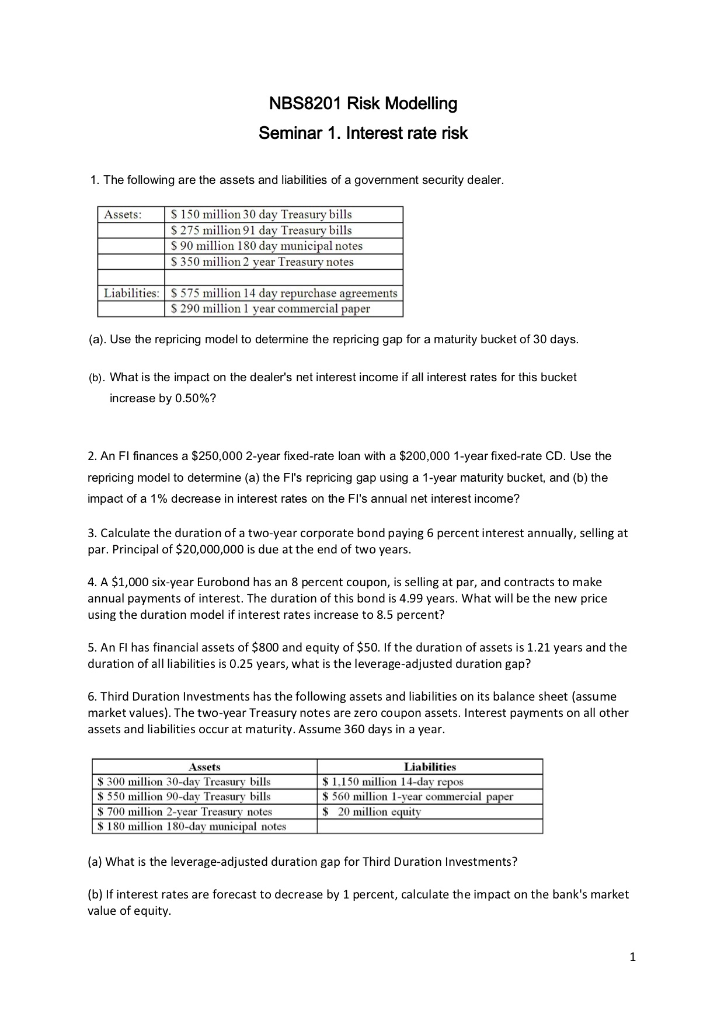

Question: NBS8201 Risk Modelling Seminar 1. Interest rate risk 1. The following are the assets and liabilities of a government security dealer S 150 miion 30

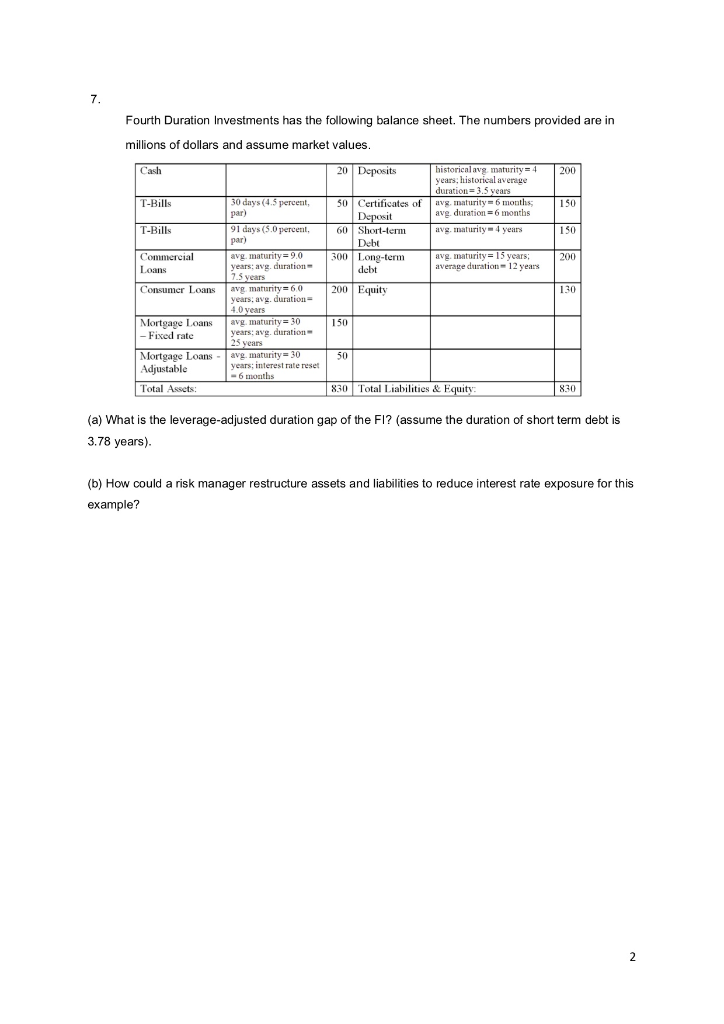

NBS8201 Risk Modelling Seminar 1. Interest rate risk 1. The following are the assets and liabilities of a government security dealer S 150 miion 30 day Treasury bills Assets S 275 million 91 day Treasury bills S90 million 180 day municipal notes 350 million 2 vear Treasury notes Liabilities: S 575 million 14 day repurchase agreements S 290 million 1 year commercial (a). Use the repricing model to determine the repricing gap for a maturity bucket of 30 days. (b). What is the impact on the dealer's net interest income if all interest rates for this bucket increase by 0.50%? 2. An FI finances a $250,000 2-year fixed-rate loan with a $200,000 1-year fixed-rate CD. Use the repricing model to determine (a) the Fl's repricing gap using a 1-year maturity bucket, and (b) the impact of a 1% decrease in interest rates on the FI's annual net interest income? 3. Calculate the duration of a two-year corporate bond paying 6 percent interest annually, selling at par. Principal of $20,000,000 is due at the end of two years. 4. A $1,000 six-year Eurobond has an 8 percent coupon, is selling at par, and contracts to make annual payments of interest. The duration of this bond is 4.99 years. What will be the new price using the duration model if interest rates increase to 8.5 percent? 5. An FI has financial assets of $800 and equity of $50. If the duration of assets is 1.21 years and the duration of all liabilities is 0.25 years, what is the leverage-adjusted duration gap? 6. Third Duration Investments has the following assets and liabilities on its balance sheet (assume market values). The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year Assets Liabilities 1,150 million 14-day repos 550 million 90-day Treasury bills 560 million 1-year commercial 700 million 2-year Treasurv notes 20 lion equity 180 million 180-day municipal notes (a) What is the leverage-adjusted duration gap for Third Duration Investments? (b) If interest rates are forecast to decrease by 1 percent, calculate the impact on the bank's market value of equity Fourth Duration Investments has the following balance sheet. The numbers provided are in millions of dollars and assume market values Cash 20 Deposits historical avg maturity years, historical average duration -3.5 years | avg, maturity-611 avg, duration= 6 months 200 T-Bills 0 days (4.5 percent, par) 150| Certificates of 150 91 days (5.0 percent, par) T-Bills 60 Short-term avg. maturily 4 year 150 Debt maturity 15 years 00ng-termaverage duration- 12 years avg maturity 9.0 years; avg. duration- 7.5 years Commercial Loans 200 debt 200 Equity 130 Consumer Loansavgmturity 60 years; avg. duration- 4.0 yearS Mortgage Loans avg maturity 30 Fixed ratoe 150 years; avg. duration- 5 vears Mortgage Loans avg maturity 30 years; interest rate reset 6 mouths 50 Adjustable 830 Total Assets 830 Total Liabilities &Equity (a) What is the leverage-adjusted duration gap of the FI? (assume the duration of short term debt is 3.78 years) (b) How could a risk manager restructure assets and liabilities to reduce interest rate exposure for this example? NBS8201 Risk Modelling Seminar 1. Interest rate risk 1. The following are the assets and liabilities of a government security dealer S 150 miion 30 day Treasury bills Assets S 275 million 91 day Treasury bills S90 million 180 day municipal notes 350 million 2 vear Treasury notes Liabilities: S 575 million 14 day repurchase agreements S 290 million 1 year commercial (a). Use the repricing model to determine the repricing gap for a maturity bucket of 30 days. (b). What is the impact on the dealer's net interest income if all interest rates for this bucket increase by 0.50%? 2. An FI finances a $250,000 2-year fixed-rate loan with a $200,000 1-year fixed-rate CD. Use the repricing model to determine (a) the Fl's repricing gap using a 1-year maturity bucket, and (b) the impact of a 1% decrease in interest rates on the FI's annual net interest income? 3. Calculate the duration of a two-year corporate bond paying 6 percent interest annually, selling at par. Principal of $20,000,000 is due at the end of two years. 4. A $1,000 six-year Eurobond has an 8 percent coupon, is selling at par, and contracts to make annual payments of interest. The duration of this bond is 4.99 years. What will be the new price using the duration model if interest rates increase to 8.5 percent? 5. An FI has financial assets of $800 and equity of $50. If the duration of assets is 1.21 years and the duration of all liabilities is 0.25 years, what is the leverage-adjusted duration gap? 6. Third Duration Investments has the following assets and liabilities on its balance sheet (assume market values). The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year Assets Liabilities 1,150 million 14-day repos 550 million 90-day Treasury bills 560 million 1-year commercial 700 million 2-year Treasurv notes 20 lion equity 180 million 180-day municipal notes (a) What is the leverage-adjusted duration gap for Third Duration Investments? (b) If interest rates are forecast to decrease by 1 percent, calculate the impact on the bank's market value of equity Fourth Duration Investments has the following balance sheet. The numbers provided are in millions of dollars and assume market values Cash 20 Deposits historical avg maturity years, historical average duration -3.5 years | avg, maturity-611 avg, duration= 6 months 200 T-Bills 0 days (4.5 percent, par) 150| Certificates of 150 91 days (5.0 percent, par) T-Bills 60 Short-term avg. maturily 4 year 150 Debt maturity 15 years 00ng-termaverage duration- 12 years avg maturity 9.0 years; avg. duration- 7.5 years Commercial Loans 200 debt 200 Equity 130 Consumer Loansavgmturity 60 years; avg. duration- 4.0 yearS Mortgage Loans avg maturity 30 Fixed ratoe 150 years; avg. duration- 5 vears Mortgage Loans avg maturity 30 years; interest rate reset 6 mouths 50 Adjustable 830 Total Assets 830 Total Liabilities &Equity (a) What is the leverage-adjusted duration gap of the FI? (assume the duration of short term debt is 3.78 years) (b) How could a risk manager restructure assets and liabilities to reduce interest rate exposure for this example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts