Question: need a tax file memorandum for research problem 2. i put an example and rules(bullet points) well give you a thumbs up Research Problem 2.

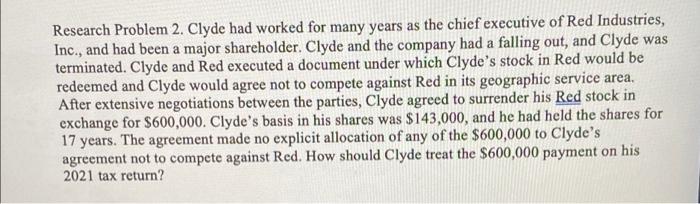

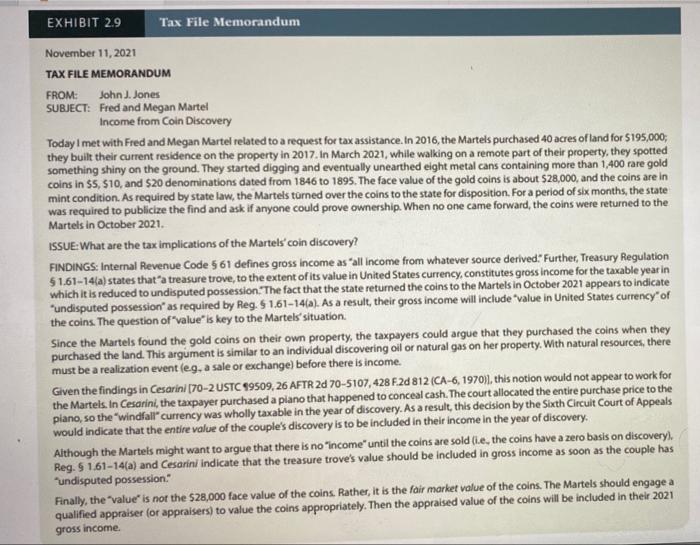

Research Problem 2. Clyde had worked for many years as the chief executive of Red Industries, Inc., and had been a major shareholder. Clyde and the company had a falling out, and Clyde was terminated. Clyde and Red executed a document under which Clyde's stock in Red would be redeemed and Clyde would agree not to compete against Red in its geographic service area. After extensive negotiations between the parties, Clyde agreed to surrender his Red stock in exchange for $600,000. Clyde's basis in his shares was $143,000, and he had held the shares for 17 years. The agreement made no explicit allocation of any of the $600,000 to Clyde's agreement not to compete against Red. How should Clyde treat the $600,000 payment on his 2021 tax return? EXHIBIT 2.9 Tax File Memorandum November 11, 2021 TAX FILE MEMORANDUM FROM: John J. Jones SUBJECT: Fred and Megan Martel Income from Coin Discovery Today I met with Fred and Megan Martel related to a request for tax assistance. In 2016, the Martels purchased 40 acres of land for $195,000; they built their current residence on the property in 2017. In March 2021, while walking on a remote part of their property, they spotted something shiny on the ground. They started digging and eventually unearthed eight metal cans containing more than 1,400 rare gold coins in $5, $10, and $20 denominations dated from 1846 to 1895. The face value of the gold coins is about $28,000, and the coins are in mint condition. As required by state law, the Martels turned over the coins to the state for disposition. For a period of six months, the state was required to publicize the find and ask if anyone could prove ownership. When no one came forward, the coins were returned to the Martels in October 2021. ISSUE: What are the tax implications of the Martels' coin discovery? FINDINGS: Internal Revenue Code 561 defines gross income as "all income from whatever source derived." Further, Treasury Regulation $1.61-14(a) states that "a treasure trove, to the extent of its value in United States currency, constitutes gross income for the taxable year in which it is reduced to undisputed possession. The fact that the state returned the coins to the Martels in October 2021 appears to indicate "undisputed possession" as required by Reg. $1.61-14(a). As a result, their gross income will include "value in United States currency" of the coins. The question of "value" is key to the Martels' situation. Since the Martels found the gold coins on their own property, the taxpayers could argue that they purchased the coins when they purchased the land. This argument is similar to an individual discovering oil or natural gas on her property. With natural resources, there must be a realization event (eg, a sale or exchange) before there is income. Given the findings in Cesarini [70-2 USTC 99509, 26 AFTR 2d 70-5107, 428 F.2d 812 (CA-6, 1970)), this notion would not appear to work for the Martels. In Cesarini, the taxpayer purchased a piano that happened to conceal cash. The court allocated the entire purchase price to the piano, so the "windfall" currency was wholly taxable in the year of discovery. As a result, this decision by the Sixth Circuit Court of Appeals would indicate that the entire value of the couple's discovery is to be included in their income in the year of discovery. Although the Martels might want to argue that there is no "income" until the coins are sold (i.e, the coins have a zero basis on discovery), Reg. $ 1.61-14(a) and Cesarini indicate that the treasure trove's value should be included in gross income as soon as the couple has "undisputed possession." Finally, the "value" is not the $28,000 face value of the coins. Rather, it is the fair market value of the coins. The Martels should engage a qualified appraiser (or appraisers) to value the coins appropriately. Then the appraised value of the coins will be included in their 2021 gross income. A clear statement of the issue. In more complex situations, a short review of the facts that raised the issue. A review of the relevant tax law sources (e.g., Code, Regulations, Revenue Rulings, Revenue Procedures, Notices, and judicial authority). Any assumptions made in arriving at the solution. The solution recommended and the logic or reasoning supporting it. The references consulted in the research process. A good tax research communication should tell the reader what was researched, the results of that research, and the justification for any recommendations." Exhibits 2.9 and 2.10 present the tax file memorandum (internal to the firm) and the client letter associated with the facts of The Big Picture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts