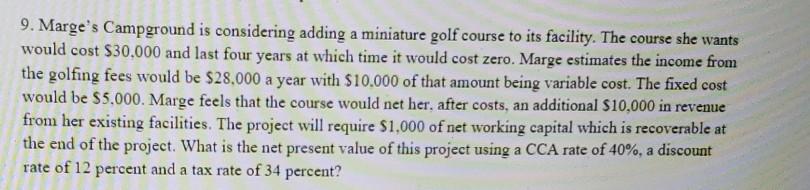

Question: need answer 9. Marge's Campground is considering adding a miniature golf course to its facility. The course she wants would cost $30,000 and last four

need answer

9. Marge's Campground is considering adding a miniature golf course to its facility. The course she wants would cost $30,000 and last four years at which time it would cost zero. Marge estimates the income from the golfing fees would be $28.000 a year with $10.000 of that amount being variable cost. The fixed cost would be $5,000. Marge feels that the course would net her, after costs, an additional $10,000 in revenue from her existing facilities. The project will require $1.000 of net working capital which is recoverable at the end of the project. What is the net present value of this project using a CCA rate of 40%, a discount rate of 12 percent and a tax rate of 34 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts