Question: 9.49% Question 40 (1 point) For a call option using Black-Scholes-Merton model adjusted for cash flows: the underlying is priced at 225; the exercise price

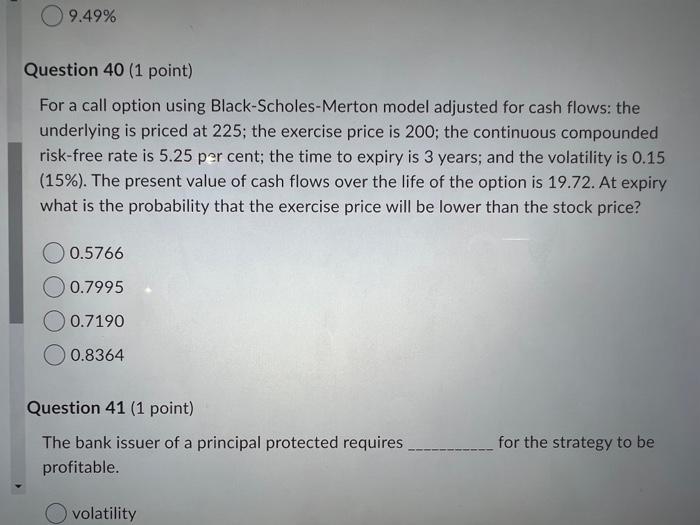

9.49% Question 40 (1 point) For a call option using Black-Scholes-Merton model adjusted for cash flows: the underlying is priced at 225; the exercise price is 200; the continuous compounded risk-free rate is 5.25 per cent; the time to expiry is 3 years; and the volatility is 0.15 (15%). The present value of cash flows over the life of the option is 19.72. At expiry what is the probability that the exercise price will be lower than the stock price? 0.5766 0.7995 0.7190 0.8364 Question 41 (1 point) The bank issuer of a principal protected requires profitable. for the strategy to be volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts