Question: Name: Instructor does not accept any other form than the handwritten homework (e g. no emailed, scanned, texted, or typed homework will be accepted for

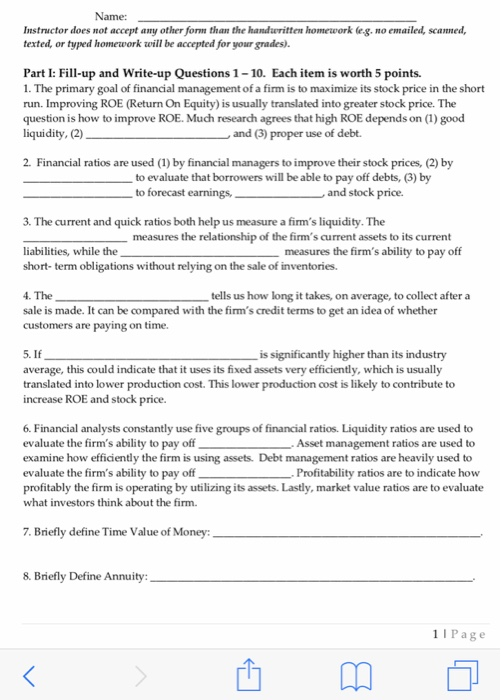

Name: Instructor does not accept any other form than the handwritten homework (e g. no emailed, scanned, texted, or typed homework will be accepted for your grades). Part I: Fill-up and Write-up Questions 1-10. Each item is worth 5 points. 1. The primary goal of financial management of a firm is to maximize its stock price in the short run. Improving ROE (Return On Equity) is usually translated into greater stock price. The question is how to improve ROE. Much research agrees that high ROE depends on (1) good liquidity, (2) and (3) proper use of debt. 2. Financial ratios are used (1) by financial managers to improve their stock prices, (2) by to evaluate that borrowers will be able to pay off debts, (3) by to forecast earnings d stock p 3. The current and quick ratios both help us measure a firm's liquidity. The measures the relationship of the firm's current assets to its current liabilities, while the short-term obligations without relying on the sale of inventories. measures the firm's ability to pay off 4. The sale is made. It can be compared with the firm's credit terms to get an idea of whether customers are paying on time. tells us how long it takes, on average, to collect after a 5. If average, this could indicate that it uses its fixed assets very efficiently, which is usually translated into lower production cost. This lower production cost is likely to contribute to increase ROE and stock price. is significantly higher than its industry 6. Financial analysts constantly use five groups of financial ratios. Liquidity ratios are used to evaluate the firm's ability to pay off. Asset management ratios are used to examine how efficiently the firm is using assets. Debt management ratios are heavily used to evaluate the firm's ability to pay off profitably the firm is operating by utilizing its assets. Lastly, market value ratios are to evaluate what investors think about the firm Profitability ratios are to indicate how 7. Briefly define Time Value of Money: 8. Briefly Define Annuity 1I Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts