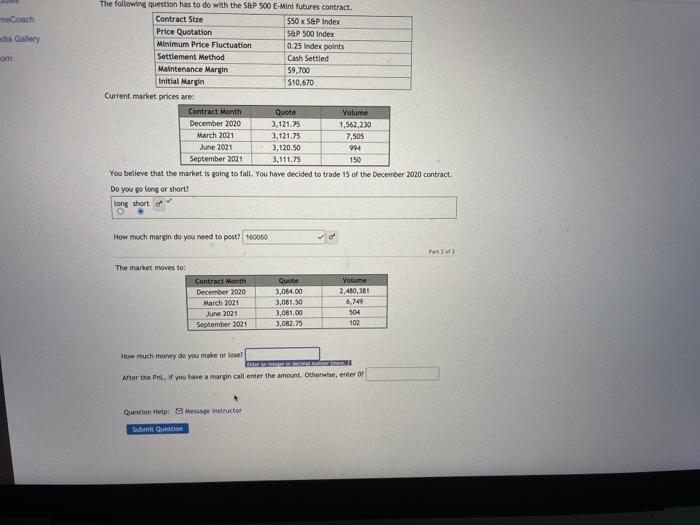

Question: neCoach da Query The following question has to do with the S&P 500 E-Mini futures contract Contract Size $50 x S&P Index Price Quotation S&P

neCoach da Query The following question has to do with the S&P 500 E-Mini futures contract Contract Size $50 x S&P Index Price Quotation S&P 500 Index Minimum Price Fluctuation 0.25 Index points Settlement Method Cash Settled Maintenance Margin 59,700 Initial Margin $10,670 Current market prices are: Contract Month Quote Volume December 2020 3.121.35 1,562,230 March 2021 3,121.75 7,505 June 2021 3,120.50 994 September 2021 3,111.75 150 You believe that the market is going to fall. You have decided to trade 15 of the December 2020 contract. Do you go long or short? long short of O How much margin do you need to post? 100050 Pro The market moves to: Contract Month December 2020 March 2021 June 2021 September 2021 Quote 3,084.00 3,081,50 3,081.00 3,082.75 Volume 2,480,381 6,749 504 102 How much money do you make or lose? After the PL, if you have a margin call enter the amount. Otherwise, enter? Question Help Messgetructor Suunto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts