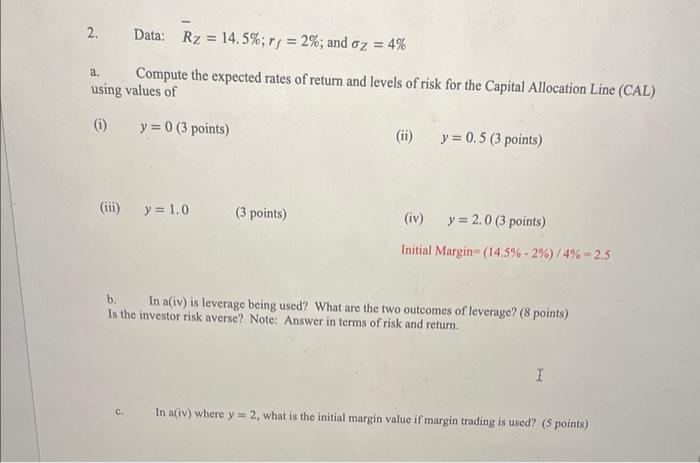

Question: need answer for a (i- iv), b, c 2. Data: Rz=14.5%;rf=2%; and Z=4% a. Compute the expected rates of return and levels of risk for

2. Data: Rz=14.5%;rf=2%; and Z=4% a. Compute the expected rates of return and levels of risk for the Capital Allocation Line (CAL) using values of (i) y=0(3 points) (ii) y=0.5 (3 points) (iii) y=1,0(3 points) (iv) y=2.0 (3 points) Initial Margin =(14.5%2%)/4%=2.5 b. In a(iv) is leverage being used? What are the two outcomes of leverage? ( 8 points) Is the investor risk averse? Note: Answer in terms of risk and return. c. In a(iv) where y=2, what is the initial margin value if margin trading is used? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts