Question: Need all only 20 98 Full vs Partial utilisation of Capacity - Accepting Incremental Offer - Evaluation of Alternatives N 98, M 00 SUBRAMANYA PRODUCTS

Need all only

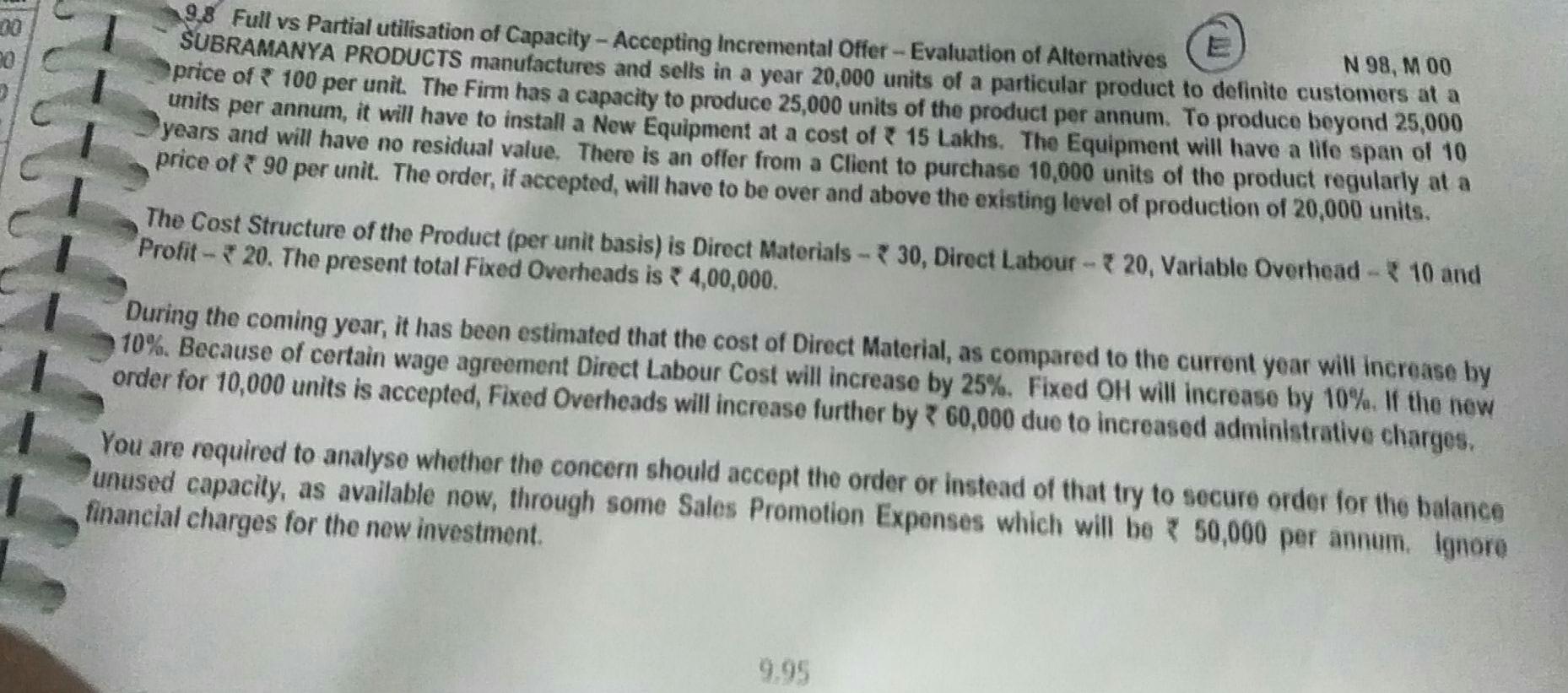

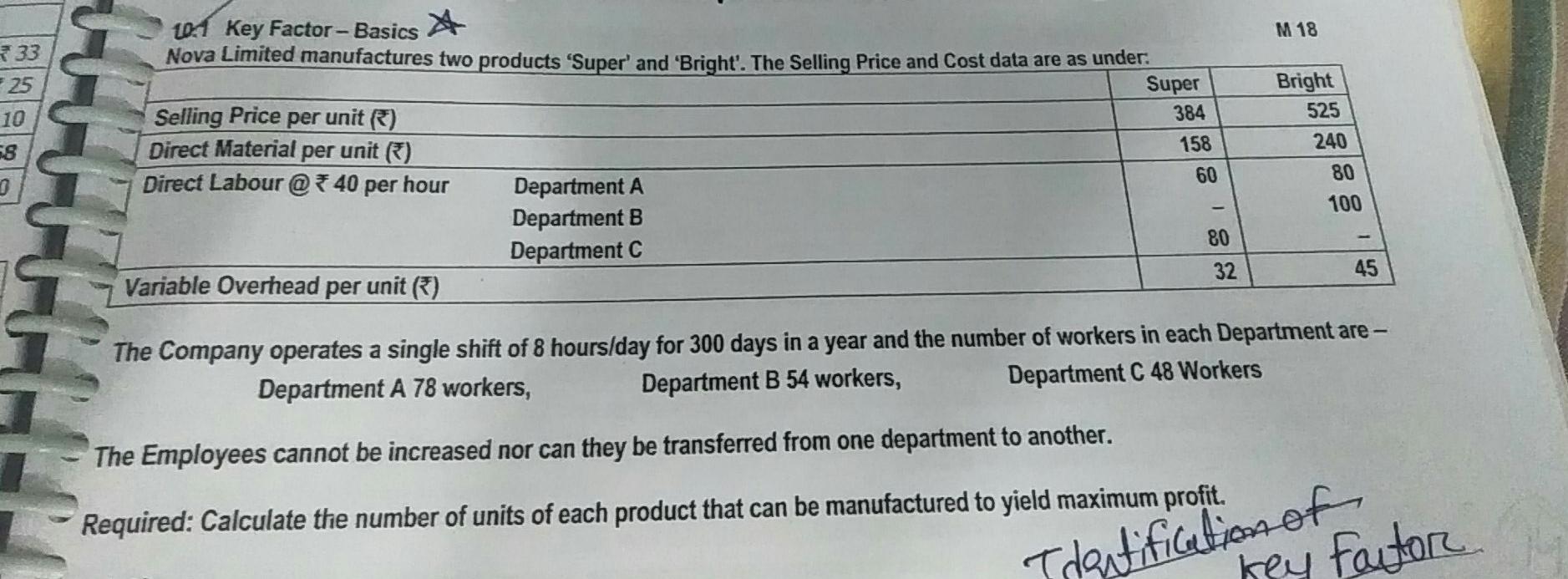

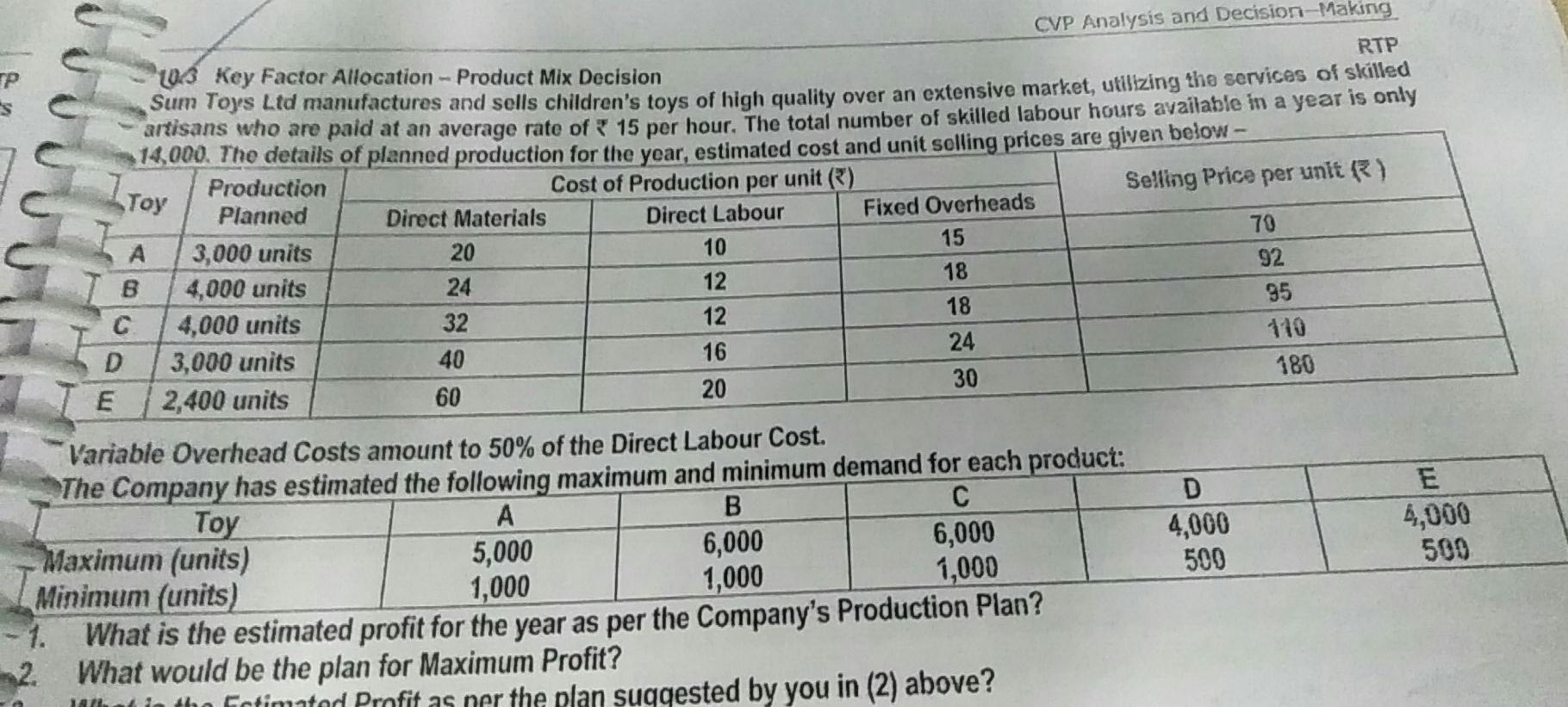

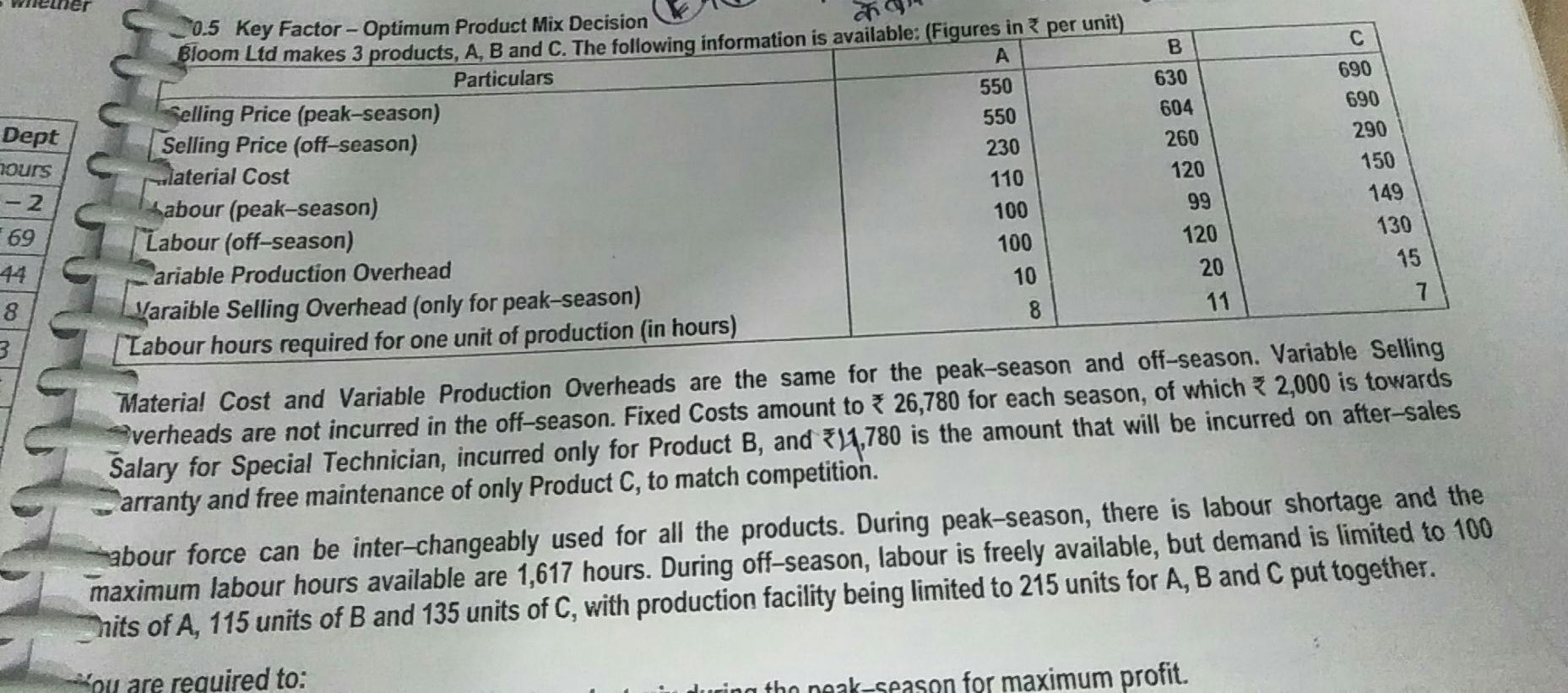

20 98 Full vs Partial utilisation of Capacity - Accepting Incremental Offer - Evaluation of Alternatives N 98, M 00 SUBRAMANYA PRODUCTS manufactures and sells in a year 20,000 units of a particular product to definite customers at a price of 100 per unit. The Firm has a capacity to produce 25,000 units of the product per annum. To produce beyond 25,000 units per annum, it will have to install a New Equipment at a cost of 15 Lakhs. The Equipment will have a life span of 10 years and will have no residual value. There is an offer from a Client to purchase 10,000 units of the product regularly at a price of 90 per unit. The order, if accepted, will have to be over and above the existing level of production of 20,000 units. The Cost Structure of the Product (per unit basis) is Direct Materials - 30, Direct Labour -20, Variable Overhead - 10 and Profit - 20. The present total Fixed Overheads is 4,00,000. During the coming year, it has been estimated that the cost of Direct Material, as compared to the current year will increase by 10%. Because of certain wage agreement Direct Labour Cost will increase by 25%. Fixed OH will increase by 10%. If the new order for 10,000 units is accepted, Fixed Overheads will increase further by 2 60,000 due to increased administrative charges. You are required to analyse whether the concern should accept the order or instead of that try to secure order for the balance unused capacity, as available now, through some Sales Promotion Expenses which will be 50,000 per annum. Ignoro financial charges for the new investment 9.95 M 18 733 25 10 10:1 Key Factor-Basics Nova Limited manufactures two products 'Super' and 'Bright'. The Selling Price and Cost data are as under: Super Selling Price per unit) 384 Direct Material per unit (5) 158 Direct Labour@*40 per hour Department A 60 Department B Department C 80 Variable Overhead per unit (5) 32 Bright 525 240 80 100 58 45 The Company operates a single shift of 8 hours/day for 300 days in a year and the number of workers in each Department are Department A 78 workers, Department B 54 workers, Department C 48 Workers The Employees cannot be increased nor can they be transferred from one department to another. Required: Calculate the number of units of each product that can be manufactured to yield maximum profit. Identification of key factor CVP Analysis and Decision-Making RTP TP Toy 2013 Key Factor Allocation - Product Mix Decision Sum Toys Ltd manufactures and sells children's toys of high quality over an extensive market, utilizing the services of skilled artisans who are paid at an average rate of 15 per hour. The total number of skilled labour hours available in a year is only 14,000. The details of planned production for the year, estimated cost and unit solling prices are given below - Production Cost of Production per unit) Selling Price per unit) Planned Direct Materials Direct Labour Fixed Overheads 70 A 3,000 units 20 10 92 4,000 units 24 18 12 95 4,000 units 32 12 18 110 D 3,000 units 40 16 24 E 30 2,400 units 20 60 15 B 180 Toy D 4,000 500 E 4,000 500 Variable Overhead Costs amount to 50% of the Direct Labour Cost. The Company has estimated the following maximum and minimum demand for each product: A B C Maximum (units) 5,000 6,000 6,000 Minimum (units) 1,000 1,000 1,000 1. What is the estimated profit for the year as per the Company's Production Plan? 2. What would be the plan for Maximum Profit? mint in the fintimatod Profit as per the plan suqqested by you in (2) above? B Dept hours 0.5 Key Factor - Optimum Product Mix Decision ah Bloom Ltd makes 3 products, A, B and C. The following information is available: (Figures in per unit) Particulars A Selling Price (peak-season) 550 Selling Price (off-season) 550 laterial Cost 230 Labour (peak-season) 110 Labour (off-season) 100 ariable Production Overhead 100 Varaible Selling Overhead (only for peak-season) 10 | Labour hours required for one unit of production (in hours) - 2 690 690 290 150 149 130 15 7 630 604 260 120 99 120 20 11 69 44 8 3 Material Cost and Variable Production Overheads are the same for the peak-season and off-season. Variable Selling verheads are not incurred in the off-season. Fixed Costs amount to 26,780 for each season, of which 2,000 is towards Salary for Special Technician, incurred only for Product B, and 511,780 is the amount that will be incurred on after-sales arranty and free maintenance of only Product C, to match competition. abour force can be inter-changeably used for all the products. During peak-season, there is labour shortage and the maximum labour hours available are 1,617 hours. During off-season, labour is freely available, but demand is limited to 100 nits of A, 115 units of B and 135 units of C, with production facility being limited to 215 units for A, B and C put together. ou are required to: during the neak-season for maximum profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts