Question: need a,b, and c please Homework: Assignment 3 Question 10, B8-23 (book/static) Part 1 of 5 HW Score: 56.67%, 56.67 of 100 points O Points:

need a,b, and c please

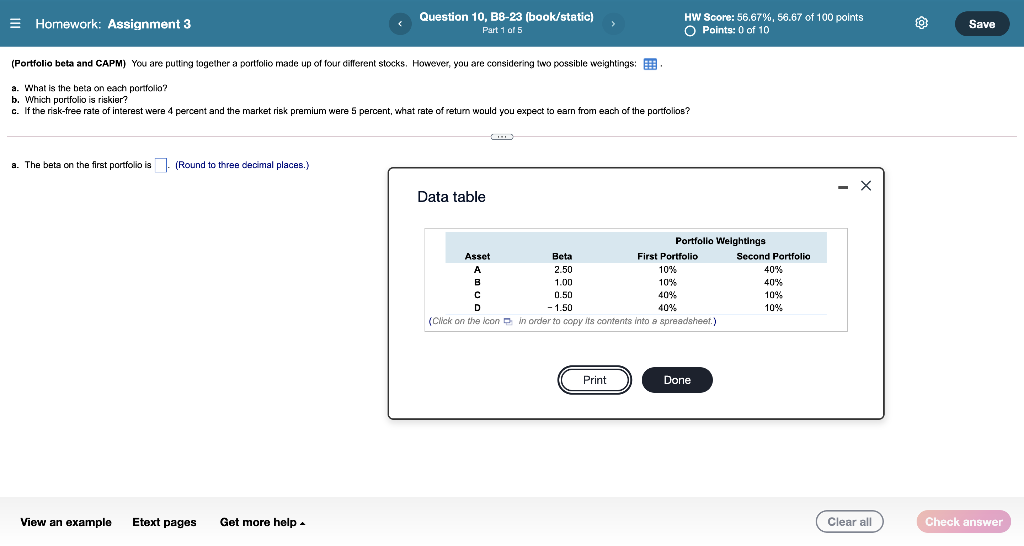

Homework: Assignment 3 Question 10, B8-23 (book/static) Part 1 of 5 HW Score: 56.67%, 56.67 of 100 points O Points: 0 of 10 @ Save (Portfolio beta and CAPM) You are putting together a portfolio made up of four different stocks. However, you are considering two possible weightings: a. What is the beta on each portfolio? b. Which portfolio is riskier? c. If the risk-free rate of interest were 4 percent and the market risk premium were 5 percent, what rate of return would you expect to earn from each of the portfolios? a. The beta on the first portfolio is (Round to three decimal places.) Data table Portfolio Welghtings Asset Beta First Portfolio Second Portfolio A 2.50 10% 40% B 1.00 10% 40% 0.50 40% 10% D - 1.50 40% 10% (Click on the icon in order to copy its contents into a spreadsheet.) . Print Done View an example Etext pages Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts