Question: Need a help to make sure I solved this right. Thanks in Advance 6. Explain how an American firm can use the options market for

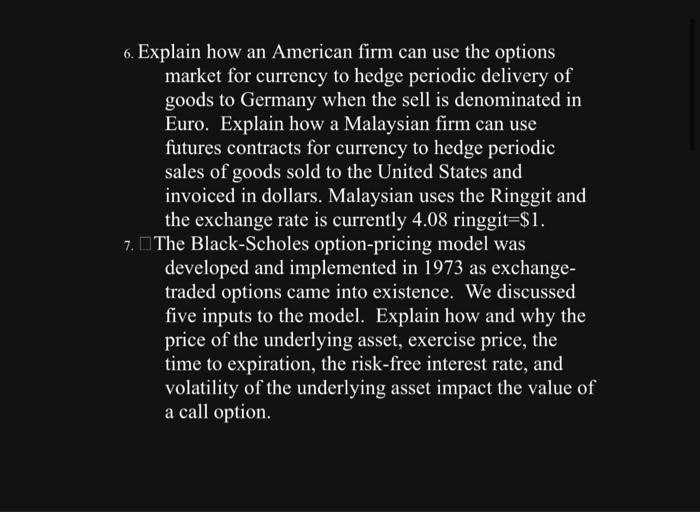

6. Explain how an American firm can use the options market for currency to hedge periodic delivery of goods to Germany when the sell is denominated in Euro. Explain how a Malaysian firm can use futures contracts for currency to hedge periodic sales of goods sold to the United States and invoiced in dollars. Malaysian uses the Ringgit and the exchange rate is currently 4.08 ringgit =$1. 7. The Black-Scholes option-pricing model was developed and implemented in 1973 as exchangetraded options came into existence. We discussed five inputs to the model. Explain how and why the price of the underlying asset, exercise price, the time to expiration, the risk-free interest rate, and volatility of the underlying asset impact the value of a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts