Question: This question has to do with the S&P 500 E-mini futures contract. Contract Size $50 x S&P Index Price Quotation S&P 500 Index Minimum Price

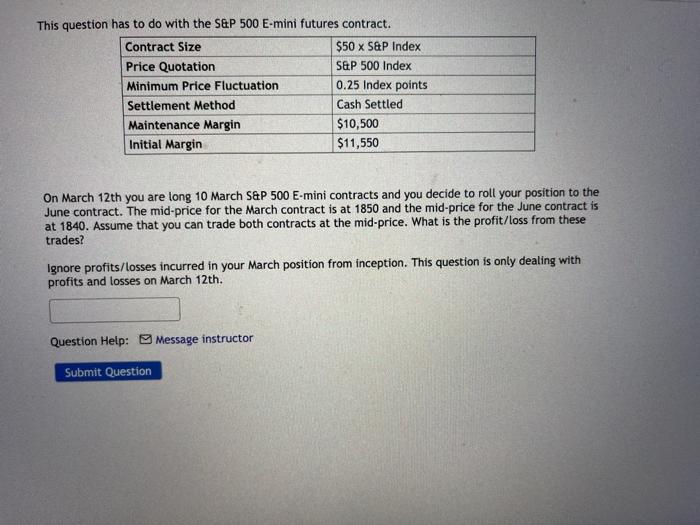

This question has to do with the S&P 500 E-mini futures contract. Contract Size $50 x S&P Index Price Quotation S&P 500 Index Minimum Price Fluctuation 0.25 Index points Settlement Method Cash Settled Maintenance Margin $10,500 Initial Margin $11,550 On March 12th you are long 10 March S&P 500 E-mini contracts and you decide to roll your position to the June contract. The mid-price for the March contract is at 1850 and the mid-price for the June contract is at 1840. Assume that you can trade both contracts at the mid-price. What is the profit/loss from these trades? Ignore profits/losses incurred in your March position from inception. This question is only dealing with profits and losses on March 12th. Question Help: Message instructor Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts