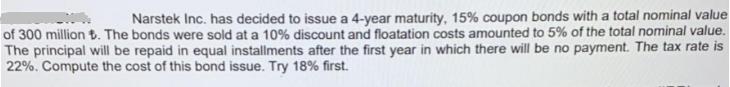

Question: Narstek Inc. has decided to issue a 4-year maturity, 15% coupon bonds with a total nominal value of 300 million . The bonds were

Narstek Inc. has decided to issue a 4-year maturity, 15% coupon bonds with a total nominal value of 300 million . The bonds were sold at a 10% discount and floatation costs amounted to 5% of the total nominal value. The principal will be repaid in equal installments after the first year in which there will be no payment. The tax rate is 22%. Compute the cost of this bond issue. Try 18% first.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

To calculate the cost of the bond issue we need to find the total amount of cash outflows ie cost that Narstek Inc will incur The cost will be calcula... View full answer

Get step-by-step solutions from verified subject matter experts