Question: Need a handwritten solution. Handwriting should be Excellent Question 2. A couple have saved $120,000 for the down payment on a home. Their monthly gross

Need a handwritten solution. Handwriting should be Excellent

Need a handwritten solution. Handwriting should be Excellent

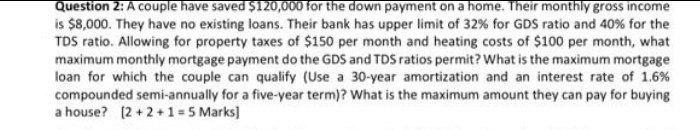

Question 2. A couple have saved $120,000 for the down payment on a home. Their monthly gross income is $8,000. They have no existing loans. Their bank has upper limit of 32% for GDS ratio and 40% for the TDS ratio. Allowing for property taxes of $150 per month and heating costs of $100 per month, what maximum monthly mortgage payment do the GDS and TDS ratios permit? What is the maximum mortgage loan for which the couple can qualify (Use a 30-year amortization and an interest rate of 1.6% compounded semi-annually for a five-year term)? What is the maximum amount they can pay for buying a house? (2 + 2 + 1 = 5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts