Question: need an answer to the question for calculating NPV www.mhhe.com Calculating NPV HO The machine requin related to the pr cease to exist. The straight-line

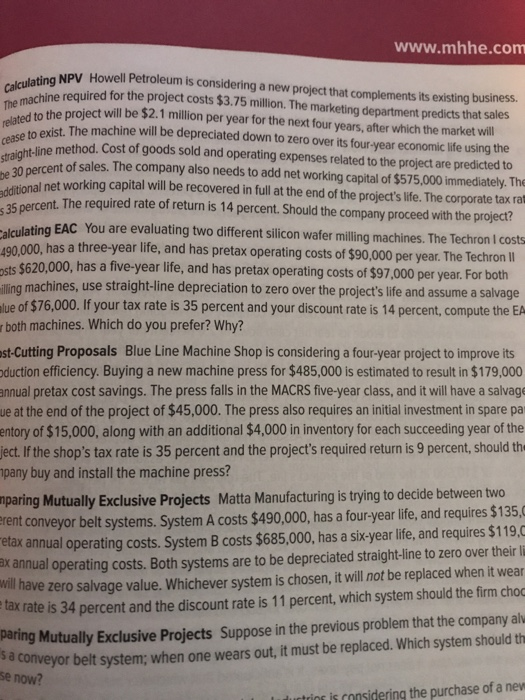

www.mhhe.com Calculating NPV HO The machine requin related to the pr cease to exist. The straight-line metho be 30 percent of sales. additional net working 35 percent. The requir NPV Howell Petroleum is considering a new project that complements its existing business. line required for the project costs $3.75 million. The marketing department predicts that sales to the project will be $2.1 million per year for the next four years, after which the market will uit The machine will be depreciated down to zero over its four-vear economic life using the line method. Cost of goods sold and operating expenses related to the project are predicted to percent of sales. The company also needs to add net working capital of $575,000 immediately. The al net working capital will be recovered in full at the end of the project's life. The corporate tax rat ercent. The required rate of return is 14 percent. Should the company proceed with the project? sulating EAC You are evaluating two different silicon wafer milling machines. The Techron I costs 100.000, has a three-year life, and has pretax operating costs of $90,000 per year. The Techron II osts $620,000, has a five-year life, and has pretax operating costs of $97.000 per year. For both illing machines, use straight-line depreciation to zero over the project's life and assume a salvage lue of $76,000. If your tax rate is 35 percent and your discount rate is 14 percent, compute the EA both machines. Which do you prefer? Why? ost-Cutting Proposals Blue Line Machine Shop is considering a four-year project to improve its oduction efficiency. Buying a new machine press for $485,000 is estimated to result in $179,000 annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage ue at the end of the project of $45,000. The press also requires an initial investment in spare pa mentory of $15,000, along with an additional $4,000 in inventory for each succeeding year of the ject. If the shop's tax rate is 35 percent and the project's required return is 9 percent, should the pany buy and install the machine press? inparing Mutually Exclusive Projects Matta Manufacturing is trying to decide between two erent conveyor belt systems. System A costs $490,000, has a four-year life, and requires $135, relax annual operating costs. System B costs $685,000, has a six-year life, and requires $119, Ex annual operating costs. Both systems are to be depreciated straight-line to zero over their have zero salvage value. Whichever system is chosen, it will not be replaced when it wear tax rate is 34 percent and the discount rate is 11 percent, which system should the firm choc pering Mutually Exclusive Projects Suppose in the previous problem that the company alv conveyor belt system; when one wears out, it must be replaced. Which system should th se now? utrips is considering the purchase of a new

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts