Question: n.com low/connecthtml Ch 6 and 7 6 Help Seve Ed Sube Brief Exercise 7-14 (Algo) Uncollectible accounts, balance sheet approach (LO7-5, 7-6] The following information

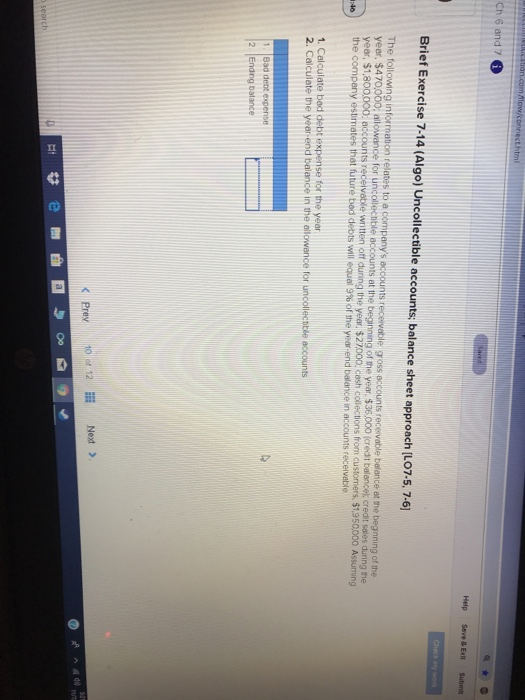

n.com low/connecthtml Ch 6 and 7 6 Help Seve Ed Sube Brief Exercise 7-14 (Algo) Uncollectible accounts, balance sheet approach (LO7-5, 7-6] The following information relates to a company's accounts receivable gross accounts receivable belance at the beginning of the year, $470,000, allowance for uncollectible accounts at the beginning of the year. $36,000 credit balance credit sales during the year, $1,800,000. accounts receivable written off during the year. $27000 cash collections from customers. $1.950,000 Assuming the company estimates that future bad debts will equal 9% of the year-end balance in accounts receivable 1. Calculate bad debt expense for the year 2. Calculate the year-end balance in the allowance for uncollectible accounts 1. Bad de expense 2. Endng balance 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts