Question: Need Answer for Question 2.3 Consider now an intertemporal model of an endowment economy with no investment in physical capital. Preferences and budget constraints are

Need Answer for Question 2.3

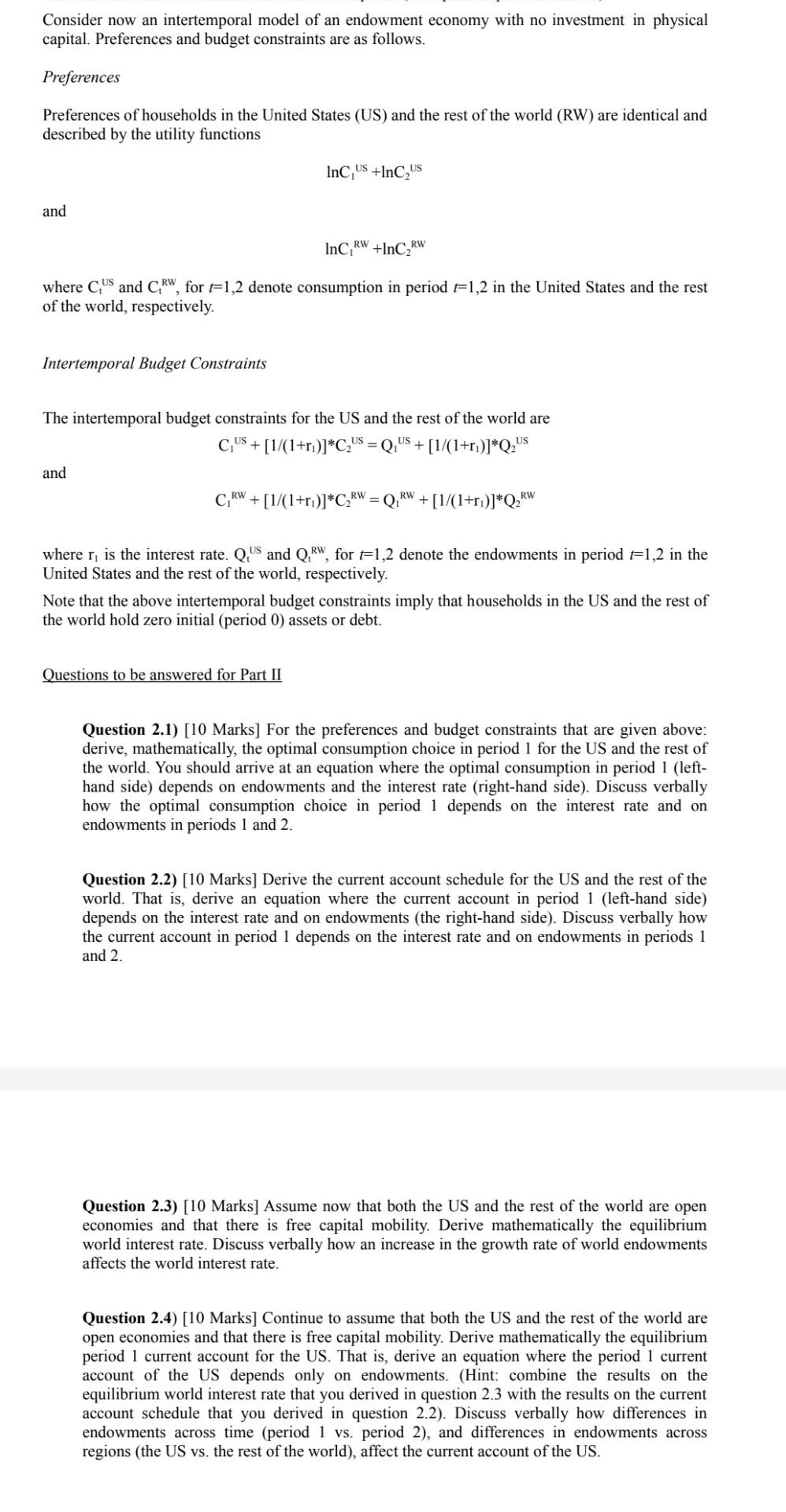

Consider now an intertemporal model of an endowment economy with no investment in physical capital. Preferences and budget constraints are as follows. Preferences Preferences of households in the United States (US) and the rest of the world (RW) are identical and described by the utility functions InCUS +InCUS and InCRW +InCRW where C,US and C,RW, for 1,2 denote consumption in period 1,2 in the United States and the rest of the world, respectively. Intertemporal Budget Constraints The intertemporal budget constraints for the US and the rest of the world are C,US+ [1/(1+r)]*CUS = QUS+ [1/(1+r)]*QUS and CRW + [1/(1+)]*CRW = QRW + [1/(1+r)]*QRW where r, is the interest rate. QUS and QRW, for 1,2 denote the endowments in period #1,2 in the United States and the rest of the world, respectively. Note that the above intertemporal budget constraints imply that households in the US and the rest of the world hold zero initial (period 0) assets or debt. Questions to be answered for Part II Question 2.1) [10 Marks] For the preferences and budget constraints that are given above: derive, mathematically, the optimal consumption choice in period 1 for the US and the rest of the world. You should arrive at an equation where the optimal consumption in period 1 (left- hand side) depends on endowments and the interest rate (right-hand side). Discuss verbally how the optimal consumption choice in period 1 depends on the interest rate and on endowments in periods 1 and 2. Question 2.2) [10 Marks] Derive the current account schedule for the US and the rest of the world. That is, derive an equation where the current account in period 1 (left-hand side) depends on the interest rate and on endowments (the right-hand side). Discuss verbally how the current account in period 1 depends on the interest rate and on endowments in periods 1 and 2. Question 2.3) [10 Marks] Assume now that both the US and the rest of the world are open economies and that there is free capital mobility. Derive mathematically the equilibrium world interest rate. Discuss verbally how an increase in the growth rate of world endowments affects the world interest rate. Question 2.4) [10 Marks] Continue to assume that both the US and the rest of the world are open economies and that there is free capital mobility. Derive mathematically the equil rium period 1 current account for the US. That is, derive an equation where the period 1 current account of the US depends only on endowments. (Hint: combine the results on the equilibrium world interest rate that you derived in question 2.3 with the results on the current account schedule that you derived in question 2.2). Discuss verbally how differences in endowments across time (period 1 vs. period 2), and differences in endowments across regions (the US vs. the rest of the world), affect the current account of the USStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock