Question: need answer asap, will leave thumbs up Use the information in the table to answer the question below. COMPANY COMPANYA COMPANY B COMPANY C ($

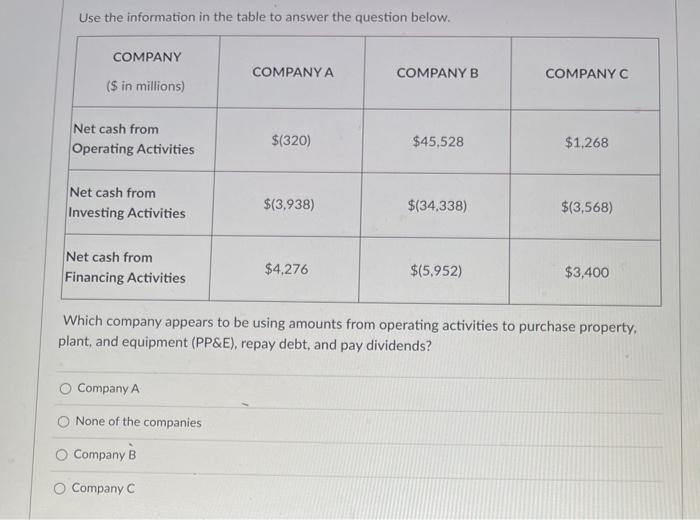

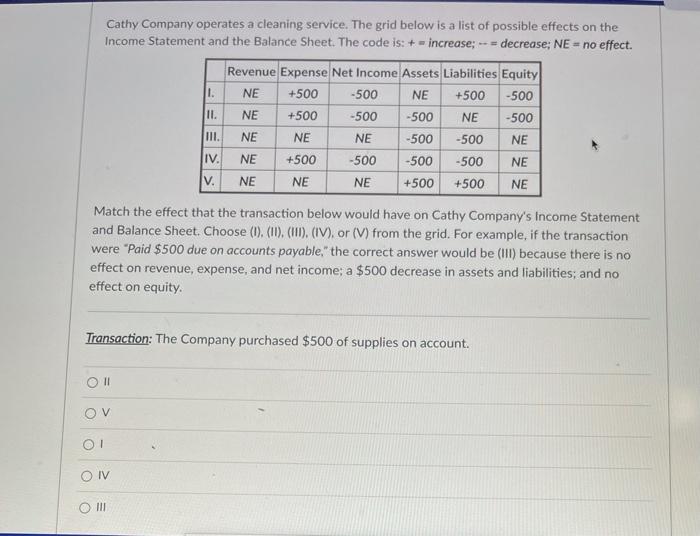

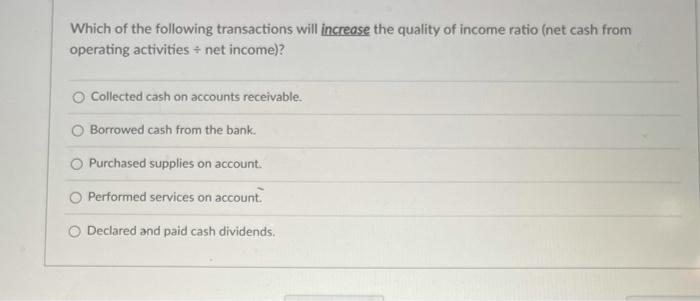

Use the information in the table to answer the question below. COMPANY COMPANYA COMPANY B COMPANY C ($ in millions) Net cash from Operating Activities $(320) $45,528 $1,268 Net cash from Investing Activities $(3,938) $(34,338) $(3,568) Net cash from Financing Activities $4,276 $(5.952) $3,400 Which company appears to be using amounts from operating activities to purchase property, plant, and equipment (PP&E), repay debt, and pay dividends? Company A None of the companies Company B O Company C Cathy Company operates a cleaning service. The grid below is a list of possible effects on the Income Statement and the Balance Sheet. The code is: + = increase; - - decrease: NE = no effect. -500 Revenue Expense Net Income Assets Liabilities Equity 1. NE +500 -500 NE +500 II. NE +500 -500 -500 NE -500 III. NE NE NE -500 -500 IV. NE +500 -500 -500 -500 NE V. NE NE NE +500 +500 NE NE Match the effect that the transaction below would have on Cathy Company's Income Statement and Balance Sheet. Choose (1). (11). (III). (IV) or (V) from the grid. For example, if the transaction were "Paid $500 due on accounts payable," the correct answer would be (III) because there is no effect on revenue, expense, and net income; a $500 decrease in assets and liabilities; and no effect on equity. Transaction: The Company purchased $500 of supplies on account. 01 OIV O III Which of the following transactions will increase the quality of income ratio (net cash from operating activities net income)? Collected cash on accounts receivable. Borrowed cash from the bank. Purchased supplies on account. Performed services on account Declared and paid cash dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts