Question: please answer quickly for a thumbs up Use this information for Kellman Company to answer the question that follow. The balance sheets at the end

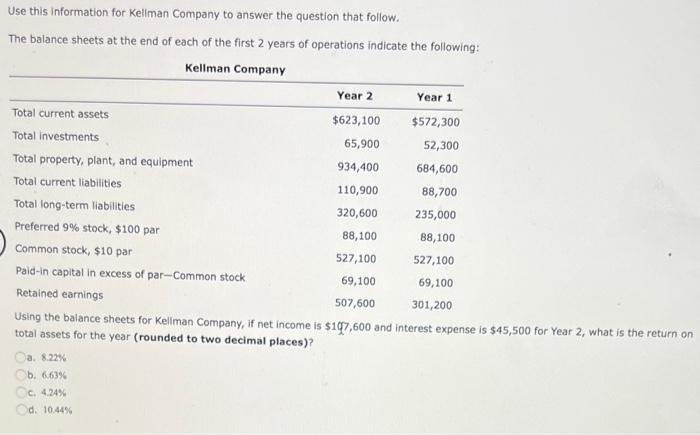

Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first 2 years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $623,100 $572,300 Total Investments 65,900 52,300 Total property, plant, and equipment 934,400 684,600 Total current liabilities 110,900 88,700 Total long-term liabilities 320,600 235,000 Preferred 9% stock, $100 par 88,100 88,100 Common stock, $10 par 527,100 527,100 Pald-in capital in excess of par-Common stock 69,100 69,100 Retained earnings 507,600 301,200 Using the balance sheets for Kellman Company, if net income is $107,600 and interest expense is $45,500 for Year 2, what is the return on total assets for the year (rounded to two decimal places)? a. 8.22% b. 6,63% CC 4.24% d. 10.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts