Question: ndk (c) The NPV is positive, although it is very small in relation to the Capital outlay of Rs. 90 lakhs. It is also apparent

ndk

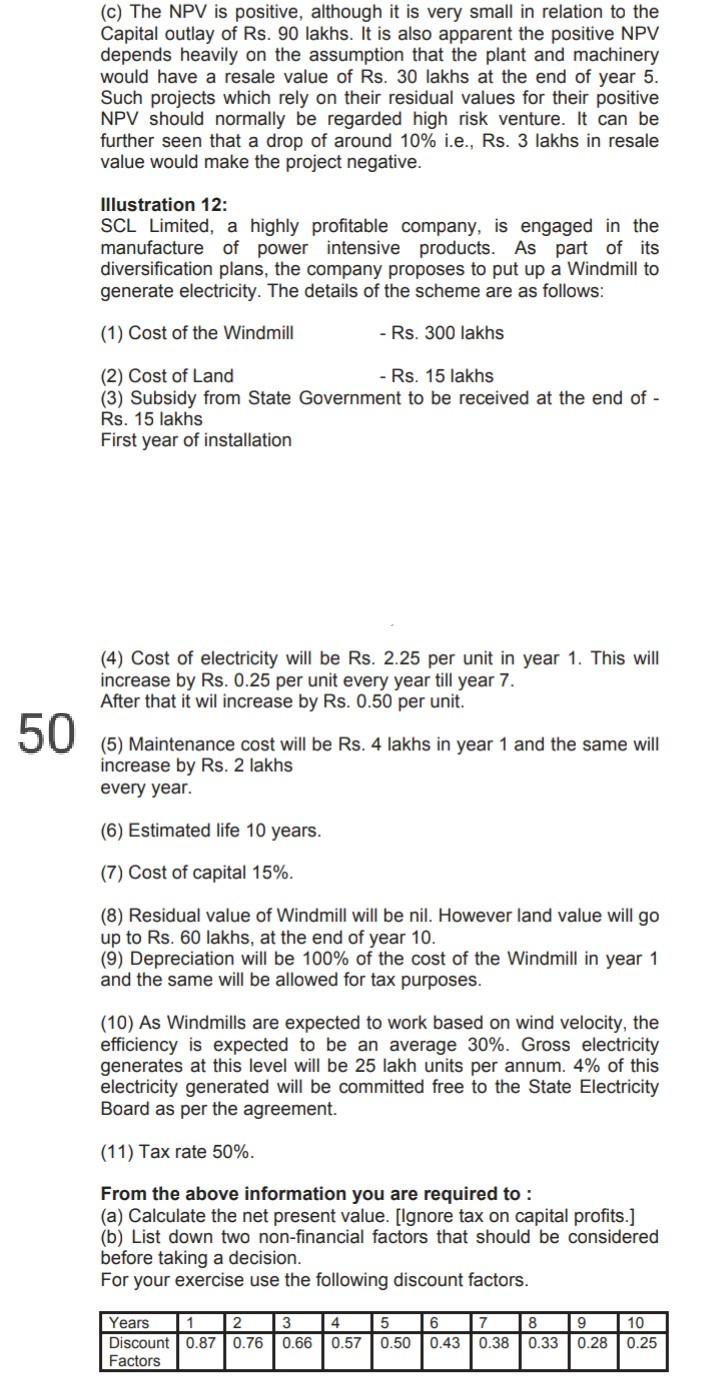

(c) The NPV is positive, although it is very small in relation to the Capital outlay of Rs. 90 lakhs. It is also apparent the positive NPV depends heavily on the assumption that the plant and machinery would have a resale value of Rs. 30 lakhs at the end of year 5. Such projects which rely on their residual values for their positive NPV should normally be regarded high risk venture. It can be further seen that a drop of around 10% i.e., Rs. 3 lakhs in resale value would make the project negative. Illustration 12: SCL Limited, a highly profitable company, is engaged in the manufacture of power intensive products. As part of its diversification plans, the company proposes to put up a Windmill to generate electricity. The details of the scheme are as follows: (1) Cost of the Windmill - Rs. 300 lakhs (2) Cost of Land Rs. 15 lakhs (3) Subsidy from State Government to be received at the end of - Rs. 15 lakhs First year of installation (4) Cost of electricity will be Rs. 2.25 per unit in year 1. This will increase by Rs. 0.25 per unit every year till year 7. After that it wil increase by Rs. 0.50 per unit. 50 (5) Maintenance cost will be Rs. 4 lakhs in year 1 and the same will increase by Rs. 2 lakhs every year. (6) Estimated life 10 years. (7) Cost of capital 15%. (8) Residual value of Windmill will be nil. However land value will go up to Rs. 60 lakhs, at the end of year 10. (9) Depreciation will be 100% of the cost of the Windmill in year 1 and the same will be allowed for tax purposes. (10) As Windmills are expected to work based on wind velocity, the efficiency is expected to be an average 30%. Gross electricity generates at this level will be 25 lakh units per annum. 4% of this electricity generated will be committed free to the State Electricity Board as per the agreement. (11) Tax rate 50%. From the above information you are required to : (a) Calculate the net present value. [Ignore tax on capital profits.] (b) List down two non-financial factors that should be considered before taking a decision. For your exercise use the following discount factors. Years 1 2 3 4 5 6 7 8 9 10 Discount 0.870.76 0.66 0.57 0.50 0.43 0.38 0.33 0.28 0.25 FactorsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock