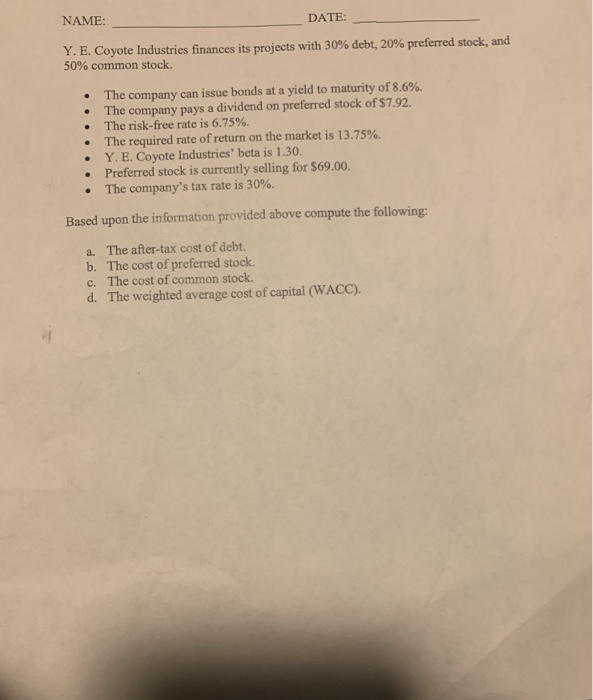

Question: NAME: DATE: Y E. Coyote Industries finances its projects with 30% debt 20% preferred stock, and 50% common stock. The company can issue bonds at

NAME: DATE: Y E. Coyote Industries finances its projects with 30% debt 20% preferred stock, and 50% common stock. The company can issue bonds at a yield to maturity of 8.6%. . The company pays a dividend on preferred stock of $7.92. The risk-free rate is 6.75%. The required rate of return on the market is 13.75%. Y. E. Coyote Industries' beta is 1.30. Preferred stock is currently selling for $69.00. The company's tax rate is 30%. . Based upon the information provided above compute the following The after-tax cost of debt. a b. The cost of preferred stock. The cost of common stock. c. d. The weighted average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts