Question: Need a thorough explanation with a three=step tree please! 3. A stock index is currently 990, the risk-free rate is 5%, and the dividend yield

Need a thorough explanation with a three=step tree please!

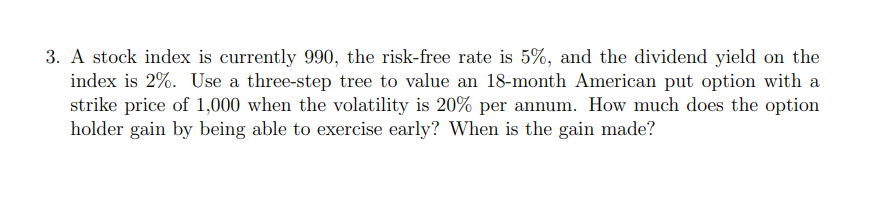

3. A stock index is currently 990, the risk-free rate is 5%, and the dividend yield on the index is 2%. Use a three-step tree to value an 18-month American put option with a strike price of 1,000 when the volatility is 20% per annum. How much does the option holder gain by being able to exercise early? When is the gain made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts