Question: need 3 and 2 thanks 2 P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios L06-4 10 points IceKreme Inc. makes ice

need 3 and 2 thanks

need 3 and 2 thanks

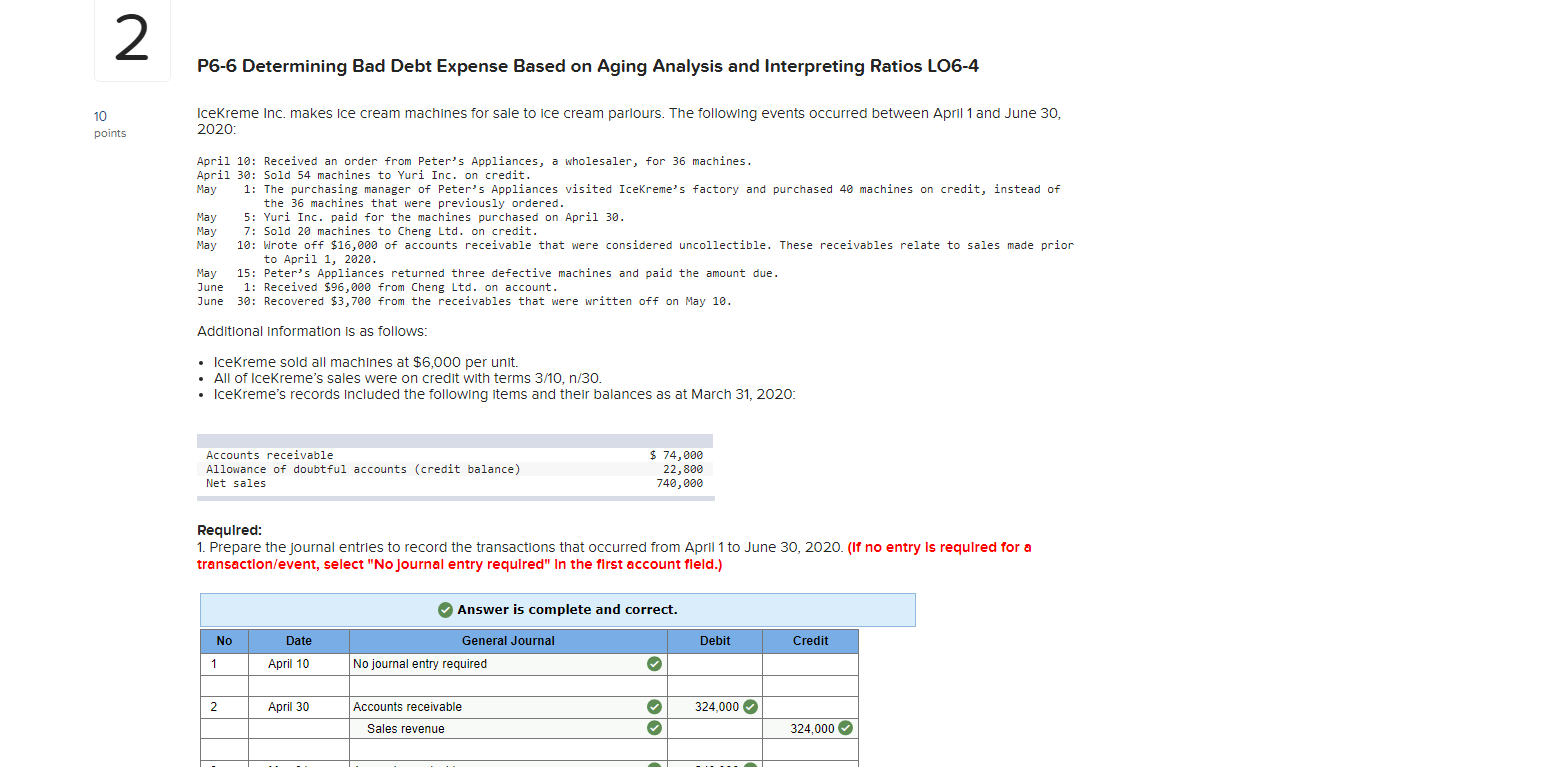

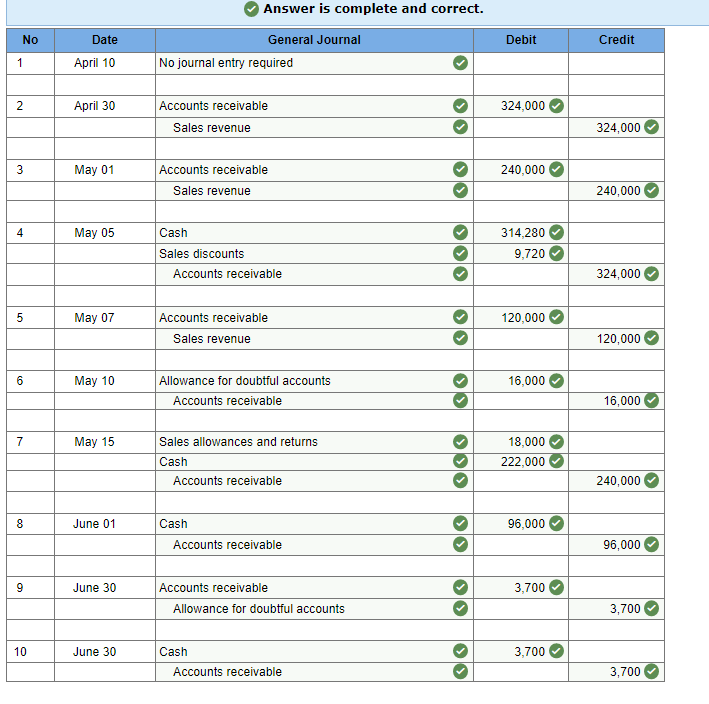

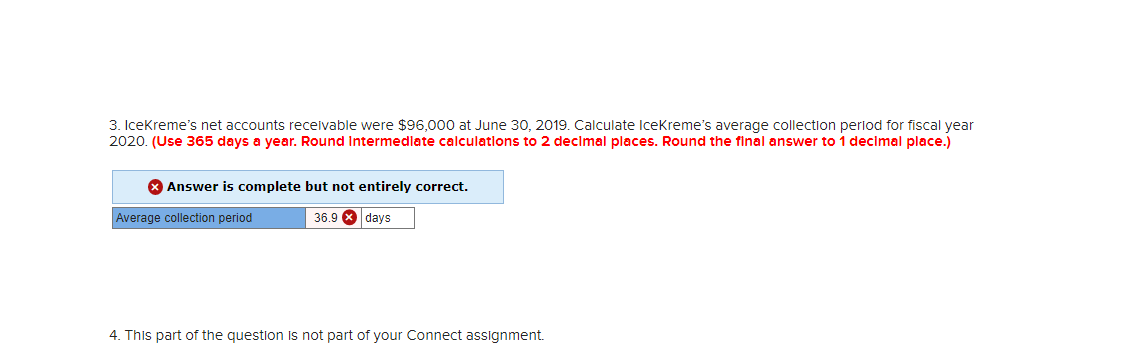

2 P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios L06-4 10 points IceKreme Inc. makes ice cream machines for sale to ice cream parlours. The following events occurred between April 1 and June 30, 2020: April 10: Received an order from Peter's Appliances, a wholesaler, for 36 machines. April 30: Sold 54 machines to Yuri Inc. on credit. May 1: The purchasing manager of Peter's Appliances visited Icekreme's factory and purchased 40 machines on credit, instead of the 36 machines that were previously ordered. May 5: Yuri Inc. paid for the machines purchased on April 30. May 7: Sold 20 machines to Cheng Ltd. on credit. May 10: Wrote off $16,000 of accounts receivable that were considered uncollectible. These receivables relate to sales made prior to April 1, 2020. May 15: Peter's Appliances returned three defective machines and paid the amount due. June 1: Received $96,000 from Cheng Ltd. on account. June 30: Recovered $3,700 from the receivables that were written off on May 10. Additional Information is as follows: IceKreme sold all machines at $6,000 per unit. All of IceKreme's sales were on credit with terms 3/10, n/30. IceKreme's records included the following items and their balances as at March 31, 2020: Accounts receivable Allowance of doubtful accounts (credit balance) Net sales $ 74,000 22,800 740,000 Required: 1. Prepare the journal entries to record the transactions that occurred from April 1 to June 30, 2020. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Answer is complete and correct. No Date General Journal Debit Credit 1 April 10 No journal entry required 2 April 30 Accounts receivable 324,000 Sales revenue 324,000 Answer is complete and correct. No Date Debit Credit General Journal No journal entry required 1 April 10 2 April 30 324,000 Accounts receivable Sales revenue 324,000 3 May 01 240,000 Accounts receivable Sales revenue 240,000 4 May 05 314,280 Cash Sales discounts Accounts receivable O 9,720 324,000 5 May 07 120,000 Accounts receivable Sales revenue >> 120,000 6 May 10 > 16,000 Allowance for doubtful accounts Accounts receivable 16,000 7 May 15 Sales allowances and returns Cash Accounts receivable 18,000 222,000 240,000 8 June 01 96,000 Cash Accounts receivable >> 96,000 9 > June 30 3,700 Accounts receivable Allowance for doubtful accounts O 3,700 10 June 30 3,700 Cash Accounts receivable 3,700 3. IceKreme's net accounts receivable were $96,000 at June 30, 2019. Calculate IceKreme's average collection period for fiscal year 2020. (Use 365 days a year. Round Intermediate calculations to 2 decimal places. Round the final answer to 1 decimal place.) X Answer is complete but not entirely correct. Average collection period 36.9 X days 4. This part of the question is not part of your Connect assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts