Question: need a breakdown for comprehensive prob 4 in financial and managerial accounting 2 18th edition.. Home Depot, Inc. ANALYSIS OF THE FINANCIAL STATEMENTS OF A

need a breakdown for comprehensive prob 4 in financial and managerial accounting 2 18th edition..

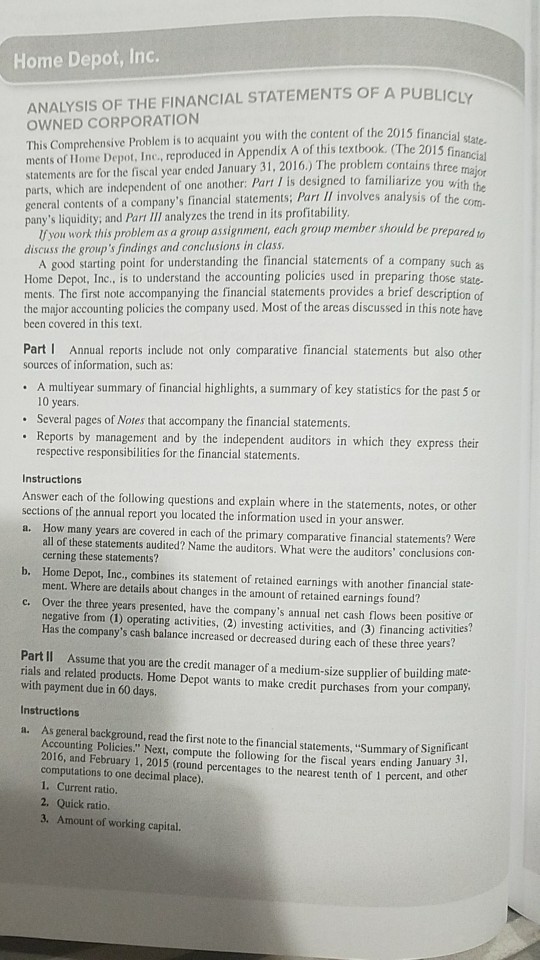

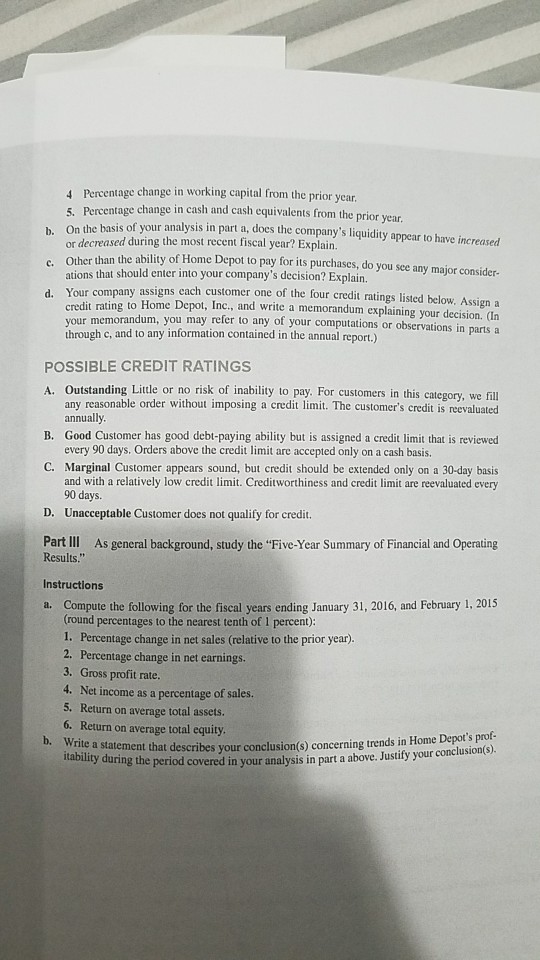

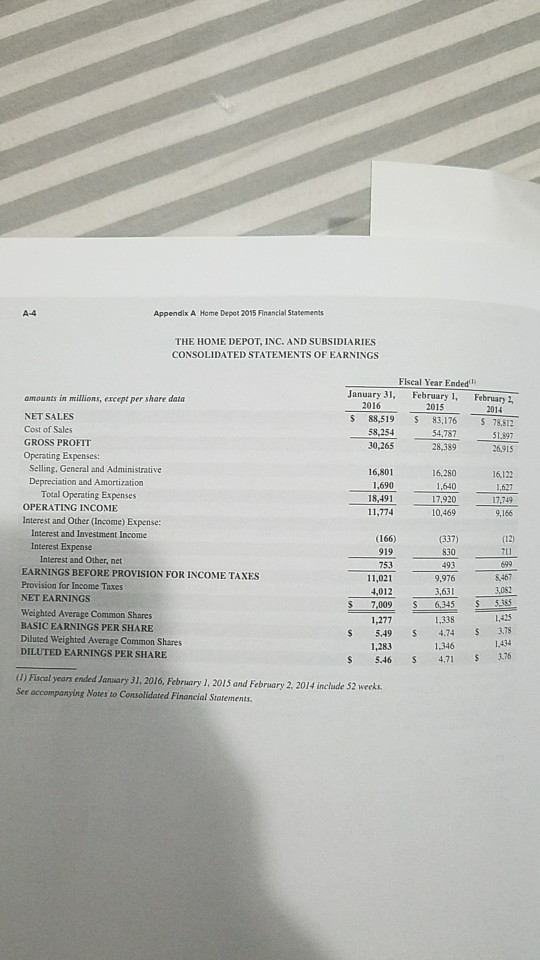

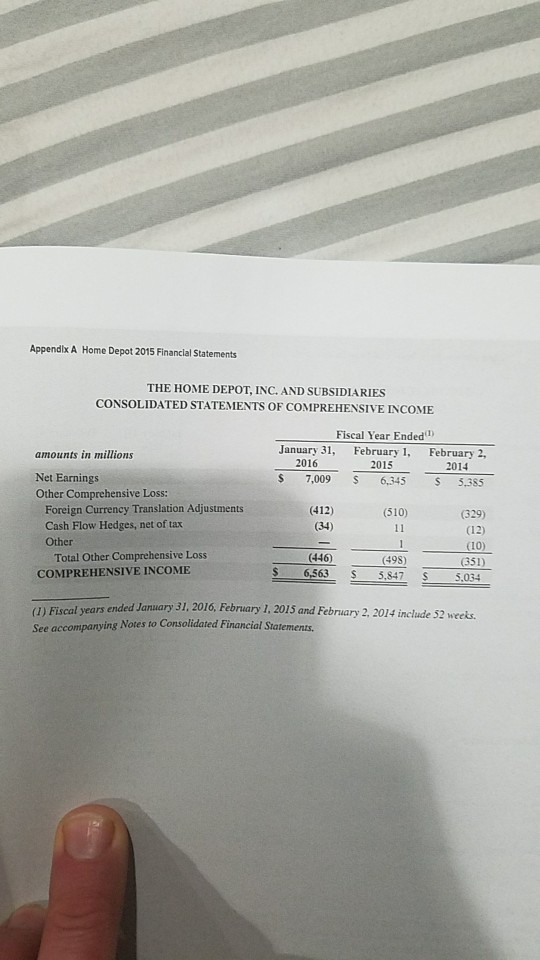

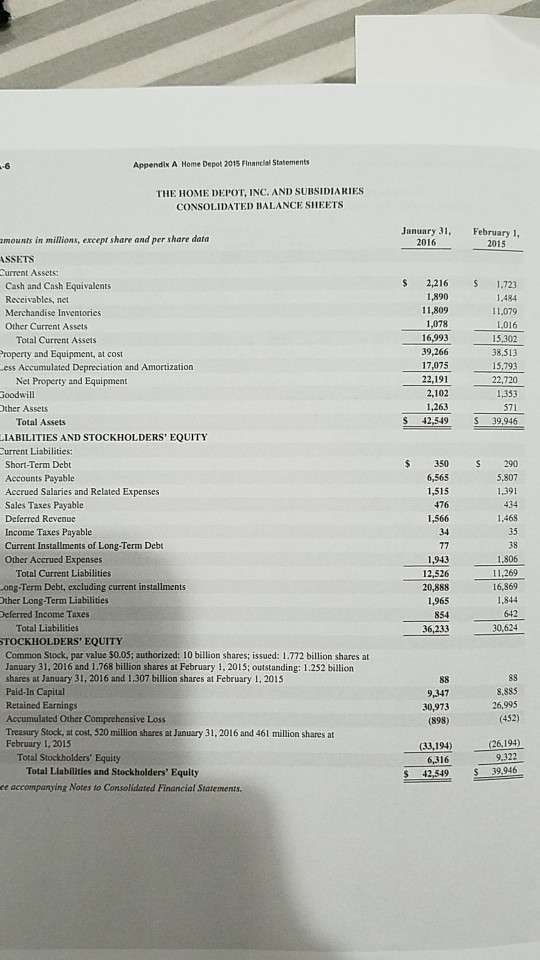

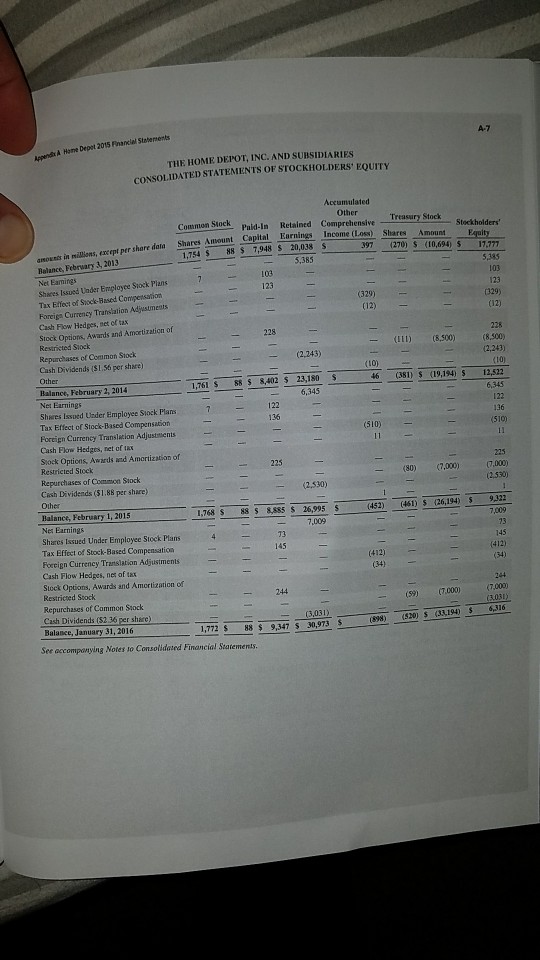

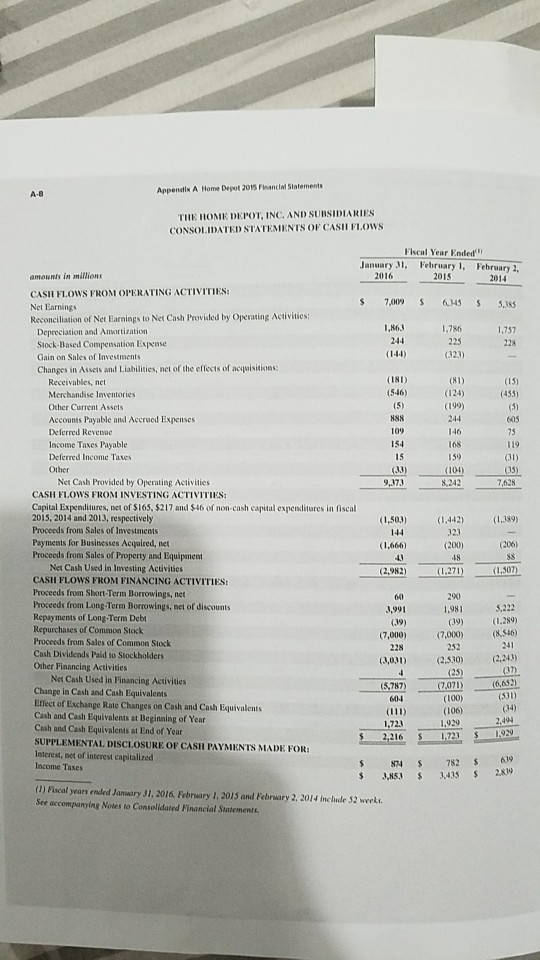

Home Depot, Inc. ANALYSIS OF THE FINANCIAL STATEMENTS OF A PUBLIC OWNED CORPORATION This Comprehensive Problem is to acquaint you with the content of the 2015 financial ments of Home Depot, Inc, reproduced in Appendix A of this textbook. (The 205a state statements are for the fiscal year ended January 31, 2016.) The problem contains t parts, which are independent of one another: Part I is designed to familiarize general contents of a company's financial statements; Part II involves anal pany's liquidity; and Part Ill analyzes the trend in its profitability financial three major you with the ember should be prepared to ifyou work this problem as a group assignment, each group m discuss the group's findings and conclusions in class. A good starting point for understanding the financial statements of a company such as Home Depot, Inc., is to understand the accounting policies used in preparing those state. ments. The first note accompanying the financial statements provides a brief description of the major accounting policies the company used. Most of the areas discussed in this note have been covered in this text. Part I Annual reports include not only comparative financial statements but also other sources of information, such as: A multiyear summary of financial highlights, a summary of key statistics for the past 5 or 10 years Several pages of Notes that accompany the financial statements. . Reports by management and by the independent auditors in which they express their respective responsibilities for the financial statements. Instructions Answer each of the following questions and explain where in the statements, notes, or o sections of the annual report you located the information used in your answer. a. her How many years are covered in each of the primary comparative financial statements? all of these statements audited? Name the auditors. What were the auditors' conclusions con cerning these statements? Were b. Home Depot, Inc.,.combines its statement of retained earnings with another financial state- ment. Where are details about changes in the amount of retained earnings found? Over the three years presented, have the company's annual net cash flows been positive or negative from (1) operating activities, (2) investing activities, and (3) financing activites Has the company's cash balance increased or decreased during each of these three years c. PartII Assume that you are the credit manager of a medium-size supplier of building mate- rials and related products, Home Depot wants to make credit purchases from your company. with payment due in 60 days. Instructions As general background, read the first note to the financial statements, "Summary of Signit , Accounting Policies." Next, compute the following for the fiscal years ending January 2016, and February 1, 2015 (round percentages to the nearest tenth of 1 percent, and computations to one decimal place). 1. Current ratio. a. 2. Quick ratio. 3. Amount of working capital. Home Depot, Inc. ANALYSIS OF THE FINANCIAL STATEMENTS OF A PUBLIC OWNED CORPORATION This Comprehensive Problem is to acquaint you with the content of the 2015 financial ments of Home Depot, Inc, reproduced in Appendix A of this textbook. (The 205a state statements are for the fiscal year ended January 31, 2016.) The problem contains t parts, which are independent of one another: Part I is designed to familiarize general contents of a company's financial statements; Part II involves anal pany's liquidity; and Part Ill analyzes the trend in its profitability financial three major you with the ember should be prepared to ifyou work this problem as a group assignment, each group m discuss the group's findings and conclusions in class. A good starting point for understanding the financial statements of a company such as Home Depot, Inc., is to understand the accounting policies used in preparing those state. ments. The first note accompanying the financial statements provides a brief description of the major accounting policies the company used. Most of the areas discussed in this note have been covered in this text. Part I Annual reports include not only comparative financial statements but also other sources of information, such as: A multiyear summary of financial highlights, a summary of key statistics for the past 5 or 10 years Several pages of Notes that accompany the financial statements. . Reports by management and by the independent auditors in which they express their respective responsibilities for the financial statements. Instructions Answer each of the following questions and explain where in the statements, notes, or o sections of the annual report you located the information used in your answer. a. her How many years are covered in each of the primary comparative financial statements? all of these statements audited? Name the auditors. What were the auditors' conclusions con cerning these statements? Were b. Home Depot, Inc.,.combines its statement of retained earnings with another financial state- ment. Where are details about changes in the amount of retained earnings found? Over the three years presented, have the company's annual net cash flows been positive or negative from (1) operating activities, (2) investing activities, and (3) financing activites Has the company's cash balance increased or decreased during each of these three years c. PartII Assume that you are the credit manager of a medium-size supplier of building mate- rials and related products, Home Depot wants to make credit purchases from your company. with payment due in 60 days. Instructions As general background, read the first note to the financial statements, "Summary of Signit , Accounting Policies." Next, compute the following for the fiscal years ending January 2016, and February 1, 2015 (round percentages to the nearest tenth of 1 percent, and computations to one decimal place). 1. Current ratio. a. 2. Quick ratio. 3. Amount of working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts