Question: Name: Date: Graded Assignment Adjusting and Closing Entries Complete the following activities. Total score: of 60 points (60 points) 1. Journal adjusting and closing entries

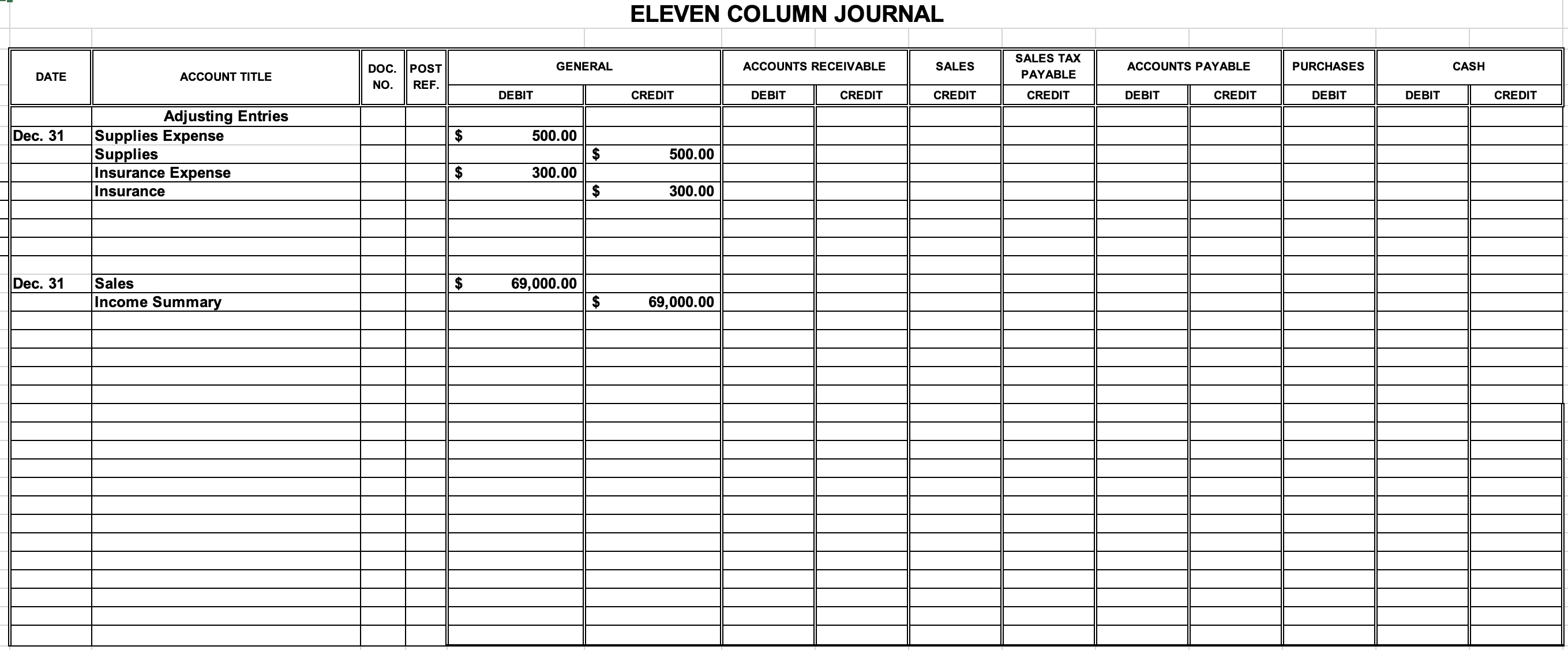

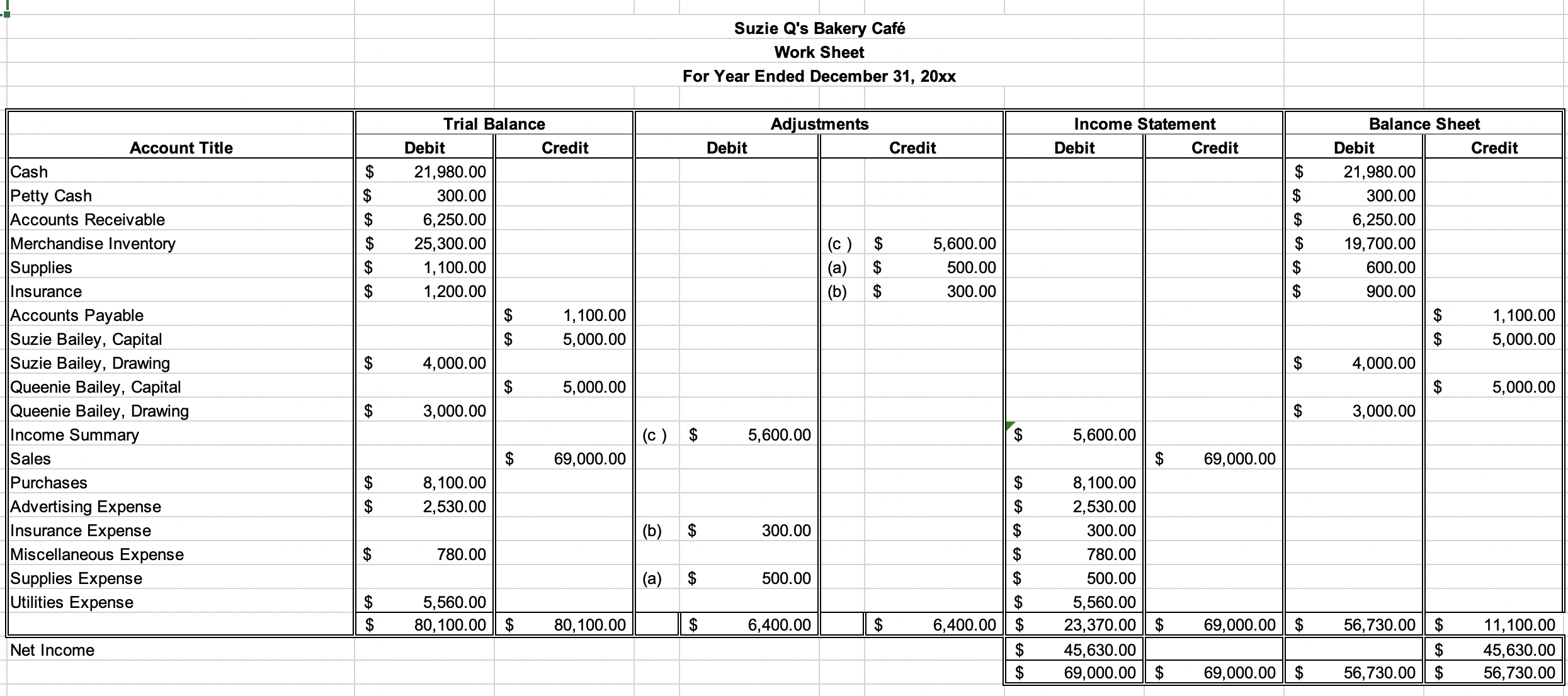

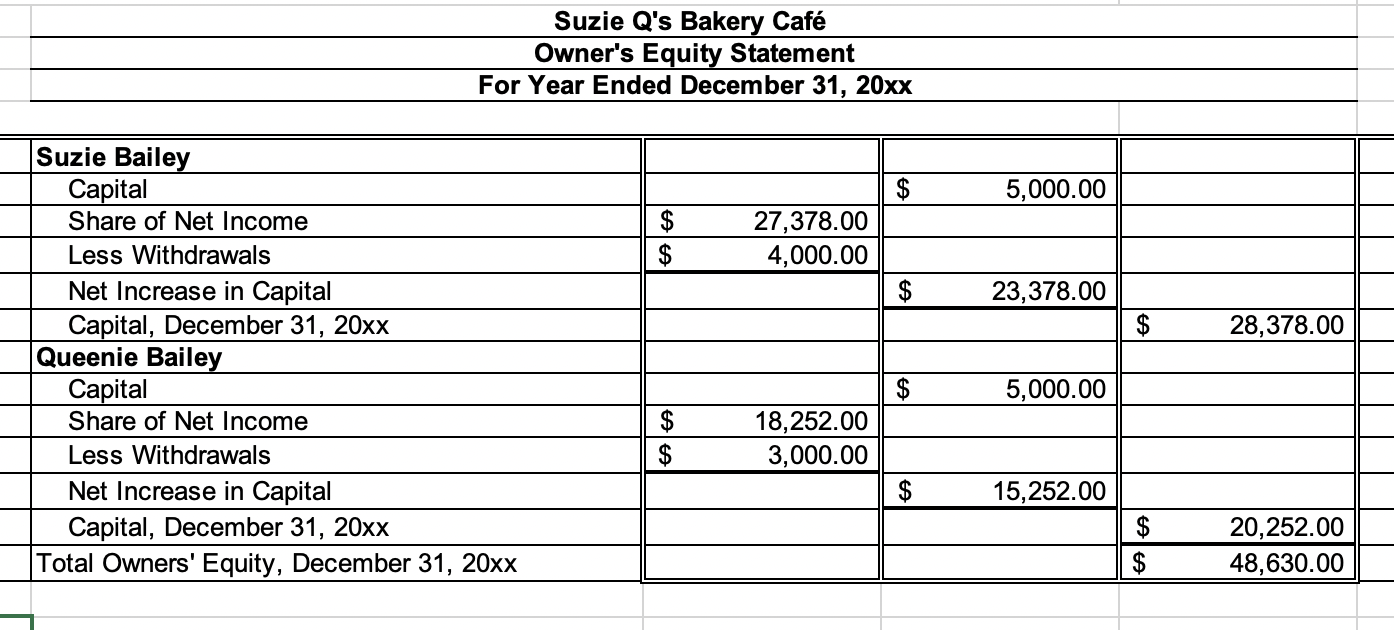

Name: Date: Graded Assignment Adjusting and Closing Entries Complete the following activities. Total score: of 60 points (60 points) 1. Journal adjusting and closing entries and prepare a post-closing trial balance for Suzy Q's Bakery Cafe. a Start Microsoft Excel, and open the BUS113_13_04.xlsx file from C:\\ACTT1\\Data\\Unit_13. b. Click the File tab, and click Save As. Save the file to C:\\ACTT'l\\Student\\Unit_13. .0 Navigate to the Journal spreadsheet tab. d. Journal the adjusting and closing entries for Suzie Q's Bakery Cafe. Use the information from the Work Sheet and Owner's Equity Statement tabs. Some entries are done for you. e. Navigate to the Post-Closing Trial Balance spreadsheet tab. f. Write the heading for the fiscal period ending December 31, 20xx. g. Prepare a post-closing trial balance using the information from the Work Sheet and Owner's Equity Statement tabs. h. Total and rule the postclosing trial balance. i. Save and close the spreadsheet. j. Submit your le to your instructor for grading. Scoring Guide Criteria Points Points Possible Earned Journalized adjusting and closing entries accurately. -- Prepared a post-closing trial balance correctly. Total Points \" ELEVEN COLUMN JOURNAL SALES TAX DATE ACCOUNT TITLE D$_ 10:: GENERAL ACCOUNTS RECEIVABLE SALES PAYABLE ACCOUNTS PAYABLE PURCHAsEs CASH ' ' DEBIT CREDIT DEBIT CREDIT CREDIT CREDIT DEBIT CREDIT DEBIT DEBIT CREDIT Adjusting Entries Dec. 31 Supplies Expense 3 500.00 Supplies S 500.00 _ Insurance Expense $ 300.00 _ Insurance $ 300.00 Dec. 31 Sales 5 $9,000.00 Income Summary S 69,000.00 Suzie Q's Bakery Caf Work Sheet For Year Ended December 31, 20xx Trial Balance Adjustments Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Debit Credit Cash $ 21,980.00 $ 21,980.00 Petty Cash $ 300.00 $ 300.00 Accounts Receivable $ 6,250.00 $ 6,250.00 Merchandise Inventory $ 25,300.00 (c ) $ 5,600.00 $ 19,700.00 Supplies $ 1,100.00 (a) $ 500.00 $ 600.00 Insurance $ 1,200.00 (b) $ 300.00 $ 900.00 Accounts Payable $ 1,100.00 $ 1,100.00 Suzie Bailey, Capital $ 5,000.00 $ 5,000.00 Suzie Bailey, Drawing $ 4,000.00 $ 4,000.00 Queenie Bailey, Capital $ 5,000.00 $ 5,000.00 Queenie Bailey, Drawing $ 3,000.00 $ 3,000.00 Income Summary (c ) $ 5,600.00 V$ 5,600.00 Sales $ 69,000.00 $ 69,000.00 Purchases $ 8,100.00 $ 8,100.00 Advertising Expense $ 2,530.00 $ 2,530.00 Insurance Expense (b) $ 300.00 $ 300.00 Miscellaneous Expense $ 780.00 $ 780.00 Supplies Expense (a) $ 500.00 $ 500.00 Utilities Expense $ 5,560.00 $ 5,560.00 $ 80,100.00 $ 80,100.00 $ 6,400.00 $ 6,400.00 $ 23,370.00 $ 69,000.00 $ 56,730.00 $ 11,100.00 Net Income $ 45,630.00 $ 45,630.00 $ 69,000.00 $ 69,000.00 $ 56,730.00 $ 56,730.00 Suzie Q's Bakery Cafe Owner's Equity Statement For Year Ended December 31, 20xx Suzie Bailey Capital $ 5,000.00 Share of Net Income 27,378.00 Less Withdrawals CA 4,000.00 Net Increase in Capital $ 23,378.00 Capital, December 31, 20xx $ 28,378.00 Queenie Bailey Capital 5,000.00 Share of Net Income 18,252.00 Less Withdrawals 3,000.00 Net Increase in Capital $ 15,252.00 Capital, December 31, 20xx 20,252.00 Total Owners' Equity, December 31, 20xx 48,630.00\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts