Question: need answer for question 6 and 7 5) You are looking to buy a $1 million home and you would like to put $100,000 down

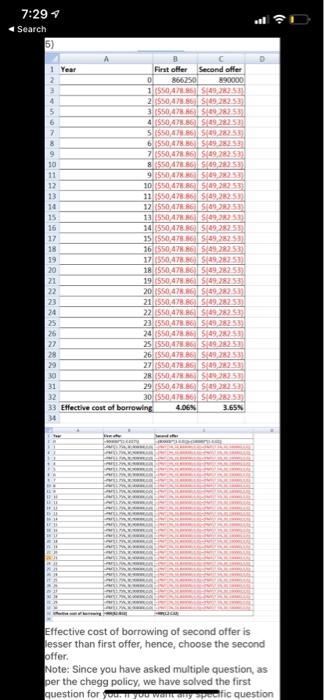

5) You are looking to buy a $1 million home and you would like to put $100,000 down and borrow the rest. You have two offers from competing banks. The first bank offers you a $900,000 first mortgage, with a rate of 3.75%, 30 year amortization and 2% origination fee. The second offer consists of an $800,000 mortgage at 3%, 30 year amortization, with 1% origination fee and a home equity loan of $100,000 at a rate of 7.5%, 30 year amortization, 2% origination fee. Which offer would you take? Hint: Take the offer with the lowest effective cost of borrowing. 6) What is the marginal cost of borrowing $900,000 at 5% rate with 25 year amortization, when you have another offer on the table at $800,000 with a 3% rate and 25 year amortization? 7) Given the information in question 5) above and based on the preferable offer, how much money would the bank expect you to make it annual taxes are 2% of the house price and annual hazard insurance is 0.3% of the price. Furthermore you have $2,000 in monthly revolving loan payments, $750 per month for car payments and $1,000 a month for credit card payments. The bank uses a front ratio of 28% and a back ratio of 43%. 7:29 Search 5) A B 1 Year First offer Second offer 0 366250 890000 15047SIS 49 4 2 150,478.86 49.282.53 31550,478 22 6 41550 428.8089282.59 7 51550,47885549222.53) 8 6 1550.478.925 7 1550,478.86 119 20:53 10 8550,4786.6928253) 11 91550 47 19 225 12 10 550,478.8649,225 13 31 550,478.86$ 49,282,5 10 12 (550476SI SIA 225 15 13 155471.514925 16 14.550.478.149.282.53 17 15 550,475.36 $49, 22:53 18 16550 476 54492) 19 171550,478.65/19,2753 20 18 SS0.478.5 49.282.53) 21 19 550,478.865149.28253 22 20 SO 47.5 49.282.53 23 21 550,478.86 S9,282.53 24 22 1550 7.589,22 33 25 23550,478. 49.282.53 26 241550 451 492 27 25 1550,67.855098353 26 $50,478.549,28253) 29 2211550.478.869.282.53 28 1550,478.512928353 31 29 550 428.69 28259) 32 30 1550.478.56) 51492825) 33 Effective cost of borrowing 4.06% 3,65N DU Effective cost of borrowing of second offer is lesser than first offer, hence, choose the second offer. Note: Since you have asked multiple question, as per the chegg policy, we have solved the first question for you. you weetfic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts