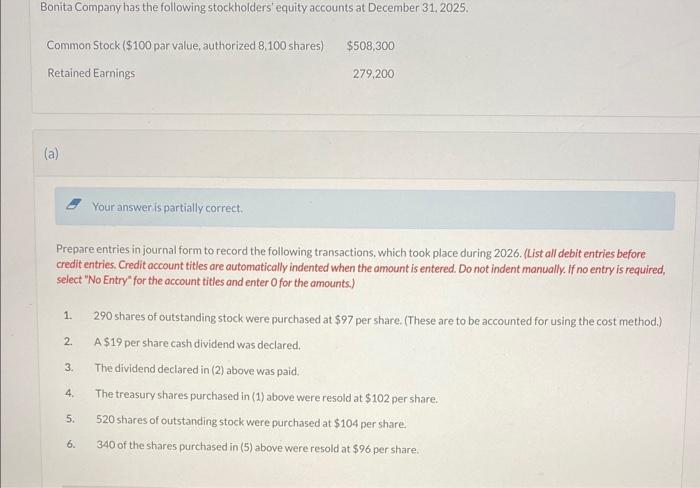

Question: Need #6 please! 2 Your answer is partially correct. Prepare entries in journal form to record the following transactions, which took place during 2026. (List

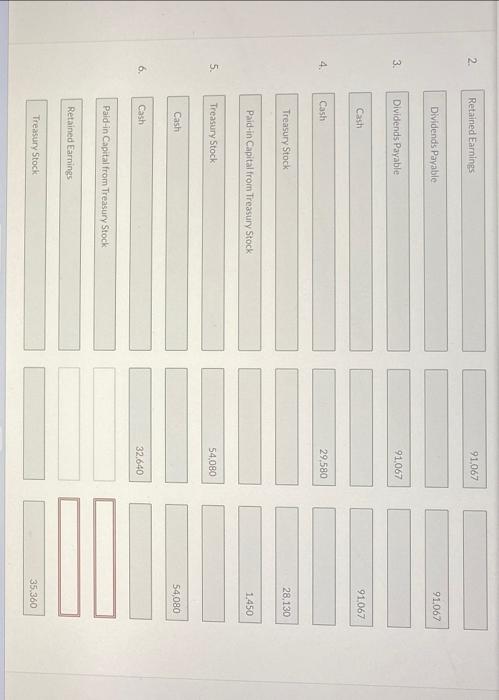

2 Your answer is partially correct. Prepare entries in journal form to record the following transactions, which took place during 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) 1. 290 shares of outstanding stock were purchased at $97 per share. (These are to be accounted for using the cost method.) 2. A $19 per share cash dividend was declared. 3. The dividend declared in (2) above was paid. 4. The treasury shares purchased in (1) above were resold at $102 per share. 5. 520 shares of outstanding stock were purchased at $104 per share. 6. 340 of the shares purchased in (5) above were resold at $96 per share. 2. Retained Eamings 91,067 Dividends Payable 91,067 3. Dividends Payable 91.067 4. Cash 29.580 Treasury Stock Paid-in Capital from Treasury Stock. 5. Treasury Stock: 54,080 6. Cash Paid-in Capital from Treasury Stock. Retained Earnings Treasury Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts