Question: need 100 RIP O2 Export vs Setting up Plant in Foreign country Skylark Inc. USA currently exports 500 Calculators per month to UAE @ $

need 100

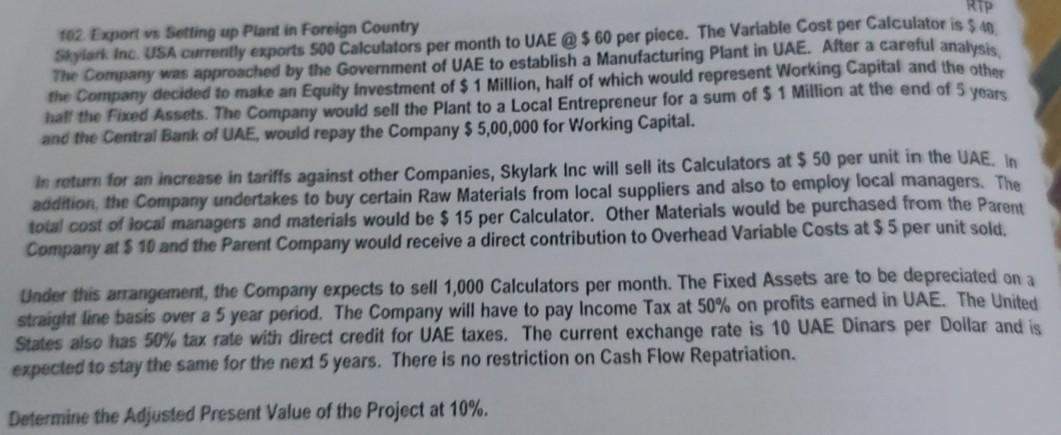

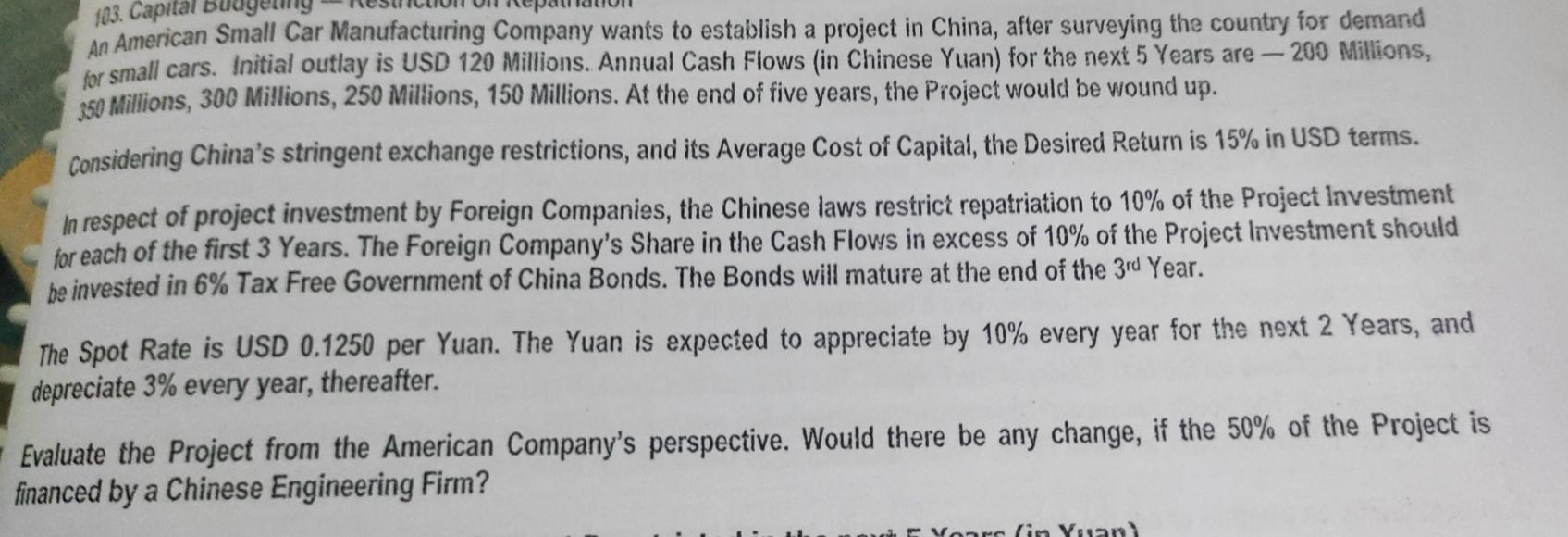

RIP O2 Export vs Setting up Plant in Foreign country Skylark Inc. USA currently exports 500 Calculators per month to UAE @ $ 60 per piece. The Variable Cost per Calculator is $ 40 The Company was approached by the Government of UAE to establish a Manufacturing Plant in UAE. After a careful analysis, the Company decided to make an Equity Investment of $ 1 Million, half of which would represent Working Capital and the other half the Fixed Assets. The Company would sell the Plant to a Local Entrepreneur for a sum of $ 1 Million at the end of 5 years and the Central Bank of UAE, would repay the Company $ 5,00,000 for Working Capital. In return for an increase in tariffs against other Companies, Skylark Inc will sell its Calculators at $ 50 per unit in the UAE. In addition, the Company undertakes to buy certain Raw Materials from local suppliers and also to employ local managers. The total cost of local managers and materials would be $ 15 per Calculator. Other Materials would be purchased from the Parent Company at $ 10 and the Parent Company would receive a direct contribution to Overhead Variable Costs at $ 5 per unit sold. Under this arrangement, the Company expects to sell 1,000 Calculators per month. The Fixed Assets are to be depreciated on a straight line basis over a 5 year period. The Company will have to pay Income Tax at 50% on profits earned in UAE. The United States also has 50% tax rate with direct credit for UAE taxes. The current exchange rate is 10 UAE Dinars per Dollar and is expected to stay the same for the next 5 years. There is no restriction on Cash Flow Repatriation. Determine the Adjusted Present Value of the Project at 10%. 103. Capital An American Small Car Manufacturing Company wants to establish a project in China, after surveying the country for demand for small cars. Initial outlay is USD 120 Millions. Annual Cash Flows (in Chinese Yuan) for the next 5 Years are - 200 Millions, 350 Millions, 300 Millions, 250 Millions, 150 Millions. At the end of five years, the Project would be wound up. Considering China's stringent exchange restrictions, and its Average Cost of Capital, the Desired Return is 15% in USD terms. In respect of project investment by Foreign Companies, the Chinese laws restrict repatriation to 10% of the Project Investment for each of the first 3 Years. The Foreign Company's Share in the Cash Flows in excess of 10% of the Project Investment should be invested in 6% Tax Free Government of China Bonds. The Bonds will mature at the end of the 3rd Year. The Spot Rate is USD 0.1250 per Yuan. The Yuan is expected to appreciate by 10% every year for the next 2 Years, and depreciate 3% every year, thereafter. Evaluate the Project from the American Company's perspective. Would there be any change, if the 50% of the Project is financed by a Chinese Engineering Firm? Voor (in Yuan)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts