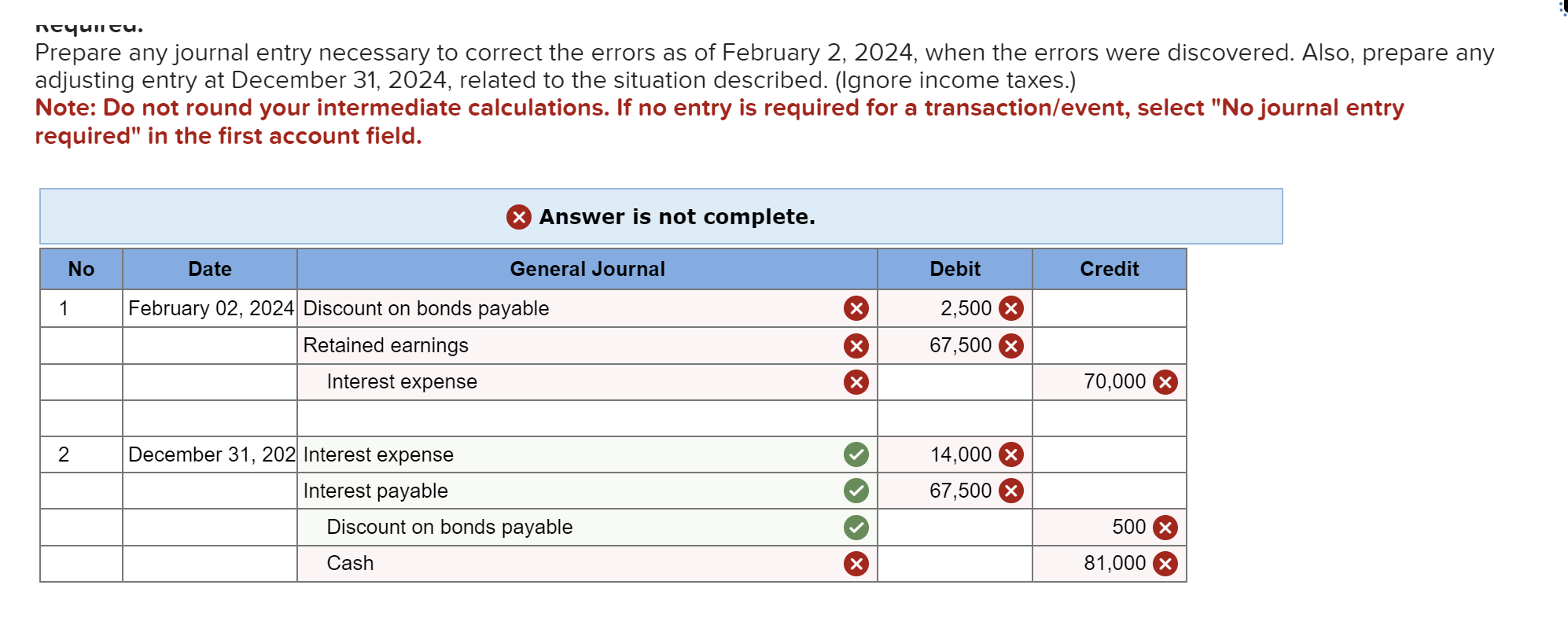

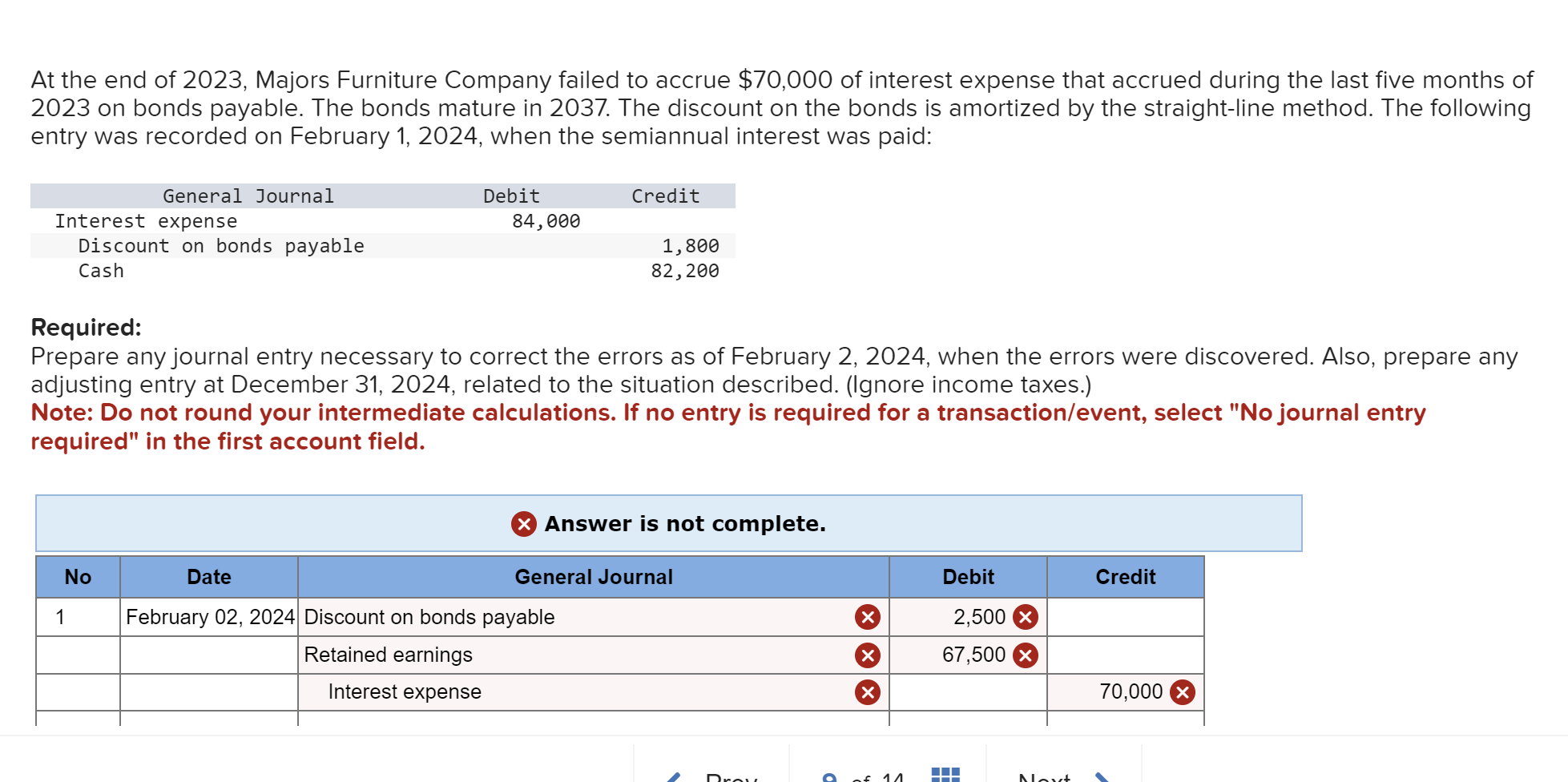

Question: ncquilcu. Prepare any journal entry necessary to correct the errors as of February 2, 2024, when the errors were discovered. Also, prepare any adjusting entry

ncquilcu. Prepare any journal entry necessary to correct the errors as of February 2, 2024, when the errors were discovered. Also, prepare any adjusting entry at December 31, 2024, related to the situation described. (Ignore income taxes.) Note: Do not round your intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. X Answer is not complete. No Date General Journal Debit Credit 1 February 02, 2024 Discount on bonds payable X 2,500 X Retained earnings X 67,500 X Interest expense X 70,000 X 2 December 31, 202 Interest expense 14,000 X Interest payable 67,500 X Discount on bonds payable V 500 X Cash X 81,000 XAt the end of 2023, Majors Furniture Company failed to accrue $70,000 of interest expense that accrued during the last five months of 2023 on bonds payable. The bonds mature in 2037, The discount on the bonds is amortized by the straightline method, The following entry was recorded on February 1, 2024, when the semiannual interest was paid: General Journal Debit Credit Interest expense 84,060 Discount on bonds payable 1,896 Cash 82,299 Required: Prepare anyjournal entry necessary to correct the errors as of February 2, 2024, when the errors were discovered. Also, prepare any adjusting entry at December 31, 2024, related to the situation described, (Ignore income taxes) Note: Do not round your intermediate calculations. If no entry is required for a transaction/event, select "Nojournal entry required" in the first account field. 6 Answer is not complete. February 02,2024 Discount on bonds payable 2, 500 Q _ Retained earnings Interest expense 3 70,000 0 1 ran... a 2:111 Ill MA"; \\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts