Question: Need a help to make sure I solved this right. Thanks in Advance 12. Consider the information provided in #11 above. Suppose that interest rates

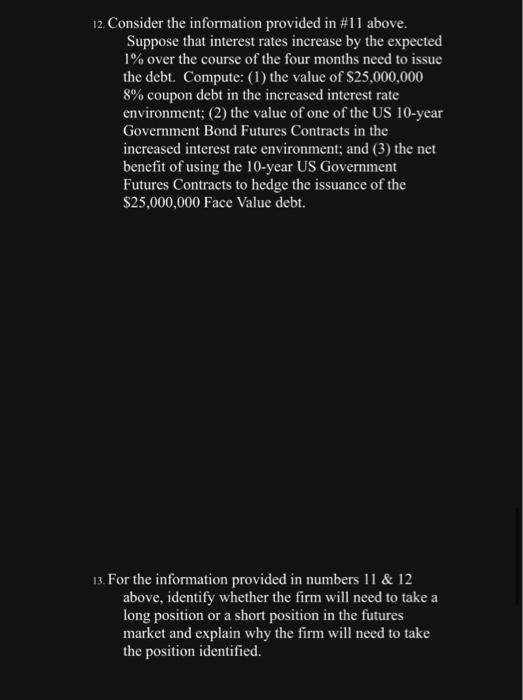

12. Consider the information provided in \#11 above. Suppose that interest rates increase by the expected 1% over the course of the four months need to issue the debt. Compute: (1) the value of $25,000,000 8% coupon debt in the increased interest rate environment; (2) the value of one of the US 10-year Government Bond Futures Contracts in the increased interest rate environment; and (3) the net benefit of using the 10-year US Government Futures Contracts to hedge the issuance of the $25,000,000 Face Value debt. 13. For the information provided in numbers 11&12 above, identify whether the firm will need to take a long position or a short position in the futures market and explain why the firm will need to take the position identified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts