Question: need answer fast plsss Normal text Arial 8 + BIVA 19 - 23 56 9. A company purchased land for $80000 cash. Real estate brokers

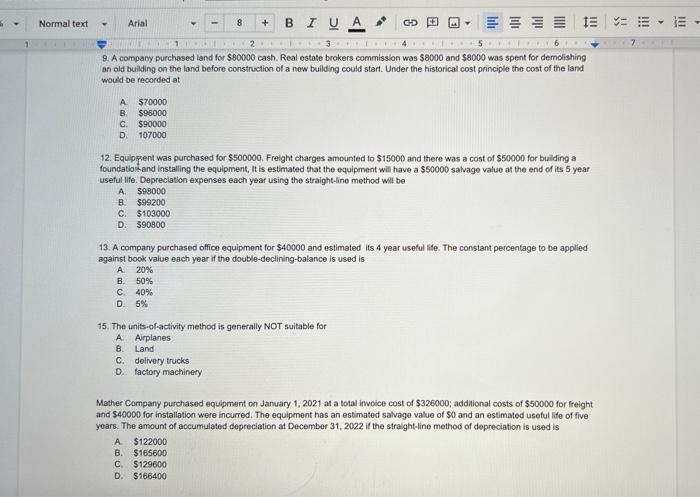

Normal text Arial 8 + BIVA 19 - 23 56 9. A company purchased land for $80000 cash. Real estate brokers commission was $8000 and $8000 was spent for demolishing an old building on the land before construction of a new building could start. Under the historical cost principle the cost of the land would be recorded at A $70000 . $95000 C. $90000 D 107000 B 12. Equipptent was purchased for $500000. Freight charges amounted to $15000 and there was a cost of $50000 for building a foundatios and installing the equipment, it is estimated that the equipment will have a $60000 salvage value at the end of its 5 year useful life. Depreciation expenses each year using the straight-ino method will be A $98000 $99200 C. $103000 D. 590800 13. A company purchased office equipment for S40000 and estimated Its 4 year useful ife. The constant percentage to be applied against book value each year if the double-declining-balance is used is A 20% B. 50% C 40% D5% 15. The units-of-activity method is generally not suitable for A Airplanes B Land c. delivery trucks D.factory machinery Mather Company purchased equipment on January 1, 2021 at a total invoice cost of $326000; additional costs of $50000 for freight and $40000 for installation were incurred. The equipment has an estimated salvage value of $0 and an estimated useful life of five years. The amount of accumulated depreciation at December 31, 2022 if the straight-line method of depreciation is used is $122000 B $165600 $129600 $166400 A D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts