Question: need 10 pages worth minimum please 1. How serious were Stephen Richards' actions? Give a reason or reasons for your opinion. 2. If Computer Associates

need 10 pages worth minimum please

need 10 pages worth minimum please

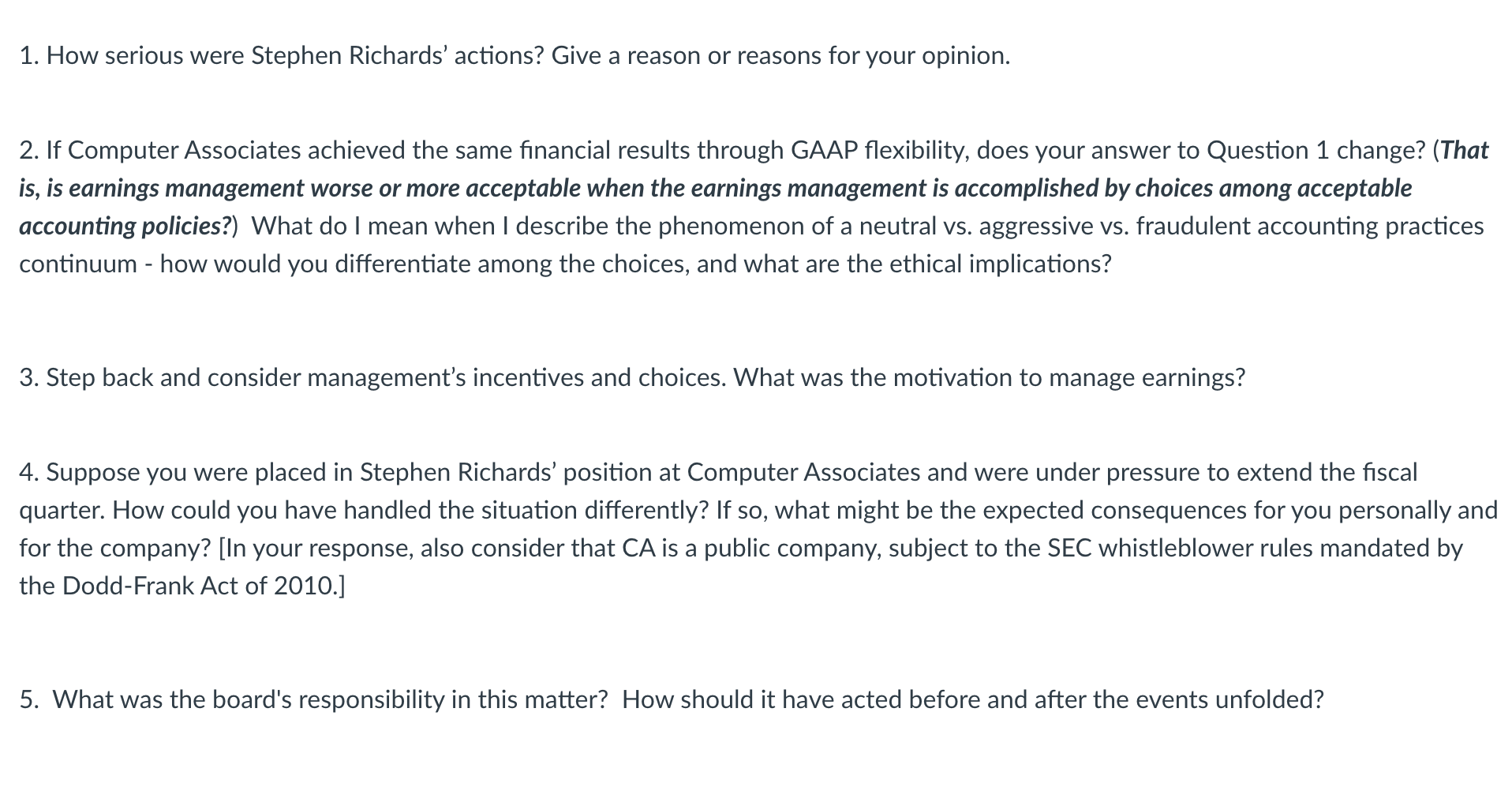

1. How serious were Stephen Richards' actions? Give a reason or reasons for your opinion. 2. If Computer Associates achieved the same financial results through GAAP flexibility, does your answer to Question 1 change? (That is, is earnings management worse or more acceptable when the earnings management is accomplished by choices among acceptable accounting policies?) What do I mean when I describe the phenomenon of a neutral vs. aggressive vs. fraudulent accounting practices continuum - how would you differentiate among the choices, and what are the ethical implications? 3. Step back and consider management's incentives and choices. What was the motivation to manage earnings? 4. Suppose you were placed in Stephen Richards' position at Computer Associates and were under pressure to extend the fiscal quarter. How could you have handled the situation differently? If so, what might be the expected consequences for you personally and for the company? [In your response, also consider that CA is a public company, subject to the SEC whistleblower rules mandated by the Dodd-Frank Act of 2010.] 5. What was the board's responsibility in this matter? How should it have acted before and after the events unfolded? 1. How serious were Stephen Richards' actions? Give a reason or reasons for your opinion. 2. If Computer Associates achieved the same financial results through GAAP flexibility, does your answer to Question 1 change? (That is, is earnings management worse or more acceptable when the earnings management is accomplished by choices among acceptable accounting policies?) What do I mean when I describe the phenomenon of a neutral vs. aggressive vs. fraudulent accounting practices continuum - how would you differentiate among the choices, and what are the ethical implications? 3. Step back and consider management's incentives and choices. What was the motivation to manage earnings? 4. Suppose you were placed in Stephen Richards' position at Computer Associates and were under pressure to extend the fiscal quarter. How could you have handled the situation differently? If so, what might be the expected consequences for you personally and for the company? [In your response, also consider that CA is a public company, subject to the SEC whistleblower rules mandated by the Dodd-Frank Act of 2010.] 5. What was the board's responsibility in this matter? How should it have acted before and after the events unfolded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts