Question: need answer for (d) Based on the below information, kindly answer the below questions: Stock Beta B. 2 D 1.82 E 1.52 The Market Expected

need answer for (d)

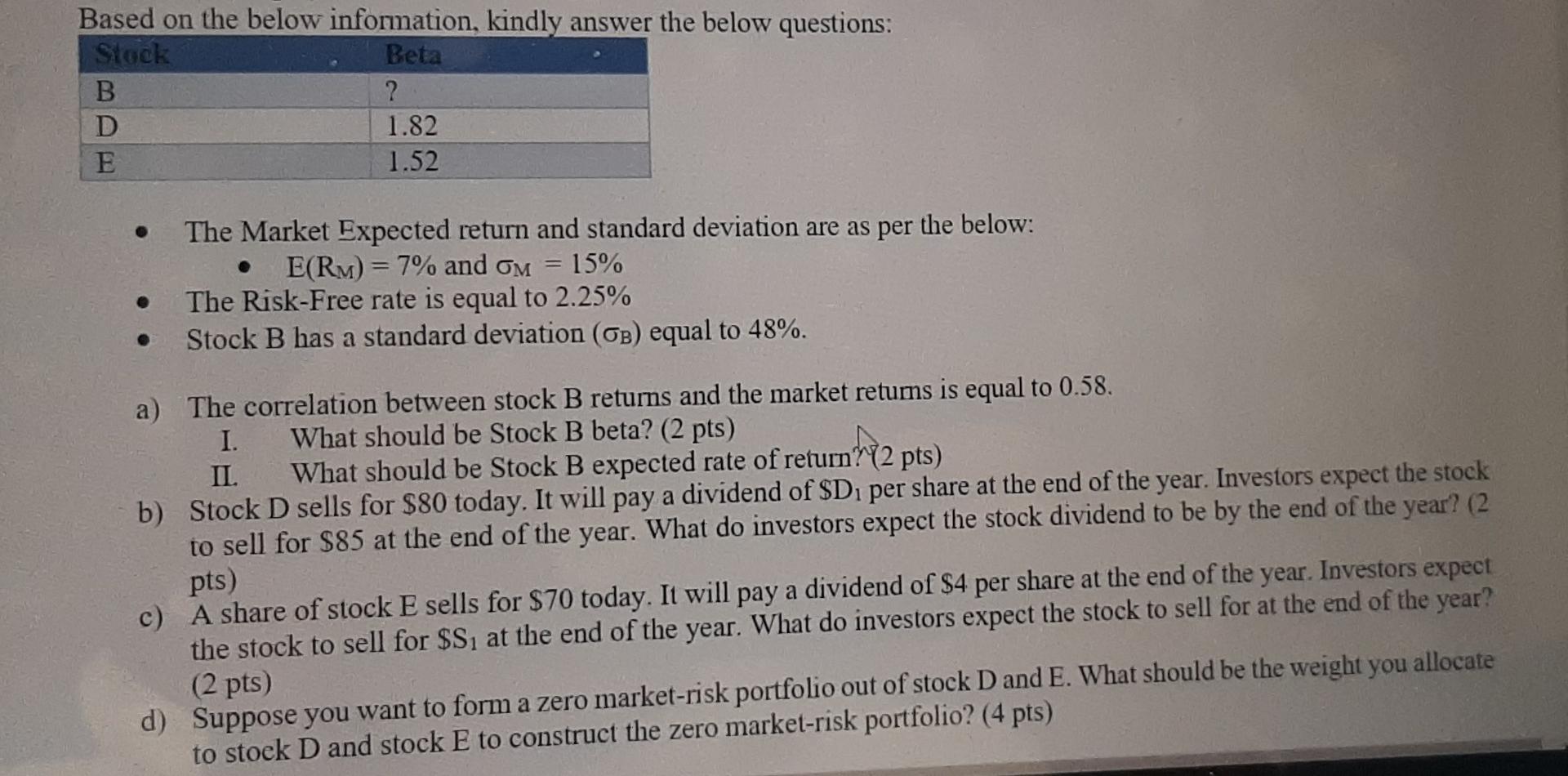

Based on the below information, kindly answer the below questions: Stock Beta B. 2 D 1.82 E 1.52 The Market Expected return and standard deviation are as per the below: E(RM) = 7% and OM - 15% The Risk-Free rate is equal to 2.25% Stock B has a standard deviation (GB) equal to 48%. a) The correlation between stock B retums and the market retums is equal to 0.58. I. What should be Stock B beta? (2 pts) IL What should be Stock B expected rate of return?72 pts) b) Stock D sells for $80 today. It will pay a dividend of SD1 per share at the end of the year. Investors expect the stock to sell for $85 at the end of the year. What do investors expect the stock dividend to be by the end of the year? (2 pts) c) A share of stock E sells for $70 today. It will pay a dividend of $4 per share at the end of the year. Investors expect the stock to sell for $S, at the end of the year. What do investors expect the stock to sell for at the end of the year? (2 pts) d) Suppose you want to form a zero market-risk portfolio out of stock D and E. What should be the weight you allocate to stock D and stock E to construct the zero market-risk portfolio? (4 pts) Based on the below information, kindly answer the below questions: Stock Beta B. 2 D 1.82 E 1.52 The Market Expected return and standard deviation are as per the below: E(RM) = 7% and OM - 15% The Risk-Free rate is equal to 2.25% Stock B has a standard deviation (GB) equal to 48%. a) The correlation between stock B retums and the market retums is equal to 0.58. I. What should be Stock B beta? (2 pts) IL What should be Stock B expected rate of return?72 pts) b) Stock D sells for $80 today. It will pay a dividend of SD1 per share at the end of the year. Investors expect the stock to sell for $85 at the end of the year. What do investors expect the stock dividend to be by the end of the year? (2 pts) c) A share of stock E sells for $70 today. It will pay a dividend of $4 per share at the end of the year. Investors expect the stock to sell for $S, at the end of the year. What do investors expect the stock to sell for at the end of the year? (2 pts) d) Suppose you want to form a zero market-risk portfolio out of stock D and E. What should be the weight you allocate to stock D and stock E to construct the zero market-risk portfolio? (4 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts