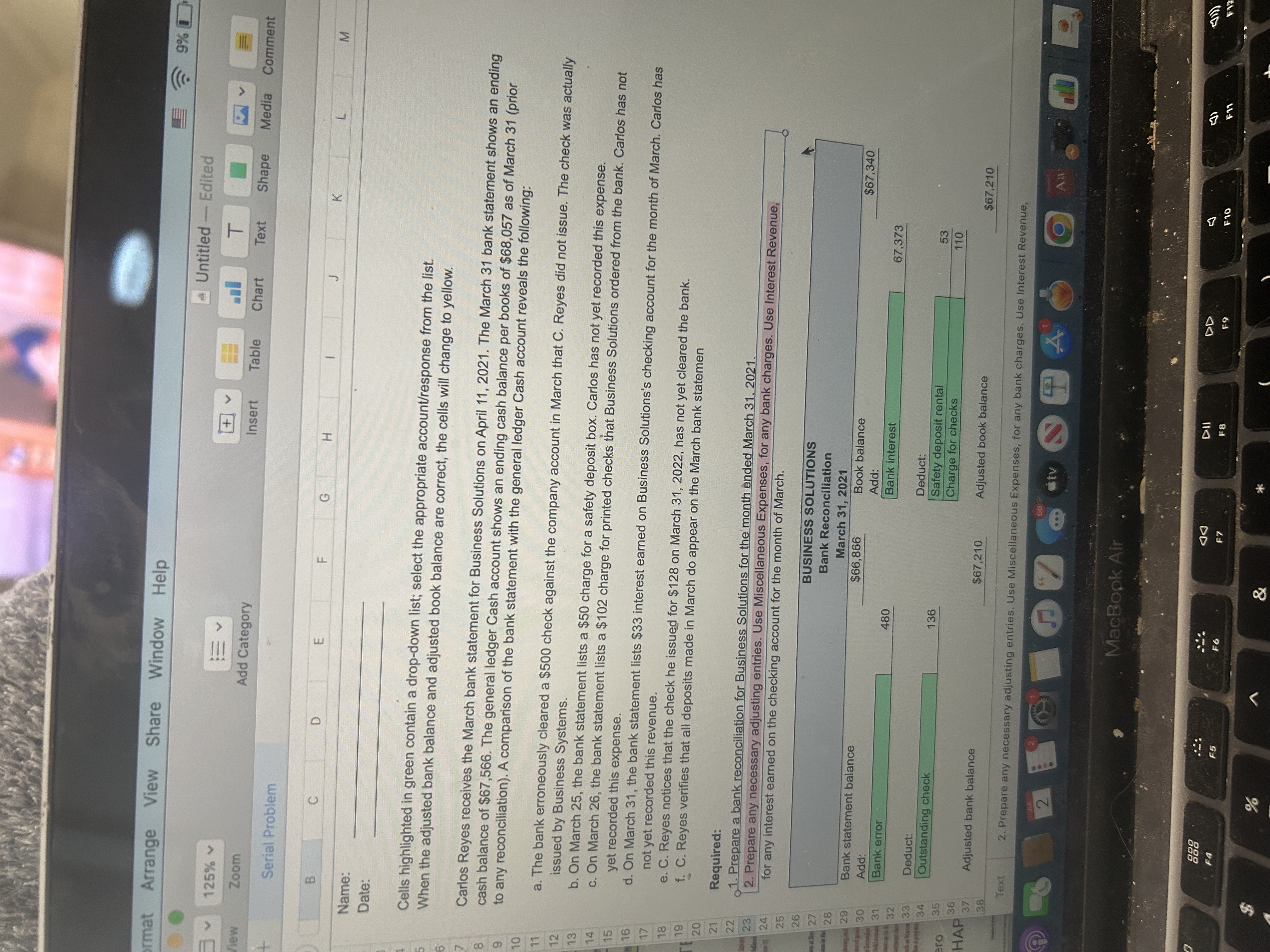

D ormat Arrange View Share Window Help 9% Untitled - Edited v 125% Ev T jew Zoom Add Category Insert Table Chart Text Shape Media Comment Serial Problem B C D E F G H J K L M Name: Date: Cells highlighted in green contain a drop-down list; select the appropriate account/response from the list. When the adjusted bank balance and adjusted book balance are correct, the cells will change to yellow. Carlos Reyes receives the March bank statement for Business Solutions on April 11, 2021. The March 31 bank statement shows an ending cash balance of $67,566. The general ledger Cash account shows an ending cash balance per books of $68,057 as of March 31 (prior to any reconciliation). A comparison of the bank statement with the general ledger Cash account reveals the following: a. The bank erroneously cleared a $500 check against the company account in March that C. Reyes did not issue. The check was actually 12 issued by Business Systems. 13 b. On March 25, the bank statement lists a $50 charge for a safety deposit box. Carlos has not yet recorded this expense. 14 c. On March 26, the bank statement lists a $102 charge for printed checks that Business Solutions ordered from the bank. Carlos has not 15 yet recorded this expense. 16 d. On March 31, the bank statement lists $33 interest earned on Business Solutions's checking account for the month of March. Carlos has 17 not yet recorded this revenue. 18 e. C. Reyes notices that the check he issued for $128 on March 31, 2022, has not yet cleared the bank. 19 f. C. Reyes verifies that all deposits made in March do appear on the March bank statemen 20 21 Required: 22 1. Prepare a bank reconciliation for Business Solutions for the month ended March 31, 2021. 23 2. Prepare any necessary adjusting entries. Use Miscellaneous Expenses, for any bank charges. Use Interest Revenue, 24 for any interest earned on the checking account for the month of March. 25 26 BUSINESS SOLUTIONS 27 Bank Reconciliation 28 March 31, 2021 29 Bank statement balance $66,866 Book balance $67,340 30 Add Add: 31 Bank error 480 Bank interest 67,373 32 33 Deduct: Deduct: 34 Outstanding check 136 Safety deposit rental 53 35 Charge for checks 110 HAD 36 37 Adjusted bank balance $67,210 Adjusted book balance $67,210 38 Text 2. Prepare any necessary adjusting entries. Use Miscellaneous Expenses, for any bank charges. Use Interest Revenue, 2 . .. tv 4 Aa MacBook Air 868 DII DD F7 F9 F10 F4 F5 F6 F8 &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts