Question: need a correct answer 8.1 Variance Analysis for Control Actions Since a budget is an instrument of control, it is necessary to compare the actual

need a correct answer

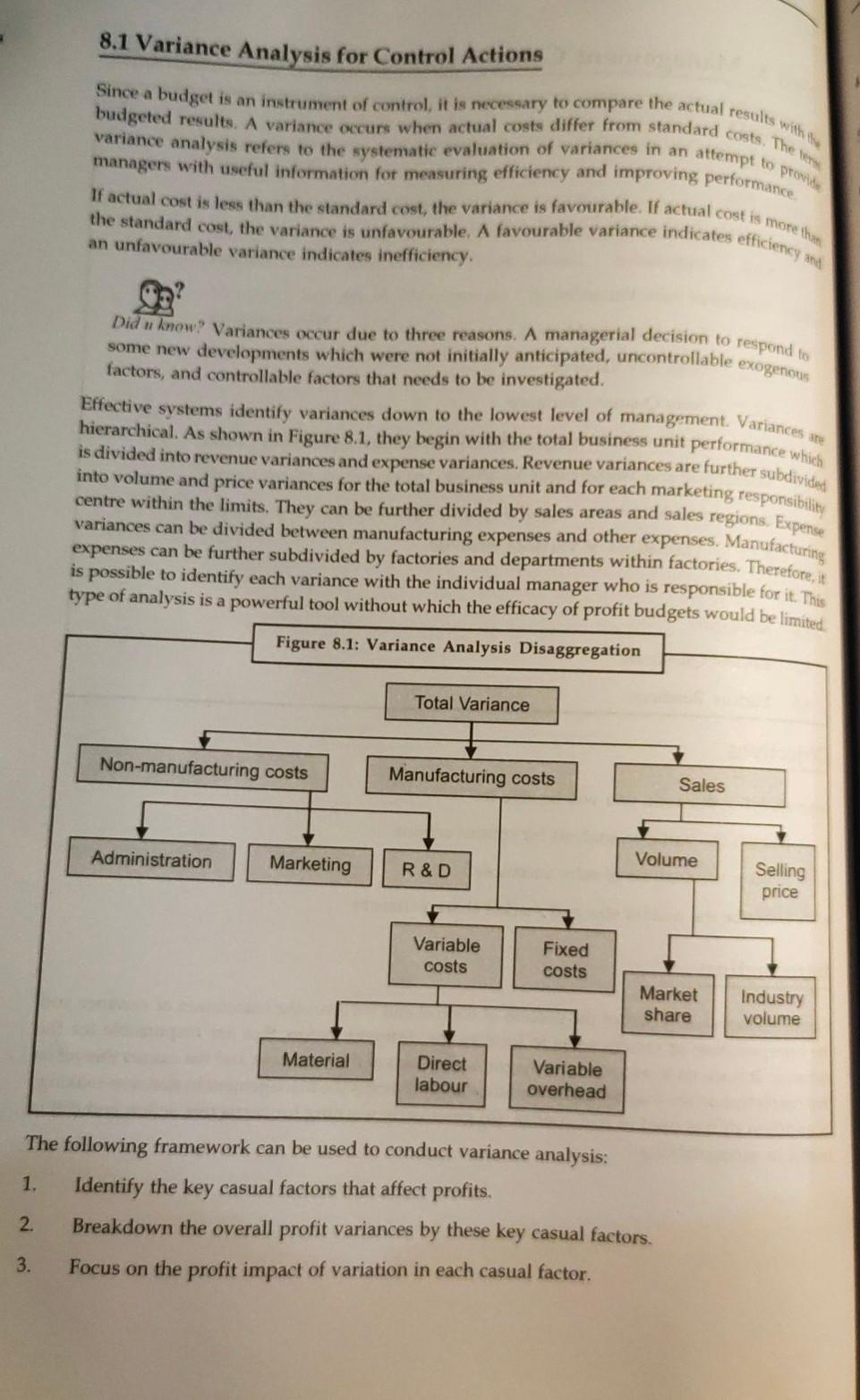

8.1 Variance Analysis for Control Actions Since a budget is an instrument of control, it is necessary to compare the actual results with variance analysis refers to the systematic evaluation of variances in an attempt to provide budgeted results. A variance occurs when actual costs differ from standard costs. The ver managers with useful information for measuring efficiency and improving performance If actual cost is less than the standard cost, the variance is favourable. If actual cost is more than the standard cost, the variance is unfavourable. A favourable variance indicates efficiency and an unfavourable variance indicates inefficiency. R? Did u know? Variances occur due to three reasons. A managerial decision to respond to some new developments which were not initially anticipated, uncontrollable exogenous factors, and controllable factors that needs to be investigated. Effective systems iden variances down to the lowest level of management. Variances are hierarchical. As shown in Figure 8.1, they begin with the total business unit performance which is divided into revenue variances and expense variances. Revenue variances are further subdivided into volume and price variances for the total business unit and for each marketing responsibility centre within the limits. They can be further divided by sales areas and sales regions. Expense variances can be divided between manufacturing expenses and other expenses. Manufacturing expenses can be further subdivided by factories and departments within factories. Therefore, it is possible to identify each variance with the individual manager who is responsible for it. This type of analysis is a powerful tool without which the efficacy of profit budgets would be limited Figure 8.1: Variance Analysis Disaggregation Total Variance Non-manufacturing costs Manufacturing costs Sales Administration Marketing Volume R&D Selling price Variable costs Fixed costs Market share Industry volume Material Direct labour Variable overhead The following framework can be used to conduct variance analysis: 1. Identify the key casual factors that affect profits. 2. Breakdown the overall profit variances by these key casual factors. 3. Focus on the profit impact of variation in each casual factorStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock