Question: NeCany Question 34 (1 point) For a call option using Black-Scholes Merton model adjusted for cash flows, the underlying is priced at 225; the exercise

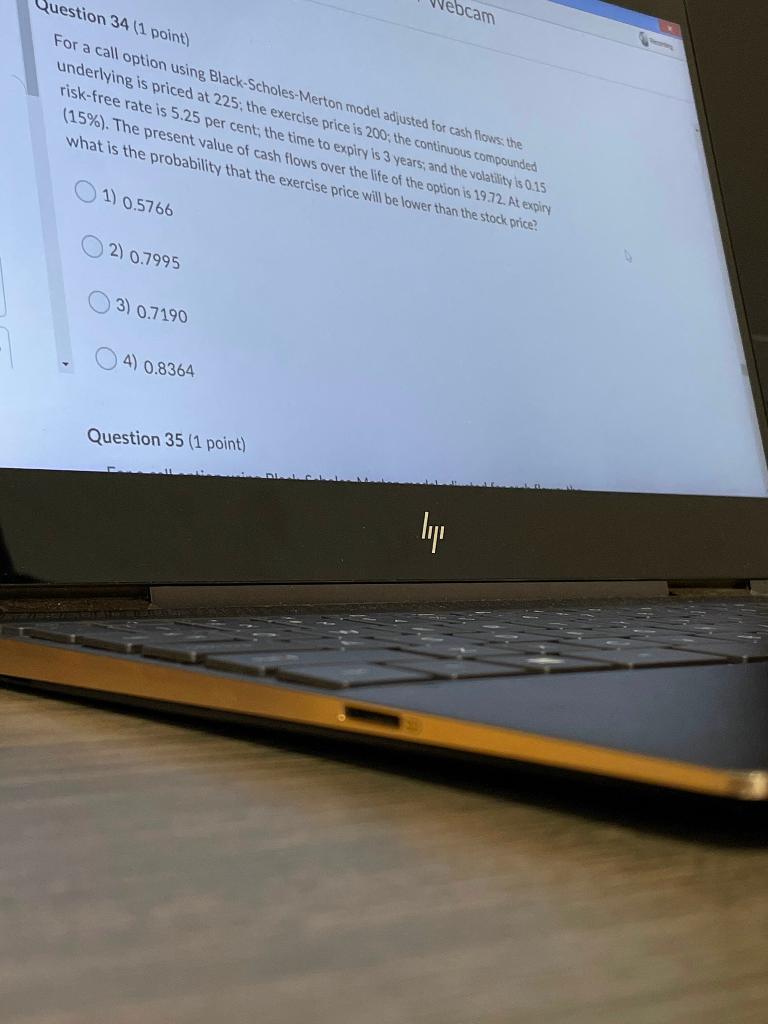

NeCany Question 34 (1 point) For a call option using Black-Scholes Merton model adjusted for cash flows, the underlying is priced at 225; the exercise price is 200, the continuous compounded risk-free rate is 5.25 per cent, the time to expiry is 3 years, and the volatility is 0.15 (15%). The present value of cash flows over the Wie of the option is 1972. Al expiry what is the probability that the exercise price will be lower than the stock price? 1) 0.5766 2) 0.7995 3) 0.7190 4) 0.8364 Question 35 (1 point) ly NeCany Question 34 (1 point) For a call option using Black-Scholes Merton model adjusted for cash flows, the underlying is priced at 225; the exercise price is 200, the continuous compounded risk-free rate is 5.25 per cent, the time to expiry is 3 years, and the volatility is 0.15 (15%). The present value of cash flows over the Wie of the option is 1972. Al expiry what is the probability that the exercise price will be lower than the stock price? 1) 0.5766 2) 0.7995 3) 0.7190 4) 0.8364 Question 35 (1 point) ly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts