Question: Document x M Course Access | Connect | Mc( X Question 1 - Quiz - Chapter 02 x Homework Help - Q&A from O X

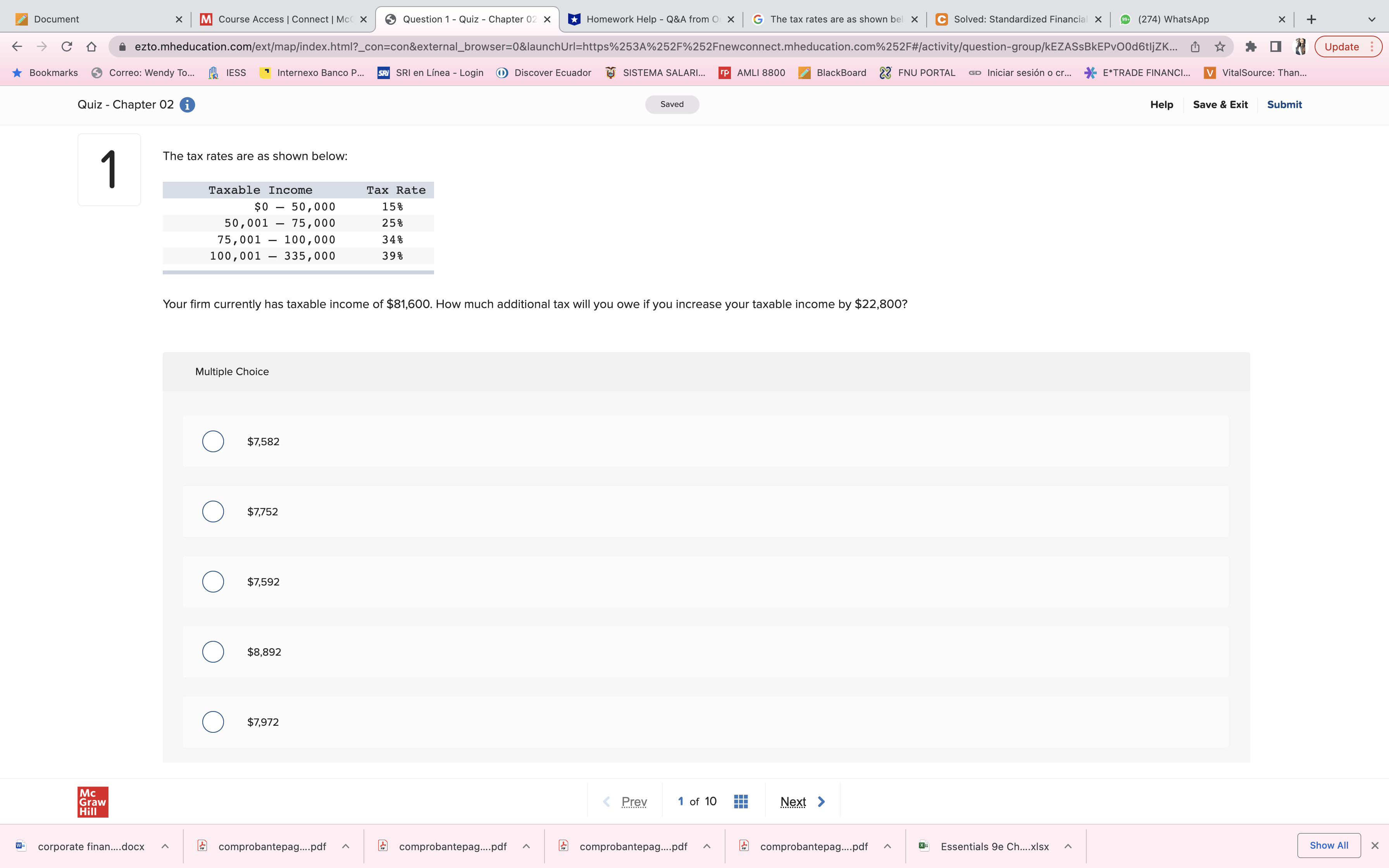

Document x M Course Access | Connect | Mc( X Question 1 - Quiz - Chapter 02 x Homework Help - Q&A from O X G The tax rates are as shown bel X C Solved: Standardized Financial X 3 (274) WhatsApp X + - C D a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/kEZASsBkEPvOod6tijZK... ( * * (Update : Bookmarks Correo: Wendy To... [ IESS 7 Internexo Banco P... Shi SRI en Linea - Login Discover Ecuador SISTEMA SALARI... IP AMLI 8800 BlackBoard 2 FNU PORTAL L GD Iniciar sesion o cr... - E*TRADE FINANCI V VitalSource: Than.. Quiz - Chapter 02 i Saved Help Save & Exit Submit The tax rates are as shown below: Taxable Income Tax Rate $0 - 50, 000 158 50, 001 - 75, 000 25% 75, 001 - 100, 000 348 100, 001 - 335,000 39% Your firm currently has taxable income of $81,600. How much additional tax will you owe if you increase your taxable income by $22,800? Multiple Choice O $7,582 O $7,752 O $7,592 O $8,892 O $7,972 Graw Prev 1 of 10 Next > corporate finan....docx comprobantepag....pdf ~ comprobantepag.pdf comprobantepag...pdf comprobantepag....pdf ~ Essentials ge Ch....xIsx Show All X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts